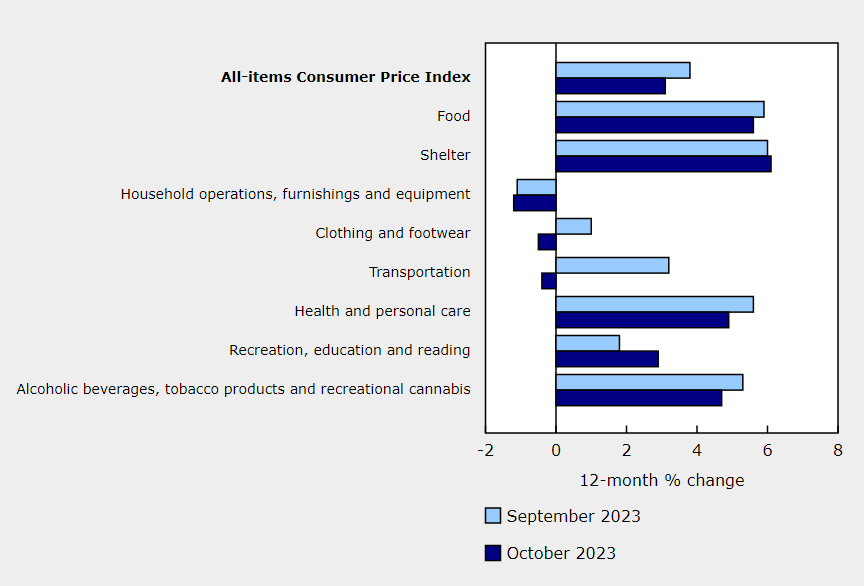

This months inflation came in at 3.1%. Last month was 3.8%, this was a drop of 0.7% Peak inflation was 8.1%. The lowest reading we got this year was 2.8% in July.

Here’s the change month over month

- Travel/tours 11%

-

Property tax 4.9%

-

Internet 3.5%

-

Mortgage 2.5%

-

Rent 1.4%

-

Kitchen items -14.8%

-

Gas -6.4%

-

Fruits/ Veggies -3.3%

Here’s the changes year over year

-

Mortgage interest 30.5%

-

Rent 8.2%

-

Restaurants 5.7%

-

Food 5.6%

-

Electricity 11.1%

-

Airfare -19.4%

-

Phone services -14.1%

-

Nat gas -13.1%

-

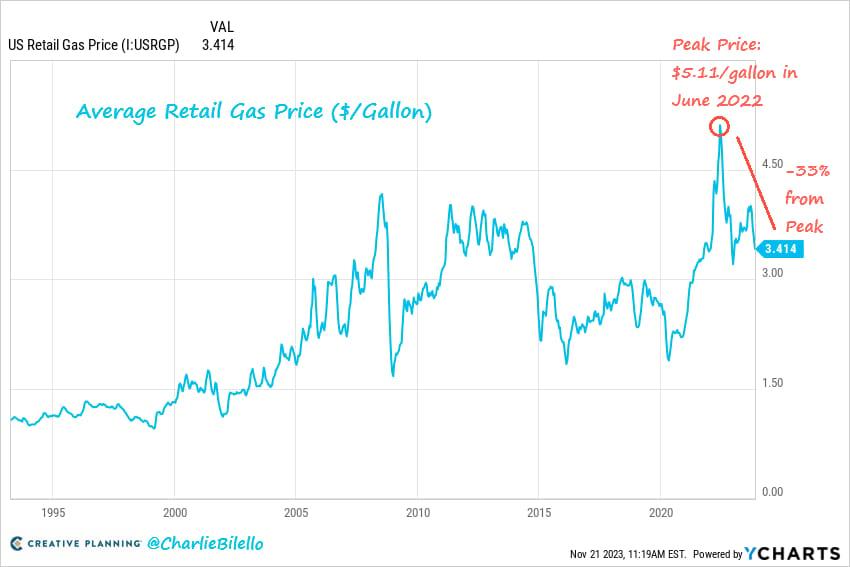

Gas -7.8%

The year-over-year deceleration was largely a result of lower prices for gasoline. However prices for travel tours , rent & property taxes keep rising.

Mortgage and rent are contradictory to inflation since interest rates are the reason why both of them keep rising. BoC would need to start cutting rates soon to lower inflation.

The next interest rate decision is Dec 6. I’m predicting a Pause in the rates.

*All data was taken from statistics Canada

More Economics

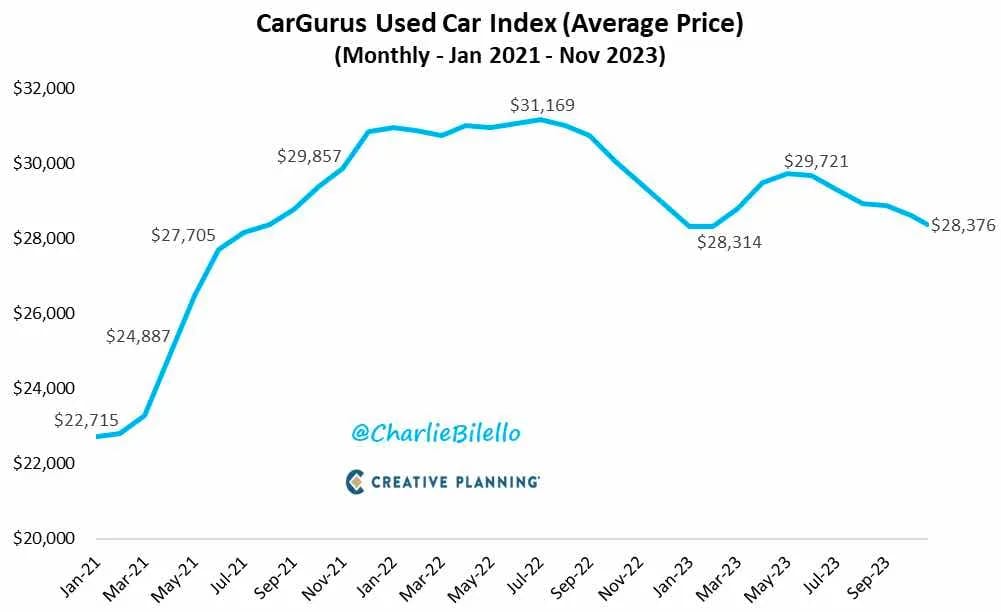

Time to buy a used car ! The average price of a used car is on pace for a 6th consecutive monthly decline and is not far from hitting a 2-year low. CPI should move down again in November.

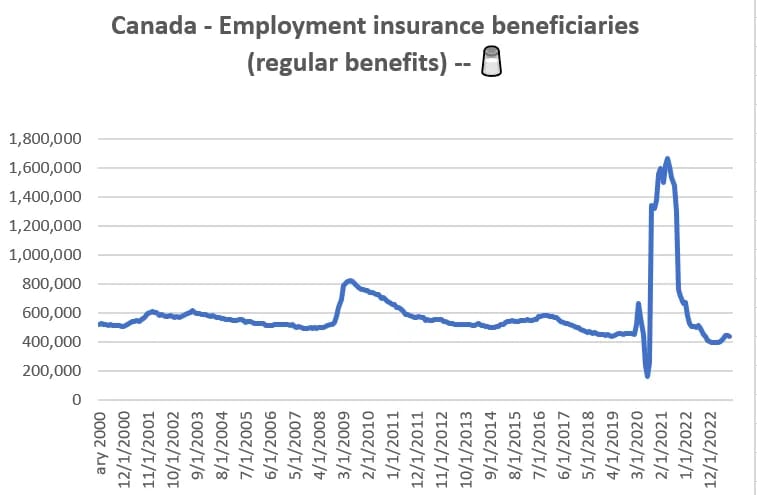

The number of Canadians receiving unemployment insurance was flat in Sept. Once again approaching all-time lows. No recession in sight.

Canada home prices slide as homebuyers go into 'hibernation' Home sales fell 5.6 per cent from September to October, mainly because of declines in Canada's biggest markets, said the Canadian Real Estate Association

According to AAA, gas prices could hit their lowest Thanksgiving level seen in years

A 'historic' credit crunch is underway in Canada, says David Rosenberg, in his note to clients. He points to data released last week suggesting consumer-credit growth in September slowed 2.9% from a year ago; mortgage-lending growth, which accounts for two-thirds of total household credit, decelerated to 3.1%, or the lowest level in over two decade