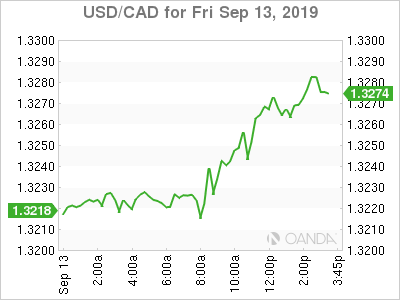

The Canadian dollar fell 0.45% Friday and will finish at 0.78 against the U.S. dollar. Canadian households have a 174.1% debt-to-income ratio in 2019 Q2. Rating agencies have already downgraded some of the banks as the risk of higher defaults rises as consumers take on more credit that they can pay back, even at record low interest rates.

Gold

Gold is struggling to recapture last week’s high on trade optimism and aftermarkets were disappointed with the European Central Bank’s cut to its deposit rate and launching of a smaller than expected new bond buying program. It appears the bullish gold punchbowl argument that massive global stimulus should help propel prices is running into a wall of renewed trade optimism. An interim trade deal is likely to become the base case.

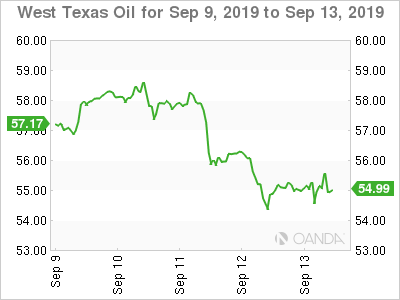

OIL

Oil prices have been slipping in recent days even as stock markets have rallied and inventory data has reported large drawdowns. This comes as the IEA and others continue to downgrade forecasts for demand as global economic growth fears mount. The monitoring committee for OPEC+ met on Thursday but no decision on future output cuts are expected until December. The new Saudi oil minister will be keen to reduce any deficit and lift prices ahead of the Saudi Aramco listing which could make the December meeting very interesting.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.

Huge drawdowns or trade optimism can’t save crude from its worst weekly drop in months. Oil seems set for hard times on glut concerns and on expectations we won’t see any enhanced efforts by OPEC and allies. Some OPEC delegates hinted a larger cut could happen next year, but rising production from U.S. and Norway will mitigate any increase to the current production cut agreement.