- Intel is cutting thousands of jobs to reduce costs and cope with a major slowdown in the personal computer market

- Intel’s dividend yield, reaching 6%, is offering a signal that its payout is under threat

- With PC prices stagnating and demand weakening, Intel may need to pursue a dividend cut to offset cash-flow headwinds

Intel Corporation's (NASDAQ:INTC) is in the news for all the wrong reasons these days. According to a report by Bloomberg, the largest chip-maker in the U.S. is going to cut thousands of jobs to reduce costs and cope with a cooling personal computer market.

The layoffs will be announced before the end of the month, with the company planning to make the move around the same time as its third-quarter earnings report on Oct. 27, according to the report. The chip-maker had 113,700 employees as of July.

The news is the latest in a string of bad developments for the California-based company that is in the middle of a major turnaround to revive growth and stop competitors grabbing its market share.

Source: InvestingPro

In July, Intel slashed sales and profit forecasts for the rest of the year, reporting steeply lower second-quarter results and warned that sales this year will be as much as $11 billion less than projected.

Pat Gelsinger, Intel’s CEO who took over last year, is asking for patience while he fixes execution issues that have dogged product releases and restores the company’s competitive advantage.

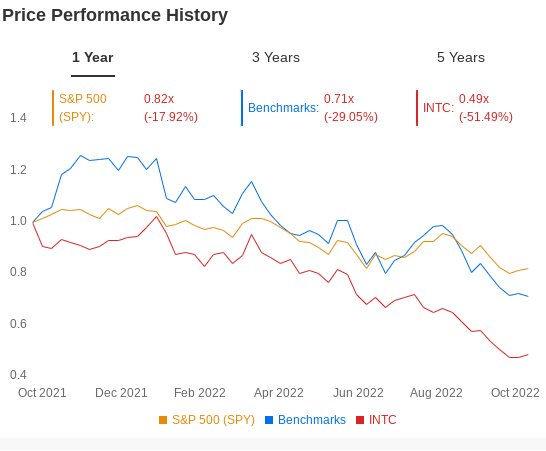

Intel’s share price, however, shows that investors have lost faith. Its stock, down more than 50% during the past year, now trades with the widest margin when compared with the industry benchmark, the Philadelphia Semiconductor Index. Such a drastic plunge in the value has ballooned the company’s annual dividend yield to about 6%, which is the highest level during the past 10 years, according to InvestingPro data.

Source:InvestingPro

Stagnating Prices and Weakening Demand

When dividend yields rise much above their normal levels, they generally ring an alarm bell about the company’s payout sustainability. Though Intel has 28 years of history for paying uninterrupted dividends, the fast declining sales and a tough competitive environment are raising concerns that it could be tough for the chip-maker to maintain its $5.6-billion annual dividend bill.

According to a Bloomberg report, with PC prices stagnating and demand weakening, Intel also may need to pursue a dividend cut to offset cash-flow headwinds. While these concerns look valid, especially when there is no end in sight for Intel’s manufacturing woes, I don’t think the risk of a dividend cut is as high as the market is pricing in.

Amid this flurry of bad news, one positive development that took a major burden off Intel's shoulders to fund its expansion was a smart $30-billion financing deal with Brookfield Asset Management Inc (TSX:BAMa) that the chip-maker signed this summer.

Under the deal, which company executives described as a first of its kind for the industry, Intel would fund 51% of the cost of building new chip-making facilities in Chandler, Ariz., and will have a controlling stake in the financing vehicle that would own the new factories. Brookfield will own the remainder of the equity and the companies will split the revenue that comes out of the factories.

This funding arrangement signals that large investors have faith in the company’s turnaround efforts. The funding will also ease pressure on Intel to cut its $1.46-a-share annual dividend while its revenues shrink and the company undertakes massive expansion.

Citi, in a recent note, gave similar arguments:

"The deal should be mildly accretive to Intel before the fabs turn on and mildly dilutive after they produce semiconductors. While the deal should help assuage concerns on Intel covering its dividend in 2023, we believe the bigger factor is Intel improving manufacturing. If Intel continues to lose share to AMD, we believe the company could be forced to cut capex to preserve the dividend."

Needham analysts also believe that the partnership will strengthen Intel’s cash position and its ability to sustain the dividend. According to Needham, the program can enable Intel to achieve $15 billion lesser capital expenditure than the traditional model. This will, in turn, boost the company’s free cash flows.

Besides this deal, Intel is predicting that the past quarter was the worst in terms of demand and things will improve from here. Its customers that are working through unused stockpiles of chips haven’t been placing new orders and will soon need to resume those purchases.

Bottom Line

Intel’s surging dividend yield clearly shows that some investors see a possibility of its payout being cut if things don’t improve and the company moves to preserve its cash. That outcome, in my view, could be averted after Intel entered a financing deal with Brookfield and decided to cut costs by reducing the headcount in a major way.

Disclaimer: At the time of writing, the author doesn’t own any shares mentioned in this report. The views expressed in this article are solely the author’s opinion and should not be taken as investment advice.