- Tesla shares fall due to weak earnings and declining sales.

- Musk's political success briefly aids stock amidst innovation concerns.

- Analysts emphasize the need for innovation to boost growth.

- Get the AI-powered monthly updated list of stock picks that smashed the S&P 500 in 2024 for less than $9 a month here.

Tesla Inc (NASDAQ:TSLA) shares have sharply declined in recent weeks. Neither technical nor fundamental analysis seems to offer hope for a reversal. The only possibility is that the ever-ingenious Elon Musk will pull off one of his classic surprises.

Early Tensions After the First 2024 Earnings Report

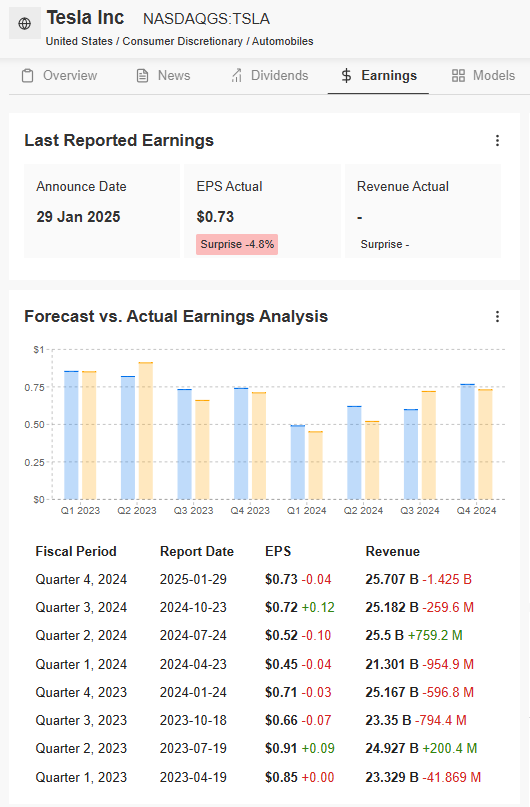

Following the post-election rally, the EV maker's stock faced challenges on January 29 when it reported lower-than-expected figures for the fourth quarter of 2024. The earnings per share stood at $0.73, falling short of the predicted $0.76, and revenues reached $25.71 billion, below analysts' expectations of $27.23 billion.

Despite this, Tesla maintained its record of nearly 2 million deliveries in a year and reduced production costs to under $35,000 per vehicle, showcasing improvements in operational efficiency.

Tesla's latest quarterly reports - Source: InvestingPro

Musk's Political Victory Bolsters the Stock

Despite uncertainties, the stock benefited from Musk's political success, climbing back above $400 per share in response to the financial results. However, since early February, the trend has reversed, and by the 11th of the month, the stock had fallen to levels seen in early December 2024.

Thomas Monteiro, a senior analyst at Investing.com, remarked shortly after the company's earnings announcement that "the success of Musk's political endeavor brought Tesla's investors the most valuable asset right now: time. And, frankly, it's probably the only thing preventing a major collapse given the numbers presented tonight."

Since January 31, though, the road has been slippery for Tesla, with the stock losing more than 13 percent in just a couple of weeks.

Musk Faces Challenges Amid Declining Tesla Sales and OpenAI Rejection

The year 2025 has already presented several hurdles for Tesla. The company has been directly impacted by a drop in sales starting in January, with significant declines in historically strong markets such as Germany (-60%), France (-63%), the UK (-8%), and China (-11.5%), particularly in Beijing, a crucial market for Tesla.

Adding to these challenges are the risks associated with dependency on its founder. Markets might have responded positively to the prospect of integrating OpenAI's latest artificial intelligence models into future vehicles. However, Sam Altman, CEO of OpenAI, wittily rejected Musk's $97.4 billion offer for the creator of ChatGPT, suggesting, "No thanks, but if you want, we can buy Twitter for $9.74 billion." This rejection not only dashed Musk's plans but also underscored the potential downsides of the political and media attention surrounding the world's wealthiest individual, which can negatively impact the companies connected to him. This adds another layer of uncertainty to Tesla's future.

Lack of Innovation

The challenges don't stop there. In his January analysis, Monteiro pointed out "weak demand for electric vehicles" and a "waning enthusiasm around Tesla," largely because of a "lack of eye-catching innovations in recent years," which is contributing to the brand's devaluation.

In essence, "Musk & Co have not figured out how to increase vehicle production without severely compressing margins. While we hold out hope for future developments to enhance Tesla's offerings, time is passing, and the company continues to show sluggish growth quarter after quarter," Monteiro concluded.

Fundamental View: Tesla is overvalued

What Do Tesla's Fundamentals Suggest for the Future?

Despite the recent decline, Tesla's stock remains far from cheap, still trading at a hefty 158 times earnings.

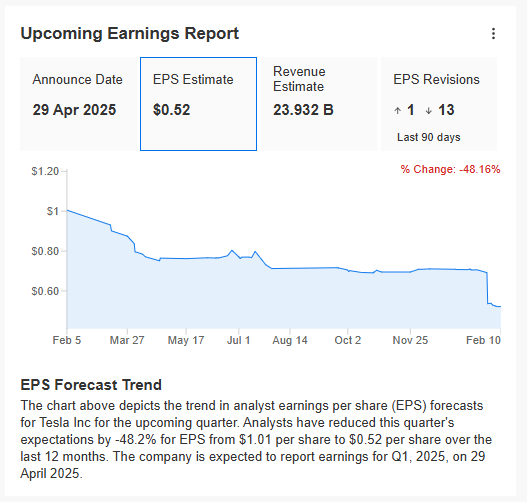

Additionally, analysts have significantly lowered their earnings expectations for this quarter. Over the past 12 months, estimates for Q1 2025 EPS have dropped from $1.01 per share to $0.52 per share, with 13 downward revisions occurring in just the past three months.

Source: InvestingPro

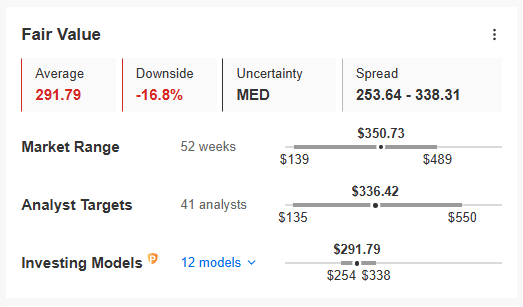

Even when considering Fair Value, which InvestingPro calculates using 12 recognized financial models tailored to Tesla's characteristics, the stock appears overvalued. It shows a potential downside of 16.8 percent from the $350.73 per share recorded at the close on February 10.

Source: InvestingPro

Meanwhile, analysts are divided on Tesla's operating plan. Among them, 19 recommend buying, 15 suggest holding, and 12 advise selling. Analysts have set a target price of $336.42 for Tesla over the next year, representing a decline of about 4 percent from current levels.

Source: Investing.com

Musk needs more time and innovation to return Tesla to growth

Can the South African-born tycoon leverage his political influence and entrepreneurial skill to boost the stock, which, it is worth noting, has gained about 86 percent over the past year? Or are his ambitions too unwieldy, potentially leaving Tesla in the already crowded space of "I wish I could but I can't"?

Only time can provide the answers. Although Musk may seem to have plenty of it, time remains relentless, and its judgment will ultimately depend on delivering winning innovations, whether they involve OpenAI or not.

***

Looking for a tool to help you choose the best stocks to buy and sell amid rising volatility? Try InvestingPro. With advanced stock screeners, Fair Value assessments, and AI-driven strategies like Propicks IA, InvestingPro is designed to help you outperform the market.

Give it a try now—CLICK HERE and start investing like a PRO!

DISCLAIMER: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. As a reminder, any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor