In March 2020, as COVID-19 rapidly spread, the Canadian equity market plummeted, with certain sectors bearing the brunt of the impact. Real Estate Investment Trusts (REITs), which often thrive on the robust flow of commerce and occupancy, found themselves particularly hard hit.

The widespread lockdowns severely disrupted the REIT market, especially those focused on industrial and commercial properties, as businesses curtailed operations and foot traffic vanished.

Even residential REITs faced challenges with government-imposed rent moratoriums and freezes, undercutting their revenue streams.

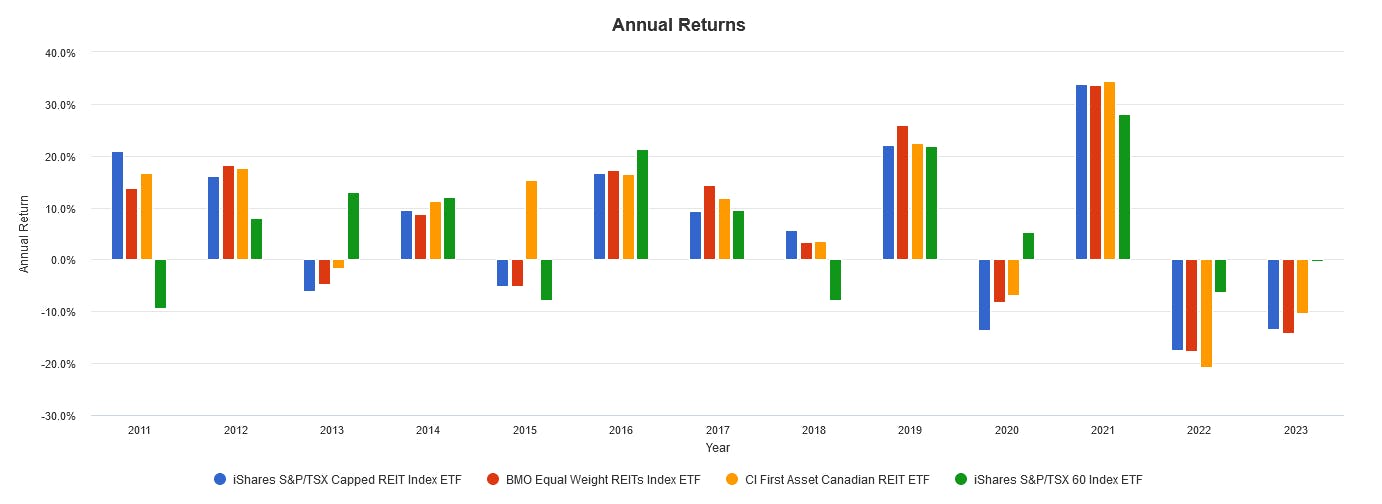

Following a sharp yet brief recovery in 2021, Canadian REIT ETFs have once again been facing a downward trend through 2022 and into 2023.

This continued pressure on REITs reflects not just the lingering effects of the pandemic but also broader economic headwinds. Let's assess the factors behind this prolonged slump and analyze some of the notable REIT ETFs in the Canadian market.

What happened from 2022 onwards?

Since 2022, the financial landscape has been largely shaped by one dominant force: rising interest rates. For those with mortgages, this trend has translated into tangible financial strain as payments increase.

This is part of a deliberate strategy by central banks to tame inflation, which has seen rates climb steadily to the point where the policy interest rate was held at 5% as of the recent October 25 decision.

The intent is clear: to cool down the overheated economy and bring inflation back to target levels. However, this monetary tightening has repercussions across various economic sectors, including REITs. They are particularly sensitive to interest rate hikes for a couple of key reasons.

Firstly, their capital structure often relies on debt to fund property acquisitions and development. As interest rates rise, the cost of borrowing increases, squeezing margins and reducing profitability. This can affect their ability to pay out dividends, which are a key attraction for investors in REITs.

Secondly, when interest rates are low, REITs are attractive to investors due to their typically higher yields compared to other fixed-income assets.

However, as rates rise, the relative attractiveness diminishes. Risk-free or lower-risk investments like Guaranteed Investment Certificates (GICs) and high-interest savings account ETFs become more competitive as they start offering yields that can surpass 5%.

This shift can lead to capital flowing out of REITs and into these safer assets, putting downward pressure on REIT prices and making them less appealing to both income-focused and growth-oriented investors.

The effect on REIT ETFs

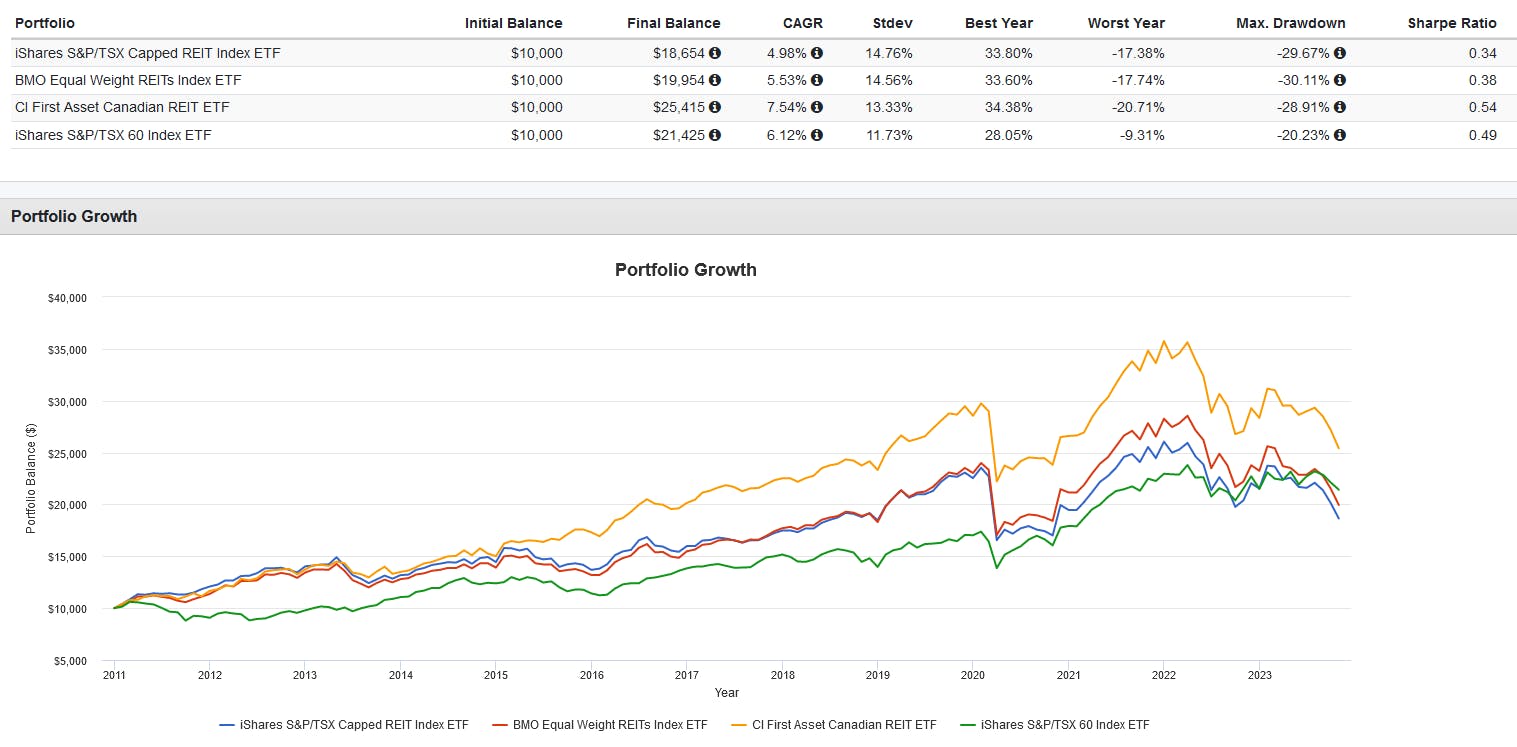

The impact of the economic and interest rate environment on the performance of Canadian REIT ETFs has been starkly negative. Three of the largest REIT ETFs by assets under management in Canada have all suffered.

The BMO (TSX:BMO) Equal Weight REITs Index ETF (TSX:ZRE)(ZRE), which adopts an equal-weight strategy, and the CI Canadian REIT ETF (TSX:RIT)(RIT), which is actively managed, have not been able to sidestep the downturn experienced by the more popular market-cap weightediShares S&P/TSX Capped REIT Index ETF (TSX:XRE) (XRE).

Throughout 2022 and into 2023, as of the end of October, these major REIT ETFs have not only underperformed in comparison to the benchmark S&P/TSX 60 Index ETF (XIU), but they have also encountered more severe drawdowns and volatility. This underperformance highlights the sensitivity of REITs to interest rate changes and broader market stress.

For risk-averse investors, these lower prices might seem like an enticing entry point, suggesting a potential rebound and buying opportunity. However, caution is warranted.

Investors who had a similar mindset in 2022 were met with continued losses, a scenario akin to 'catching a falling knife.' With this in mind, it could be prudent to look beyond Canadian borders for opportunities.

Diversification is often a key tenet of resilient investing, and in the face of domestic REITs' struggles, turning to global markets might provide a more stable ground.

Tools like the Cboe ETF screener can help investors find REIT and real estate ETFs with global exposure, potentially mitigating risks associated with the Canadian real estate market and offering a hedge against local economic downturns.

This content was originally published by our partners at the Canadian ETF Marketplace.