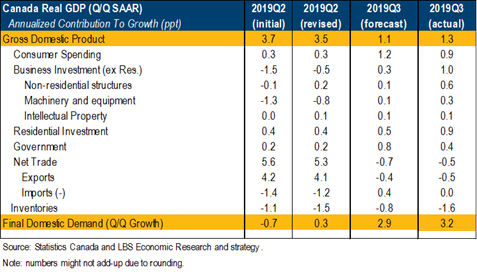

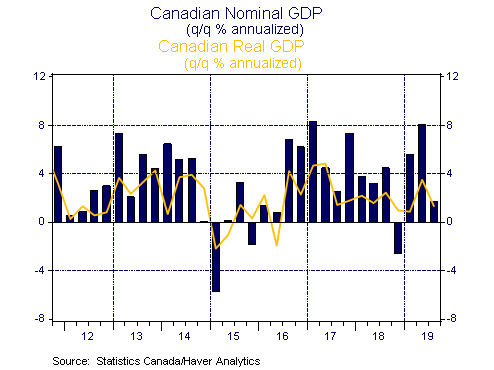

The Canadian economy showed encouraging signs of resilience lately, a necessity for the Bank of Canada in order to remain on the sidelines. Real GDP advanced by 1.3% (q/q, seasonally adjusted at annual rate) in 2019 Q3, in line with consensus and the October Monetary Policy Report (MPR) forecast. Real GDP rose at a moderate clip of 1.7% in the first three quarters of 2019 relative to the same period a year ago.

The first sign of resilience relates to business investment, which has been trending up modestly since 2017. Statistics Canada revised up the profile of business investment for 2019 Q2, which will please BoC officials.

Furthermore, in 2019 Q3, Canadian companies increased their investment (+9%) in M&E, non-residential buildings and intellectual property products.

Second, residential investment, a reliable measure for broad housing activity, rose at a pace unseen since 2012 (+13.3%). Both ownership transfer costs (+39.4%) tied to the surge in MLS resale transactions and new construction activity (+14.0%) soared during the quarter, while renovation activity stagnated.

In our view, the stars are aligned for further strengthening of the Canadian housing market due to lower mortgage rates, the addition of about 300,000 full-time jobs so far this year and one of the strongest household formation rates among industrialized countries.

Excluding housing, households are more cautious lately when it comes to spending on goods and services: consumption in real terms rose by a modest 1.6% in 2019 Q3 on the heels of a tepid 0.5% increase in 2019 Q2. Those are soft readings considering that nominal household disposable income growth accelerated briskly (+4.4% so far in 2019 relative to 2018). The good news is that the personal savings rate increased for a third consecutive quarter, reaching a 4-year high of 3.2% in 2019 Q3.

Third, stronger balance sheets allow all levels of government to be a steady tailwind to economic activity. Government expenditures and public investment rose by 1.8% in 2019 Q3.

Of course, the picture is far from perfect. Some cracks undeniably opened in the Canadian economy. For instance, net exports dragged down real GDP growth in three of the last six quarters, including a 0.5pp drag in 2019 Q3 (see table). In addition, trade tensions weighed down on commodity prices, which, in turn, crippled down the GDP deflator to an anemic increase of 0.4% q/q annualized. Thus, the overlooked nominal GDP figure advanced at a very soft pace in 2019Q3 (+1.7% q/q ann.).

Bottom Line: The details of the GDP report are generally encouraging. Also, the weaker accumulation of business inventories, which shaved 1.6pp to real GDP growth in 2019 Q3, reflects stronger domestic demand. Overall, this report reinforces our view that the BoC is unlikely to cut its policy rate next week or during the winter of 2020. Before Christmas, the top issue to watch remains trade developments. The October MPR already incorporates the U.S. tariffs on Chinese imports that could be implemented on Dec. 15. If the U.S. and China officialize soon their so-called Phase 1 deal, it would definitively improve the outlook relative to the October MPR base case scenario, forcing markets to re-consider the current partial pricing of BoC rate cuts for the first half of 2020.