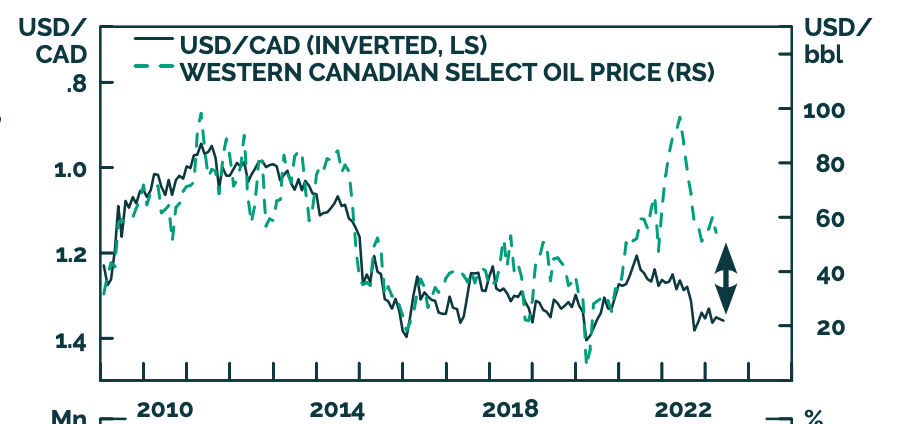

Over the last month, CAD has been flat. Year-to-date, the loonie is down roughly 0.9%.

This is partly due to softness in oil prices.

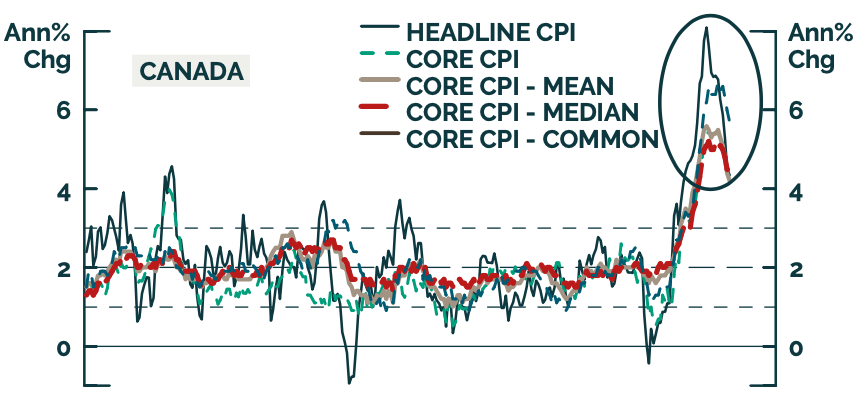

In April, core inflation slowed to 4.1% from 4.3%. Headline, however, rose to 4.4% from 4.3%

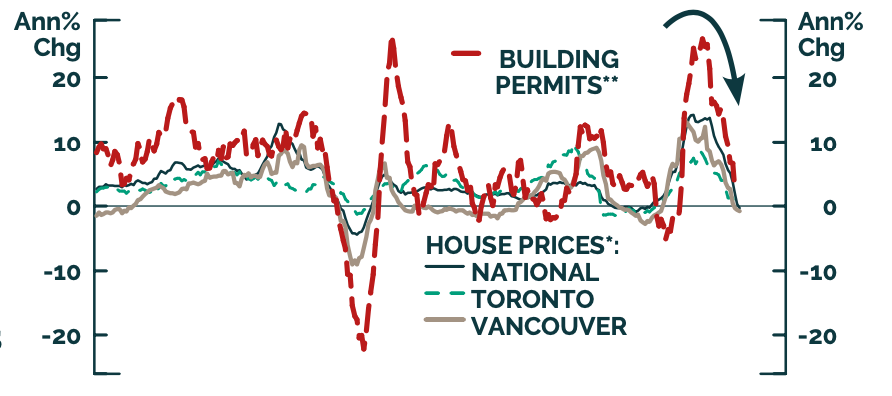

House prices have also been weakening on the back of higher interest rates, with national prices turned negative year-over-year.

Building permits indicate this contraction could stall.

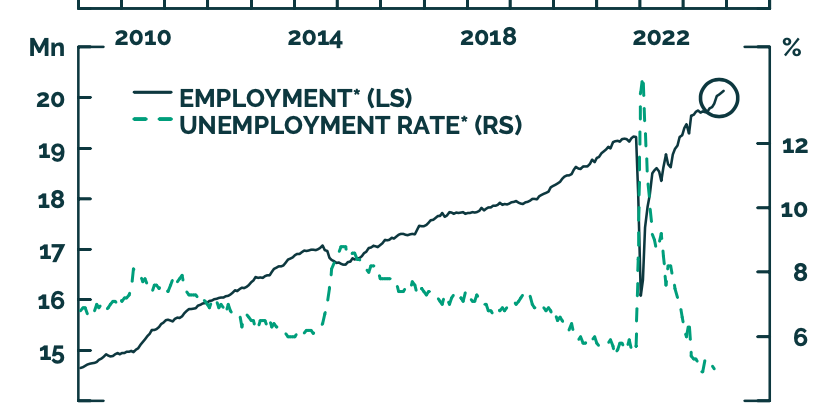

The labor market remains resilient however,as the unemployment rate is unchanged at 5% in April. Average hourly wages also stayed flat at 5.2% year-on-year in April.

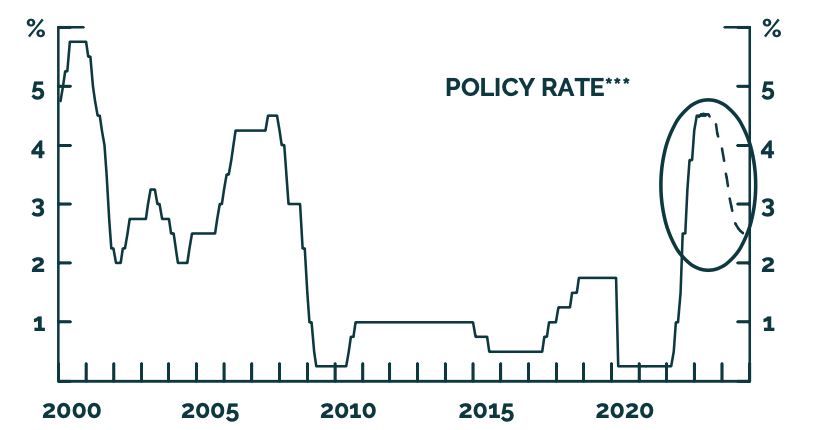

The difference was largely because of a substantial month-over-month increase of 6.3% in gasoline prices in April. 20 This was due to oil prices increasing on the 19 back of OPEC supply cuts. In our view, the CAD will likely underper- form at the crosses, given that more rate cuts are priced in the US, and that Canada is more vulnerable to higher rates.