In September of this year, rumours began swirling that the SEC planned to approve the U.S.’ first Bitcoin ETF for trading. Speculation (and the price of Bitcoin) skyrocketed through early October, with October 19 marking a major milestone as the ProShares Bitcoin Strategy ETF (NYSE:BITO) began trading on the NYSE. Propelled by BITO’s launch, and the implied softening of the SEC’s stance on crypto, BTC marched steadily towards a new high, surpassing its previous peak of $64,888.99 in April to reach $66,140 on October 20, 2021. At the time of writing Bitcoin is trading at $64,784, falling from a new all-time high of $67,580 earlier this week.

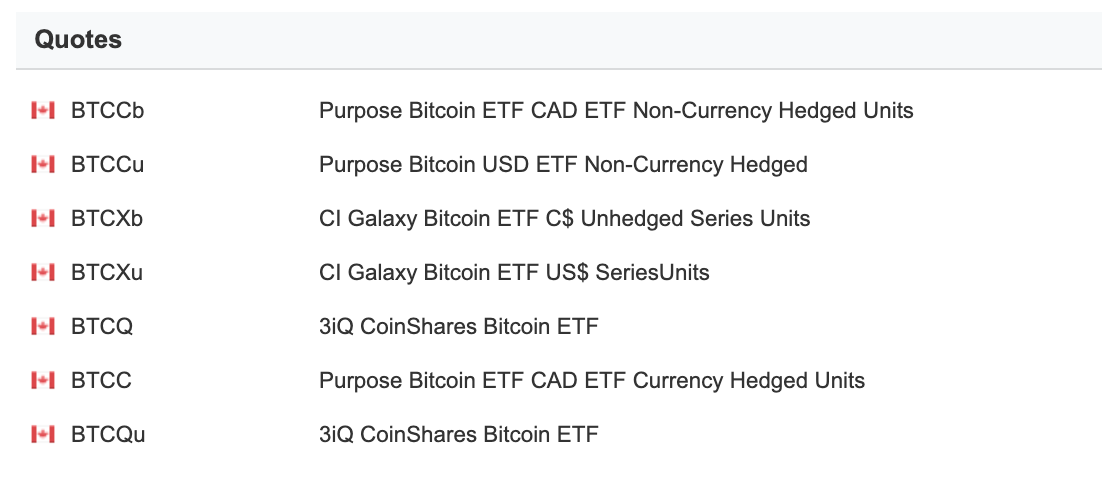

Although a novel product for the U.S. market, Bitcoin ETFs are old news north of the border. Canadian investors have had access to Bitcoin ETFs since February 18, 2021, when Purpose's ETF (TSX:BTCC) became the first Bitcoin ETF to launch not just in Canada, but globally. BTCC’s launch on the TSX marked the beginning of the Bitcoin ETF frenzy in Canada, with Evolve’s Bitcoin ETF launching the very next day, followed by the CI Galaxy Bitcoin ETF (TSX:BTCXb) in March.

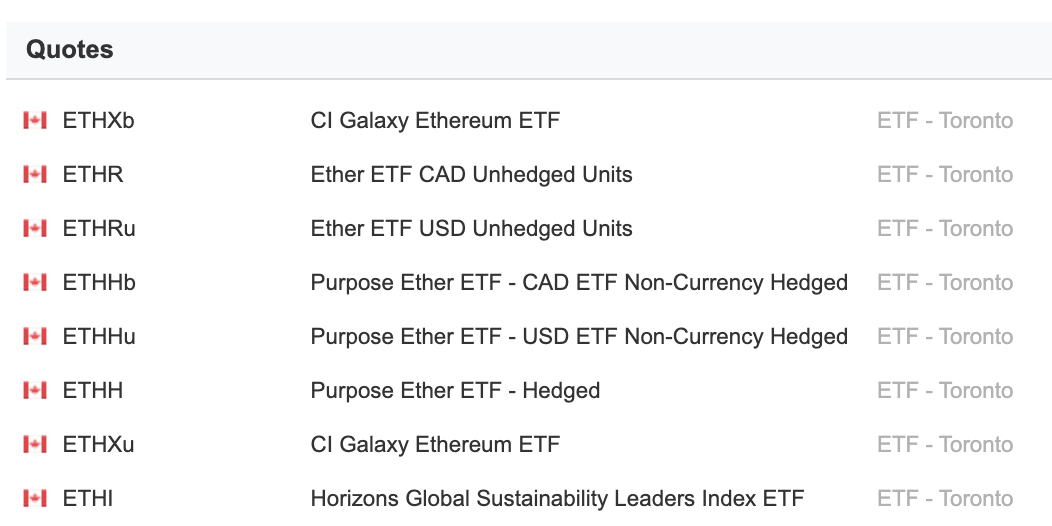

Currently, Canadian investors have access to a diverse marketplace of crypto ETFs. In addition to the various BTC ETFs in their various USD and CAD, hedged and unhedged denominations, Canadian crypto ETFs include Ethereum ETFs such as Purpose's Ether ETF (TSX:ETHH) and the CI Galaxy ETF (TSX:ETHXb). Canadian investors also have access to combined Bitcoin-Ethereum ETFs like the Evolve Cryptocurrencies ETF (TSX:ETC), and even an ETF that shorts Bitcoin, BetaPro Inverse Bitcoin ETF (TSX:BITI).

The difference between US and Canadian ETFs

In addition to offering a far more sophisticated marketplace, Canadian Bitcoin ETFs are arguably better products. Unlike their U.S. counterparts, which invest in Bitcoin Futures, Canada’s Bitcoin ETFs invest directly in the cryptocurrency. This difference is key. Since U.S. ETFs track future rather than current prices of Bitcoin, the Purpose and Valkyrie Bitcoin ETFs (NASDAQ:BTF) are unlikely to correlate to Bitcoin prices.

By betting on and buying at future prices, investors risk underperforming BTC over time if prices continue to rise, or losing a significant part of their holdings if markets fall. Futures’ roll-overs at expiry also introduce an extra cost. Canadian ETFs invest directly in Bitcoin, purchasing the crypto at the lowest spot prices on the market attained by a reverse auction with market-makers. As a result, and unlike their U.S. counterparts, Canadian Bitcoin ETFs tend to directly mirror the movements of the volatile cryptocurrency, except on the weekend when, unlike crypto markets, ETFs are closed for trading.

Is the BTC ETF a better financial product than BTC itself?

For Canadian investors, Bitcoin ETFs can offer several advantages relative to purchasing Bitcoin. The most significant advantage is that Bitcoin ETFs allow investors exposure to the volatile cryptocurrency through the mechanisms of a more traditional and familiar product, without needing to manage complex elements of the ecosystem such as a public address, private keys, crypto wallets, or cold storage. Instead, ETF investors simply purchase shares of the ETF through their brokerage account.

Another benefit of investing in a Bitcoin ETF over BTC is the ability to short sell ETF positions if investors are bearish on BTC in the short term. It is not possible to short sell Bitcoin, although investors interested in shorting the crypto can do so through futures, options, and other derivative products.

Canadian Tax Advantages of Bitcoin ETFs

Canadian investors can also take advantage of significant tax benefits by holding positions in Bitcoin ETFs through registered tax-sheltered accounts like a Registered Retirement Savings Plan (RRSP) or a Tax-Free Savings Account (TFSA). While cryptocurrencies cannot be held directly within an RRSP or TFSA, Bitcoin ETFs can be held within these accounts, offering a legally acceptable way to lower or eliminate taxes on crypto holdings.

Any gains realized through holding bitcoin ETFs within a TFSA are tax-free. Within the RRSP, capital gains are tax-deferred. Gains on Bitcoin ETF holdings will not be taxed at the time of deposit but at the time of withdrawal, with the capital gains taxed at the presumably lower marginal tax rate at the time of retirement.

Outside of ETFs held in tax-sheltered accounts, any realized gains from selling crypto in Canada are subject to income taxes. 50% of profits from crypto are added to income, either as business income or capital gains depending on the circumstance, and taxed at the marginal tax rate. It’s important for investors to keep in mind that cumulative holdings in an RRSP or TFSA can only be maximized up to individual contribution limits, providing a hard cap on the value of holdings that can be held in the registered accounts.

Limitations of Canada's BTC ETFs relative to BTC

Despite the tax benefits, there are downsides to investing in a Bitcoin ETF instead of holding the crypto. One such disadvantage is the significant management fees ETFs charge in addition to the brokerage fees. For Purpose’s Bitcoin ETF, the management fee is a hefty 1%, whilst Evolve’s management fee is slightly cheaper at 0.75%. CI’s Bitcoin ETF offers the lowest management fee at 0.4%.

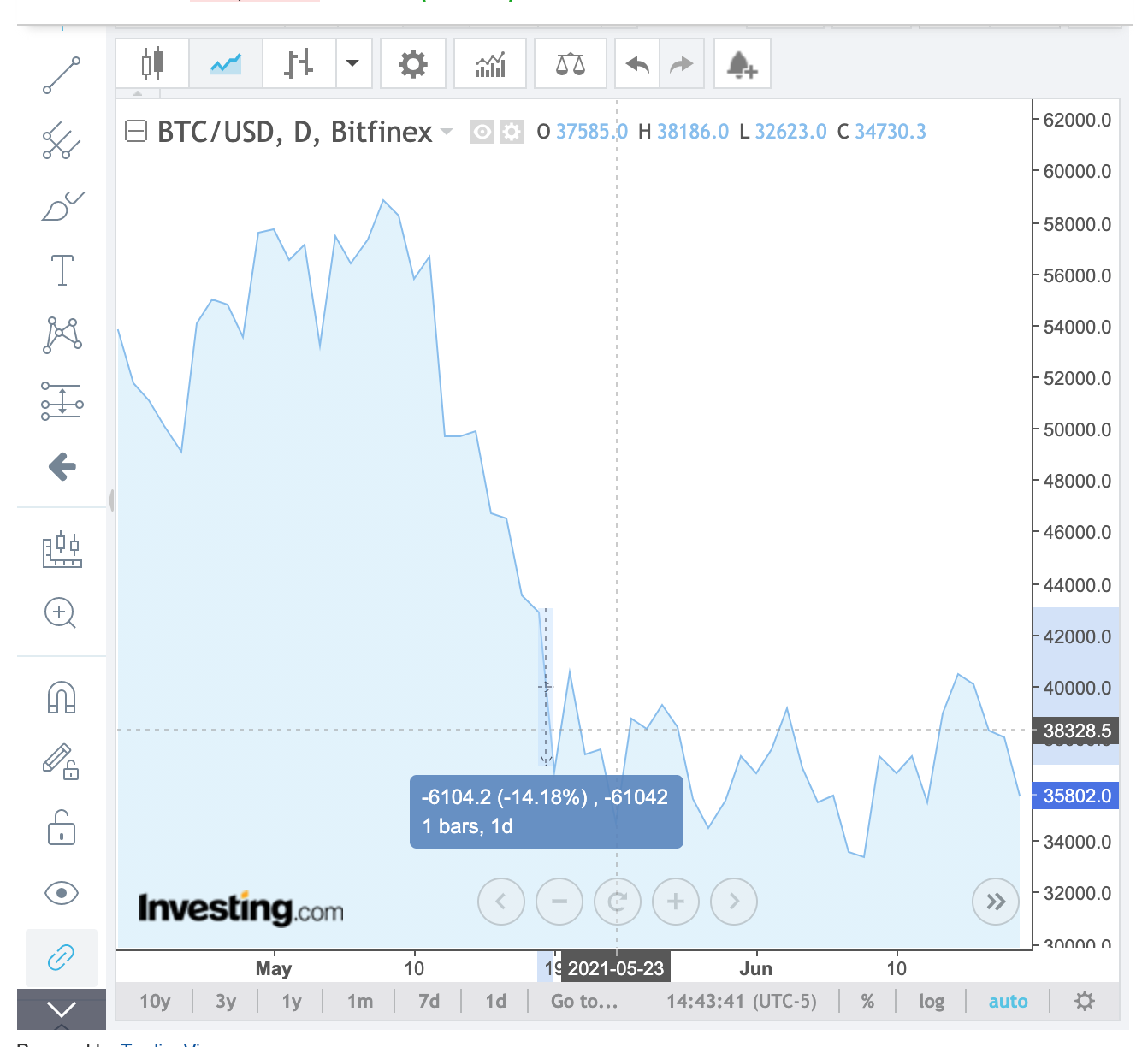

Another major downside is that while crypto markets are open 24/7, ETFs are only open to trade during market hours. In a market so volatile, trades are particularly time-sensitive. In a worst-case scenario, ETF investors may find themselves in the unenviable position of watching BTC prices plummet while they remain unable to execute trades on their ETFs. With Bitcoin, such a scenario is unfortunately not unlikely.

Although they hold positions in ETFs that invest directly into Bitcoin, investors must recognize that they do not own the underlying Bitcoin. This adds another layer of risk to an already high-risk investment, as wallet-holders on the world’s largest crypto exchange Binance learned when withdrawals were temporarily halted in the first week of November, leaving traders immobilized. Remember, “Not your keys, not your Bitcoin.”

As they do not hold the underlying Bitcoin, investors must also forego any potential for yield on their BTC, such as through P2P lending, liquidity mining, and yield farming. Bitcoin held through ETFs functions purely as a growth asset. For investors planning to hold BTC ETFs in registered accounts, it is important to consider the implication of capital losses on contribution limits. Unlike withdrawals, capital losses cannot be recouped in the contribution room the following year.

The Verdict on Bitcoin ETFs

Bitcoin ETFs are ideal for investors who seek limited exposure to the risky asset, or traditional investors who would like to hold positions in Bitcoin, but feel more comfortable doing so through the mechanisms of more traditional managed products. For Canadian investors, the tax benefits of holding BTC ETFs in their RRSPs and TFSAs are also attractive, and currently the only legal way to circumvent taxes on their crypto gains.

For traders and investors with high-risk tolerance, however, it makes more sense to invest in BTC directly rather than through ETFs, since the potential for gains is significantly higher despite tax inefficiencies. Canadian investors who play for high stakes might well find that their gains on swing trading crypto outweigh the savings unlocked with RRSP or TFSA contribution.

Beyond financial considerations, there is also an ideological consideration to investing in BTC vs the ETF. Cryptocurrencies like Bitcoin represent a rejection of fiat currencies, financial institutions, and centralized authority - an ideology that is fundamentally contrarian to the mainstreaming of the asset class that an ETF represents.