This article was written exclusively for Investing.com

- The parabolic period ends - Bitcoin halves, Ethereum does slightly better on the downside

- Bitcoin is the leader - Ethereum is a distant second

- Ethereum and Bitcoin have different goals

- Risk-reward could favor Ethereum

- Ethereum’s proof of stake lowers costs, DeFi is bullish for Ethereum

As of June 7, 10,332 cryptocurrencies were floating around in cyberspace. The number of new cryptos bursting on the scene continues to rise each day. The appreciation in the leading cryptos has caused market participants to search for the next Bitcoin or Ethereum that will transform a small investment into a large fortune.

A $10 investment in Bitcoin in 2010 at five cents per token was worth over $13 million at the recent high of over $65,000. In 2015, Ethereum traded below $1 at the recent peak of over $4400 per token. $100 invested seven years ago was worth a cool $440,000.

Other cryptocurrencies have created incredible returns for investors. Dogecoin, Elon Musk’s favorite pet crypto, exploded higher on the back of a speculative frenzy in the asset class and PR from high-profile supporters.

With over 10,000 other cryptos, the search for the diamond in the rough will continue. Massive profits are a powerful magnet for speculative activity.

Meanwhile, the ascent of Bitcoin and Ethereum has been incredible. Even after halving in value over the past weeks, the asset class leaders continue to be at stratospheric levels, with many market participants expecting new and higher highs.

The parabolic period ends - Bitcoin halves, Ethereum does slightly better on the downside

Bitcoin, the undisputed leader and namesake of the asset class, reached its most recent high on Apr. 14. The digital currency leader peaked on the day that Coinbase (NASDAQ:COIN) listed its shares on NASDAQ.

COIN is a pick-and-shovel play on the cryptocurrency asset class. The trading platform earns profits on trading volume instead of price levels for the digital currencies. COIN operates in the crypto arena as the CME and ICE do in futures and other asset classes. The three are investment and trading platforms.

Cryptocurrencies have developed a pattern of making new highs as market events further their acceptance as mainstream investment and trading vehicles. In late 2017, the introduction of futures on the CME pushed Bitcoin over the $20,000 level for the first time.

High-profile investments by Square (NYSE:SQ) and Tesla (NASDAQ:TSLA) in late 2020, and early 2021, sent Bitcoin to higher highs. Futures on Ethereum lifted the price of the second-leading cryptocurrency earlier this year.

Meanwhile, adverse events have caused corrections. The first example came in 2014 when the Mount Gox hack and failure sent Bitcoin’s price reeling. The most recent event was Tesla’s decision not to accept Bitcoin for its EVs for environmental reasons.

China’s ban on digital currencies as it rolls out its digital yuan was likely more influential in pushing prices lower and ending the parabolic rallies.

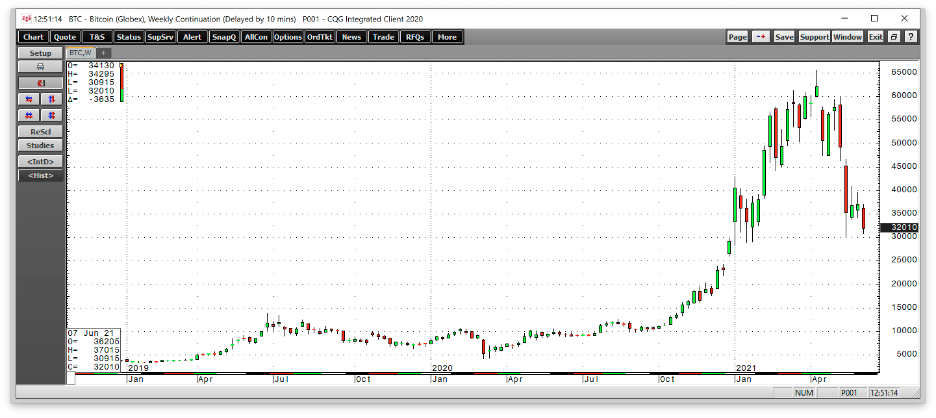

Source: CQG

The weekly chart of Bitcoin futures shows the drop from $65,520 on Apr.14 to a low of $30,205 per token a little over one month later. The 53.9% decline was a reminder that parabolic markets can become falling knives in the blink of an eye. At the $32,000 level on June 8, Bitcoin was still over 51% below its record peak and 5.9% above its most recent low.

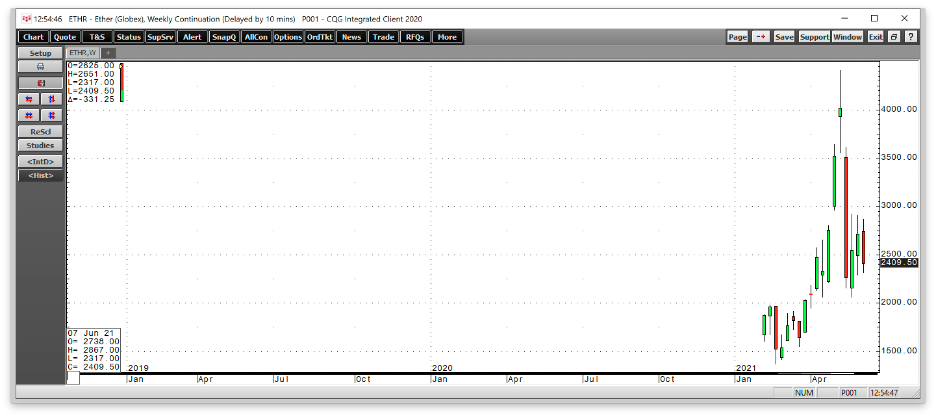

Source: CQG

Ethereum peaked at $4,406.50 during the week of May 10 and fell to a low of $2,062 two weeks after the high, a decline of 53.2%. At the $2,410 level on June 8, Ethereum was 45.3% off its high, but 16.9% above the recent low. Ethereum has outperformed Bitcoin over the past weeks.

Bitcoin is the leader - Ethereum is a distant second

As of June 8, Bitcoin’s market cap stood at the $602.280 billion level, with Ethereum in second place at $279.611 billion. Bitcoin has 41.3% and Ethereum 19.2% of the $1.462 trillion market cap.

Bitcoin and Ethereum are the dominant members, sharing over 60% of the asset class’s total value. While Ethereum is a distant second, its profile and value have been rising, taking share from the leader. Bitcoin and Ethereum are far different cryptocurrencies with different agendas.

Ethereum and Bitcoin have different goals

Bitcoin is the embodiment of the cryptocurrency ideology as it appeals to the libertarian spirit of removing control of the money supply from governments, central banks, and monetary authorities. It is the leading brand in the asset class, with the highest level of attention from large investors as the market cap offers the greatest liquidity level.

As a decentralized currency, away from the clutches of the Federal Reserve, or any other central bank, Bitcoin provides a preset maximum supply. Bitcoin is attractive to market participants who oppose money printing and other monetary policy initiatives that manipulate the overall supply of money in the financial system for political purposes.

Moreover, the performance over the past 11 years has made Bitcoin a hot commodity, as nothing spurs investment and trading like a raging bull market. Bitcoin’s limited supply means there are 21 million Bitcoin. Approximately 90% of 18.6 million Bitcoin has already been mined.

The rate of new Bitcoin creation gets smaller over time via Bitcoin halving, which cuts the pace of Bitcoin creation in half every 210,000 block transactions. The last halving occurred in May 2020; the next comes sometime in 2024. The bottom line is Bitcoin is a pure libertarian alternative to money.

Ethereum operates as a decentralized network with the potential for applications. Many other cryptocurrency tokens are appearing from the Ethereum network. Bitcoin is money, Ethereum is infrastructure as it is a blockchain that can revolutionize finance and technology.

Ethereum’s utility is only limited by the innovations of the world’s developers, creating far more activity on its platform. While Bitcoin mining depends on power consumption, the most significant power in Ethereum’s market comes from ownership stakes.

Minting new Ethereum tokens come via a “proof of stake” process, where the collateral is the token that is a validator of the network. The more Ethereum, the more power within the system.

Risk-reward could favor Ethereum

Bitcoin and Ethereum may be the leaders of the cryptocurrency asset class, but Ethereum’s utility and structure should cause its value to climb compared to Bitcoin. While Bitcoin is just a token with blockchain technology, Ethereum is a token and a platform with far-reaching potential.

I expect Ethereum’s market share to continue to climb at the expense of Bitcoin, as Ethereum has the potential to spawn innovation, and Bitcoin is a means of exchange.

While it could take years for Ethereum to overtake Bitcoin in the leadership role, it appears to have more growth potential when it comes to value, making risk-reward favor Ethereum.

Ethereum’s proof of stake lowers costs, DeFi is bullish for Ethereum

As DeFi or decentralized finance grows, Ethereum’s role will expand. If cryptocurrencies eliminate the need for traditional financial intermediaries, like brokerages and exchanges, the innovative nature of Ethereum as a platform to create blockchains could dramatically lift the crypto’s value.

Ethereum still has a higher risk than Bitcoin as it has less history. Since a reward is always a function of risk, Ethereum’s success could create outperformance compared to the asset classes’ leader.

Ethereum’s proof of stake process reduces the need for energy to mine tokens. Innovation will create tokens rather than electricity and hardware. The most efficient and innovative programmers will collect the most tokens, making Ethereum far more carbon neutral as the world addresses climate change.

We may see Elon Musk and Tesla (TSLA) embrace Ethereum sooner, rather than later, as it fits the company’s mission to reduce the carbon footprint with their products. While TLSA’s batteries contain toxic metals that pollute the environment, the company’s engineers and CEO are likely hard at work on solutions.

The four issues facing the cryptocurrency asset class are custody, security, carbon, and the political dilemma of controlling the money supply. Ethereum may address the carbon issue, giving it a leg up on Bitcoin, but custody and security remain thorny issues.

Control of the money supply is a power issue. China’s ban of cryptocurrencies that caused prices to halve over the past weeks signifies that politics will remain the greatest threat to the asset class.