Two of the key takeaways from the 2023 Trackinsight ETF survey that have stayed in my rear view mirror so far are as follows: 1). Investors continue to prioritize low fees as their primary motivation for choosing ETFs, and 2). Investors are more and more inclined to invest in an actively managed ETF.

ETF managers have taken note of these two trends, offering a wider range of lower-cost actively managed solutions. Earlier in October, I profiled some of the cheapest NYSE-listed actively managed ETFs out there and also covered five of Capital Group's new ETF debuts.

Today's focus combines aspects of both these articles to examine the unique Capital Group Dividend Value ETF (CGDV), which offers active management at a very competitive 0.33% expense ratio.

Why is CGDV worth a look?

CGDV emerges as a distinctive player in the ETF realm, particularly in a year when growth-oriented investment styles once again overshadowed value strategies—a trend propelled by a few mega-cap stocks that exert a disproportionate influence on market-cap-weighted indexes.

Amidst this landscape, dividend-focused strategies generally saw lackluster performance, primarily due to their leanings towards value-oriented portfolios.

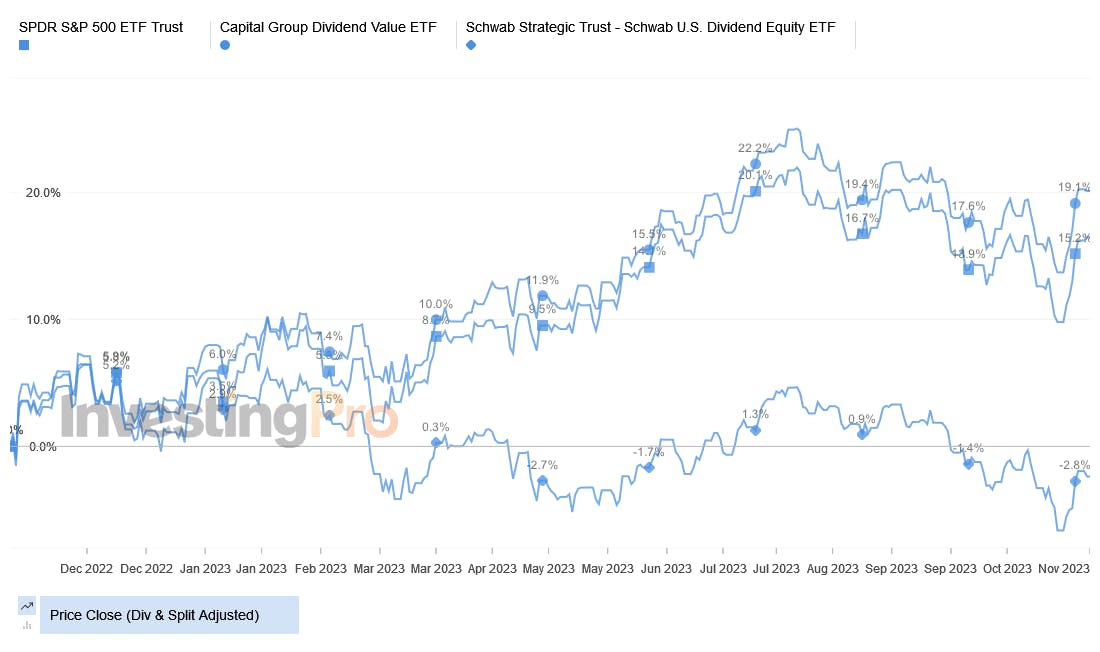

In stark contrast, CGDV carved out its own success story. Not only did it keep pace, but it also managed to secure a slight advantage over the more cost-effective SPDR S&P 500 ETF (SPY (NYSE:SPY)) throughout the trailing year. This feat is especially noteworthy considering the backdrop of 2023's market dynamics.

While it might be premature to draw long-term conclusions from a single year's performance, this does unequivocally set CGDV apart from its peers, particularly when compared to other popular index-based dividend ETFs—such as the Schwab U.S. Dividend Equity ETF (NYSE:SCHD)—which have not fared as well in the same timeframe.

Source: https://www.investing.com/pro/ - Investing.com Pro

CGDV's ability to outperform in a period where passive ETFs in its category points to the potential effectiveness of its active management in limiting risk. In my opinion, this points to possible merits of actively managing a dividend and value strategy. But what exactly makes CGDV tick?

CGDV strategy breakdown

CGDV's active management focuses on investing in established, larger U.S. companies that pay dividends. Basically, it targets potentially undervalued blue-chip stocks with market caps of over $4 billion, with the goal of providing a stream of income higher than the S&P 500 index.

The ETF primarily invests in companies that are financially sound, indicated by having investment-grade debt ratings. While it's focused on U.S. stocks, the fund can invest a small portion (up to 10%) in similar large companies from outside the U.S.

Also, it's worth noting that CGDV isn't as diversified as most index ETFs, meaning it might invest more heavily in fewer companies, which could increase both the risk and potential reward. As of November 7th, the ETF has just 50 holdings.

This is actually desirable from an active management perspective, as it reduces the likelihood that an ETF is "closet indexing", a phenomenon where firms purport to offer active management, but are merely replicating a benchmark and charging higher fees for it.

The ETF has also delivered on its promise of value exposure so far, with lower price-to-book, price-to-cash-flow, and price-to-earnings ratios compared to the S&P 500 index as of September 30th, 2023.

CGDV portfolio breakdown

CGDV's portfolio breakdown reveals that the ETF is heavily weighted towards U.S. equities, which make up over 90% of its assets. This demonstrates a clear preference for the domestic market.

The presence of non-U.S. equities at 6.3% shows a modest diversification into international markets, potentially capturing growth outside of the U.S. without significantly increasing risk.

Looking at the market capitalization, a vast majority of the fund's investments are in large-cap companies. This focus on large-cap stocks likely provides a foundation of stability and resilience, as these companies are generally well-established and financially robust.

Sector-wise, the portfolio is quite diversified, with the largest holdings in information technology and industrials. This suggests a balance between growth-oriented sectors and those that are traditionally seen as more stable. Health care represents a significant portion as well, which could provide defensive stability during market downturns.

The top equities include prominent companies like Microsoft (NASDAQ:MSFT) and Broadcom (NASDAQ:AVGO), which indicates a tilt towards tech and industrial stocks that have the potential for both capital appreciation and dividend income. The presence of companies like American International Group (NYSE:AIG) and General Electric (NYSE:GE) shows a mix of industries that balance cyclical exposure with steady performers.

My thoughts on CGDV

If one were to argue in favor of active management within the ETF sphere, CGDV presents a compelling case due to numerous factors.

It strikes a good balance with a portfolio that is concentrated, reflecting high conviction picks, yet it remains well-diversified across various sectors, avoiding excessive concentration in any one area.

Furthermore, its expense ratio of 0.33% is impressively low, not just for an actively managed ETF but also when compared to many smart-beta and factor-based ETFs that typically carry higher fees.

The portfolio turnover rate of 30% is also modest, especially within the context of active management, suggesting a disciplined approach that doesn't incur excessive trading costs, which can erode returns over time.

With approximately $4.3 billion in assets under management (AUM), CGDV is a well-capitalized fund not in any danger of being shut down soon.

While manager-specific risk is an inherent consideration in actively managed funds, Capital Group's storied background and provenance in mutual fund management lend credence to their capability to navigate such risks effectively.

Their reputation, built upon their mutual fund success, is a reassuring factor for investors contemplating an actively managed ETF like CGDV.

This content was originally published by our partners at ETF Central.