This is an edition of the Market Pulse Newsletter. Everything you need to know about Canadian Real Estate in a 2-3 minute read.

Interest Rates and Inflation

CPI numbers jumped back up in July to 3.3% up from 2.8% in June. A sign that inflation is still raging on and further justification for the Bank of Canada to hike the interest rates up once again.

However, if you exclude the increase in mortgage interest (which are included in the CPI calculation), we get a CPI of 2.4% for July. With this, there is potential that the BoC may keep rates steady. After all, many fixed mortgage holders are in for a rude awakening renewing at the current levels anyways.

So when will rates come down? Not this year, that's for sure.

Mortgage Renewal Fears Are In The Air

The prime rate is sitting at 7.20% and we're looking down the barrel of another 25 basis points. It's not looking good for mortgage renewals.

Fixed rates at banks have been increasing in line with bond yields which usually lead fixed rate mortgage decisions at the banks. Credit tightening is already being felt throughout the system and soon the majority of mortgages will be renewing around the 6s and 7s putting even more strain on borrowers.

A survey found 65% of Canadian mortgage holders are worried about renewing in this rate environment. Fixed rate holders and variable fixed payment mortgage holders are definitely feeling the anxiety. New payments for some may be 2x what they’re currently paying.

100 Million Canadians by 2100

The century initiative is a plan put together by McKinsey & Company, a company who our government loves to outsource decision making to. The goal of the initiative is to expand the population of Canada to 100 million by 2100. It even has a real-time population counter on the website as well.

Immigration is definitely the backbone of a strong economy and we need more of it. However, when we prioritise immigration at all costs without accounting for basic infrastructure like essential services and housing for new Canadians, we're actively participating in lowering the quality of life for everyone. Right now we're putting pressure on a housing supply that just can't keep up in the current economic environment.

If this Century Initiative is a guiding star for the government without other considerations, we can be sure to see continued stresses on housing for the foreseeable future.

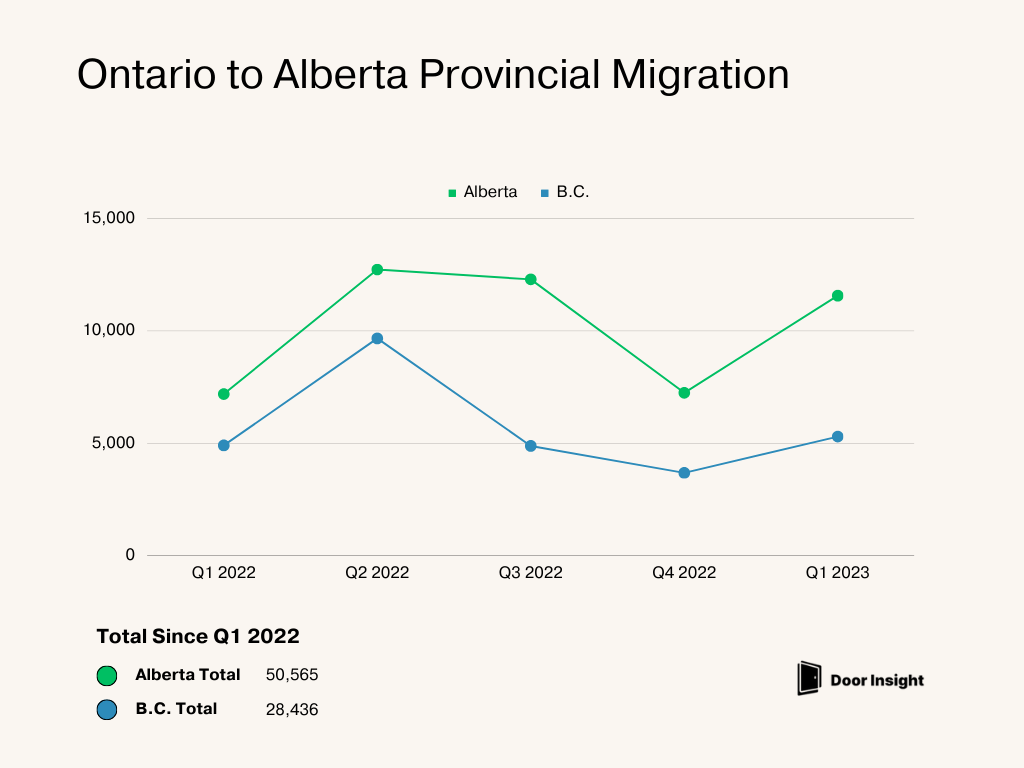

The Ontario to Alberta Migration

Ontarians have been heading out to Alberta in large numbers compared to any other province. The chart below shows the inter-migration of Ontarians to Alberta for the last few quarters. Rent in some areas of Calgary have skyrocketed by 20% since last quarter and home prices have surged over 18% since last year.

In the first quarter of 2023, 11,564 people have moved to Alberta from Ontario and since last year over 50,000 people have left to live amongst the rockies. Almost double the amount that have gone to B.C.

The thing with Alberta is, there isn't as much red tape to building new homes so once the interest rates drop again, developers can ramp up construction and expand the inventory much more easily than Ontario. Right now, the housing supply is definitely lagging behind demand but this is something we've seen before:

Whenever there's an energy boom, we see an undersupply of housing and when oil prices collapse we see an oversupply. The situation might be a little different now but not that far off and Alberta is still an economy dependent on the oil cycle.

For now, high energy prices coupled with the pursuit of affordable housing will continue to fuel the Alberta economy and attract more Canadians.

Chart by Door Insight [doorinsight.com]. Data from Stats Canada [statscan.gc.ca]

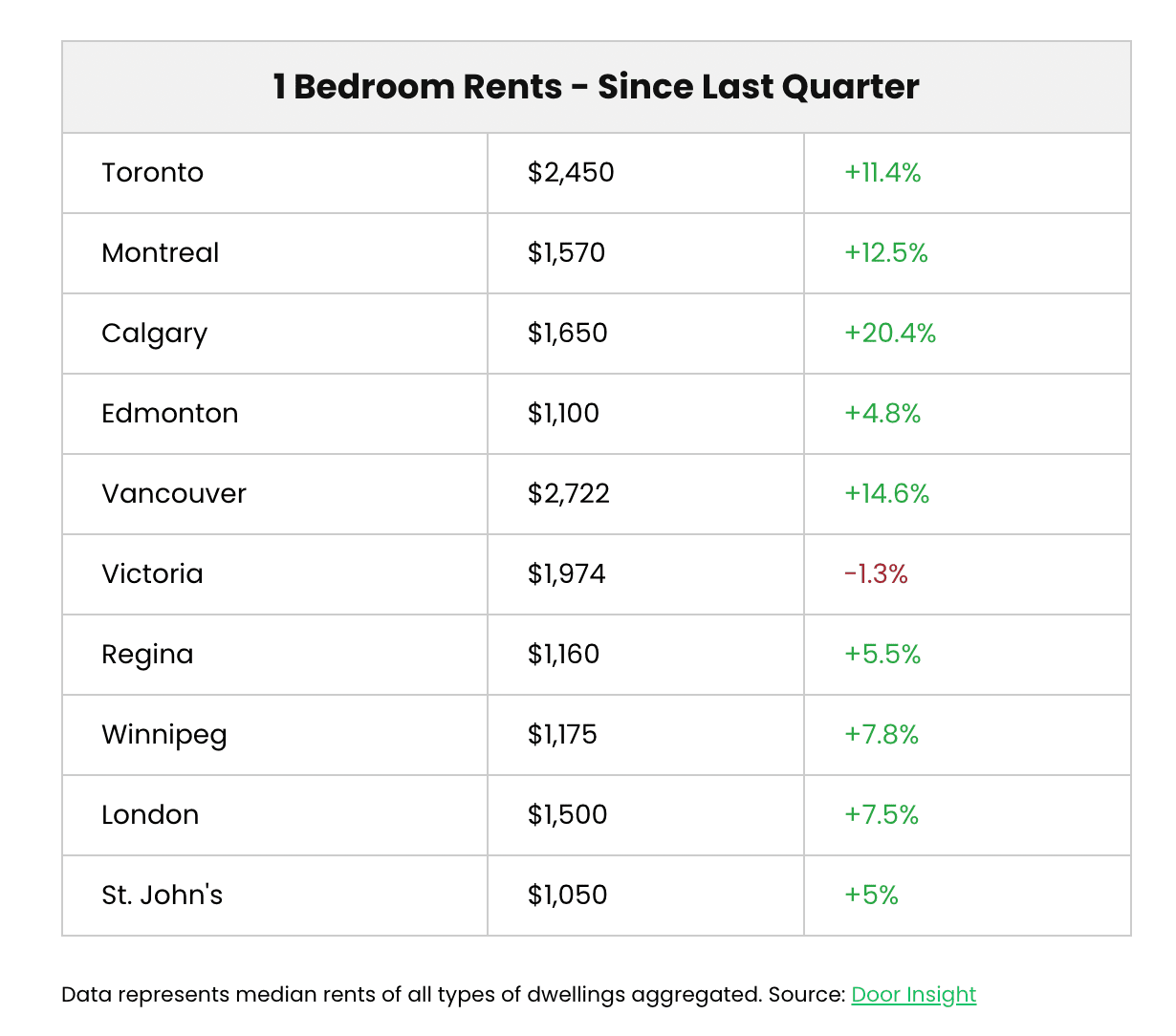

Canadian Residential Rent Snapshot

Rents have once again been skyrocketing across the country with Calgary leading the way since last quarter. More people moving to Calgary this year has put more pressure on both home prices and rents in Calgary. Edmonton has also seen an uptick in rents since last quarter but less pronounced than its sister city.

|

||

Chart and data by Door Insight [doorinsight.com]

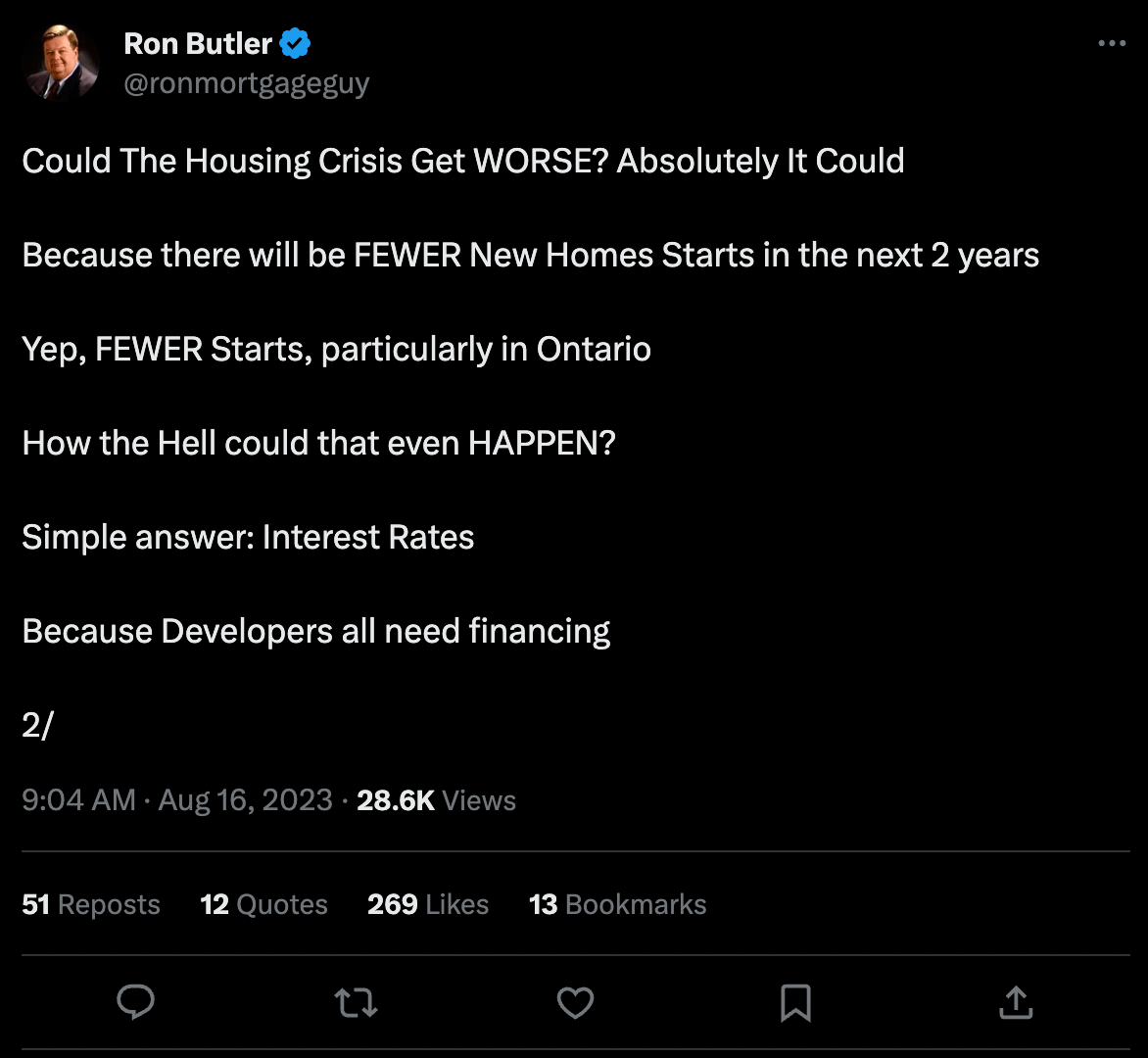

Tweet Of The Week

Housing starts are suffering as interest rates rise leading to a vicious cycle where higher interest rates leads to less homes being built and less homes being built leads to more inflation in home prices.

If you enjoyed this edition of Market Pulse, please consider subscribing to our newsletter where we tell you everything you need to know about Canadian Real Estate in a 2-3 minute read.

This content was originally published in the Doorinsight.com newsletter.