May 16th 2023, came with a lot of uncalled surprises for all of us as it was the day when the inflation rate rose to 4.4%. From that point onwards all eyes have been on the Bank of Canada, which in all fairness was not expecting for this to happen, trying to guess what their course of action would be to tackle the running 30 - year high inflation.

Although many experts at the time believed that BOC still had some wiggle room, as the days passed it became abundantly clear that it wasn't the case. Finally, on June 7th 2023 the Bank of Canada made its decision, which is to increase the policy rate by 25 basis points leaving home buyers of both the past and the future uncertain of their place in the upcoming Canadian real estate industry.

If you are one of them then this report from The Canadian Home is for you. Not only will we look into what led to this but also where it is leading to so that you are in a better position to gauge where you stand and where to go from here.

WHY DO IT?

There are many factors that forced the Bank of Canada into raising the policy rates after months of hold however the sum total of which can be categorized into three.

1) TO TACKLE THE INFLATION

Bank of Canada governor Tiff Macklem made it clear in a speech following a decision to hold the interest rate previously by saying "This pause is conditional, it depends on whether the economy develops as we think it will and whether inflation continues to fall."

Since that did not happen and the inflation contrary to what they thought increased instead the rate hike was inevitable. Bank of Canada has been raising interest rates to tackle inflation, which refers to the increase in prices over time. One way to measure inflation is through the Consumer Price Index (CPI). In April, the CPI went up by 4.4% compared to the previous year from a 4.3% in March.

2) GROWTH IN GDP

Now, let's talk about Canada's economy. In the first quarter, which covers the first three months of the year, the country's economy grew at a rate of 3.1% when compared to the previous year. This growth rate is higher than what the central bank had predicted. BoC had expected the economy to slow down during this period. However, the latest data indicates that the economy performed better than anticipated resulting in a higher inflation rate.

3) THE JOB MARKET

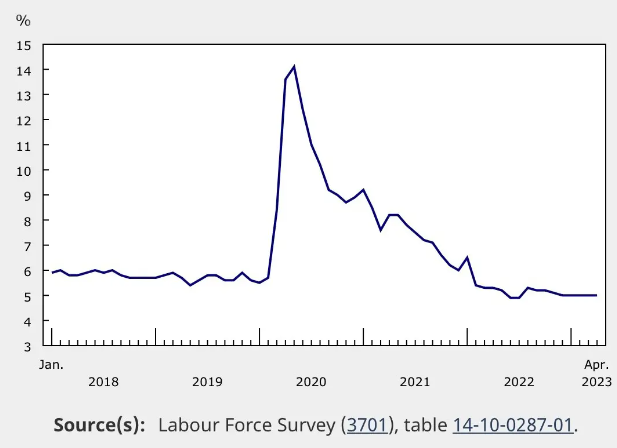

The Canadian job market is currently going strong, as indicated by the record-low unemployment rate of 5%. In the past month alone, employment rate has increased by 2%. This basically results in a direct impact on people's spending capacity. As people's spending capacity improves due to favourable employment conditions, businesses respond by increasing prices to meet the rising demand which then contributes to inflationary pressures in the economy.

In response to this robust labour market and with the aim of reaching their 2% inflation target by the end of 2024, the Bank of Canada has decided to raise interest rates. This decision takes into consideration the ongoing economic growth and the strength of the labour market.

THE IMPACT IT WILL HAVE

To say that this change in the policy rate will have impacts that are far reaching and multi-faceted will be an understatement. Almost every aspect of the Canadian real estate from buyer behavior to market dynamics will be affected.

1) A DIP IN AFFORDABILITY

Housing affordability has been a long running crisis in Canada and given the record-low housing supply this change in policy rate will further amplify the problem as higher interest rates will only add to the overall cost of the home which was already high due to low supply. For a $500,000 home, a 1% increase in interest rates adds around $320 per month to mortgage payments, resulting in an extra cost of approximately $96,000 over a 25-year mortgage term.

2) A SHIFT IN THE MARKET DYANAMICS

Since December 2022, there has been an upturn in the Canadian housing market which in the month of May topped off and we saw some of the highest numbers in sales and listings since last year leading many experts to believe that we were entering a sellers market. However with the recent rate hike this momentum will surely be disrupted as demands will soon start to decline leading.

According to Manoj Karatha The broker of record at The Canadian Home-"Given the current circumstances this was something that we were expecting, and we believe that a market shift is right around the corner. Instead of a seller's market, it appears to be transitioning towards a neutral market. This change suggests that buyers may have a better chance of affording housing in the near future although not right away"

3) TOUGH TIMES FOR MORTGAGE HOLDERS

This hike in the policy rate will now be followed by a hike in the mortgage rates and thus Canadian mortgage holders will have to brace themselves for higher monthly payments. The total residential mortgage debt in the country has reached a staggering $2.08 trillion. While the majority of mortgage holders have fixed-rate loans, only about 30% have variable rates. However, a potential concern arises when fixed-rate and variable-rate mortgage owners need to renew their loans in 2024-2025, as this could lead to a default issue due to the impact of rising rates.

According to Robin Cherian CEO of real estate firm The Canadian Home-"In the month of January The Canadian Home published a report in which we predicted two rate hikes for the year 2023. The first one happened in January 2023 and with this one we have reached the second hike. The real estate market is expected to become more challenging, particularly for individuals whose mortgage rates are up for renewal."

IT WAS INEVITABLE

BoC's decision of a rate hike after months of hold is definitely something that will be frowned upon by many but what we have to understand is that there was no avoiding it. Even if the central bank chose not to increase the rate in June they would have to in July and at that time it would have been much higher than what we got this time. BoC is still trying their best to meet their target of 2% inflation rate by the end of 2024 and if that happens then we can very well see a rate decrease on the horizon.

By all means the upcoming few months will be a toughie for all of us especially for home sellers and mortgage holders. But as demand decreases so will the prices and thus if a home buyer times it just right they might be able to bag the biggest bang for their buck.

This article was originally published on The Canadian Home