From its humble inception in 1990 with the introduction of the iShares S&P/TSX 60 Index ETF (XIU), the Canadian ETF landscape has transformed into a thriving ecosystem, now accounting for approximately 15% of total publicly offered investment fund assets in the country.

This staggering growth hasn’t been without its challenges. Recent developments, such as liquid alternatives ETFs, high-interest cash ETFs, single-stock ETFs, and notably, spot cryptocurrency ETFs, have not only broadened the scope but have also ushered in new complexities.

Such innovations are undoubtedly pushing the boundaries, testing the resilience and applicability of existing regulations. But what regulatory body is at the forefront of understanding and overseeing the fast-paced and innovative Canadian ETF industry?

Enter the Canadian Securities Administrators (CSA). Tasked with the responsibility of ensuring the integrity of the nation's financial markets, the CSA plays a crucial role in developing regulatory standards, and this time, their focus is now set on a regulatory review of the burgeoning ETF sector.

As Stan Magidson, the Chair of the CSA and CEO of the Alberta Securities Commission, rightly points out, "Canada is a pioneer in ETFs." And with a pioneering spirit comes the responsibility of adaptation, to ensure that regulatory frameworks remain relevant.

As the ETF market expands its horizons, embracing new structures and trading mechanisms, it is paramount that its regulatory framework follows suit, ensuring that it caters to the unique characteristics and demands of this industry.

So, as the CSA embarks on this critical review throughout 2023, what can investors and asset managers expect? In this discussion, we will delve deep into the potential implications of the CSA's announcement, shedding light on how this regulatory evaluation could shape the future of ETFs in Canada.

What the CSA is focusing on

As the CSA gears up for the second half of 2023, a key agenda on their plate is an assessment of the current regulations pertaining to ETFs. Specifically, the CSA aims to determine if the regulations in place adequately cater to the "unique features" of ETFs. These features, which set ETFs apart from traditional investment vehicles like mutual funds and close-ended funds, are:

- Secondary Market Trading: At its core, this involves the transaction of ETF shares on stock exchanges, akin to how individual stocks are traded. For instance, when Jane wishes to purchase shares of an ETF, she can carry out the transaction through her brokerage account, effectively buying from another investor looking to sell, without any direct interaction with the ETF entity itself.

- Creation and Redemption by Authorized Dealers: This process bypasses the conventional method where an ETF directly interacts with the general public for issuing or buying back shares. Instead, specialized financial institutions, termed as authorized dealers, take on this role. They hold the unique privilege of creating or redeeming ETF units in sizable blocks, commonly referred to as "creation units." An example to shed light on this would be when an ETF sees a surge in demand. An authorized dealer can procure the assets the ETF represents and swap them for fresh ETF shares, thus increasing the supply.

- Arbitrage Mechanism: This element is vital to ensure the price stability of an ETF relative to the net value of its assets. In scenarios where an ETF's price veers away from its Net Asset Value (NAV), arbitrageurs step in to exploit this price difference. For instance, if an ETF trades at a premium compared to its NAV, an arbitrageur can purchase the underlying assets at a cheaper rate and offload the ETF at a higher price. This transaction not only guarantees them a profit but concurrently aligns the ETF's price closer to its NAV.

A possible area of scrutiny

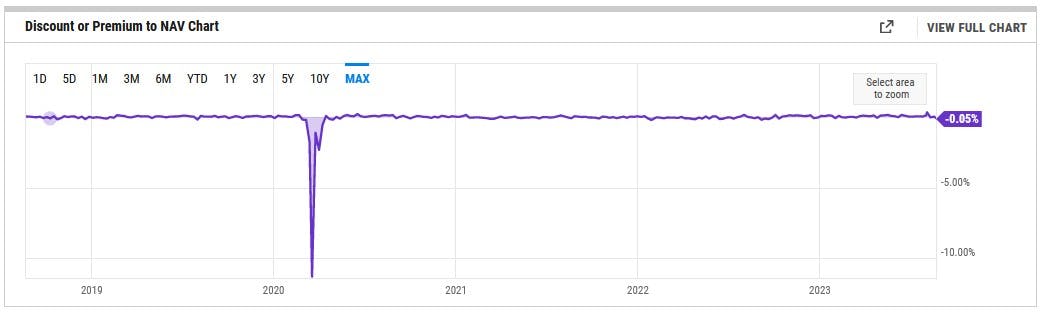

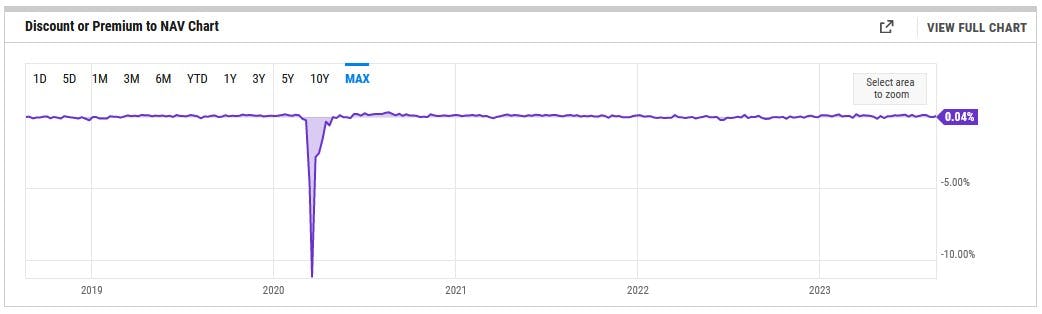

A real-world example that may draw the CSA's scrutiny is the March 2020 COVID-19 market crash. During this tumultuous period, many popular Canadian bond ETFs, especially those holding less liquid corporate bonds traded at significant discounts to their NAV, as seen below:

- BMO (TSX:BMO) Aggregate Bond Index ETF (ZAG): -11.30% discount to NAV on March 18, 2020.

- iShares Core Canadian Short Term Corporate + Maple Bond Index ETF (XSH): -11.20% discount to NAV on March 18, 2020.

For investors, this meant that the market price of these ETFs was considerably lower than the value of the bonds they held. Investors selling the ETF during this time might have realized losses larger than if they had held the underlying bonds directly.

Such events raise questions about the efficacy of the arbitrage mechanism during market stress and whether there's a need for enhanced regulatory oversight to prevent such discrepancies in the future, especially when it comes to ETFs holding less liquid underlying assets.

This content was originally published by our partners at the Canadian ETF Marketplace.