With the landscape of today’s economy characterized by high interest rates and sticky inflation affecting consumer purchasing power, investors are seeking a safe haven for their savings. Cash ETFs can help them gain exposure to high-interest savings and deposit accounts, promising an appealing avenue for capital appreciation.

Appeal of Cash ETFs

Cash ETFs resemble high interest savings accounts in that they are liquid and can be converted into cash at any time. These funds take advantage of the high real interest rates in the market, positioning them as seemingly risk-free investments promising notable returns. In a nutshell, they invest your money into special high interest savings accounts at the largest North American banks. In an environment where traditional investment avenues are fraught with uncertainties, the allure of cash ETFs is understandably strong. Unlike a deposit or HISA account you have at a bank, Cash ETFs also offer tax advantages when held in registered accounts.

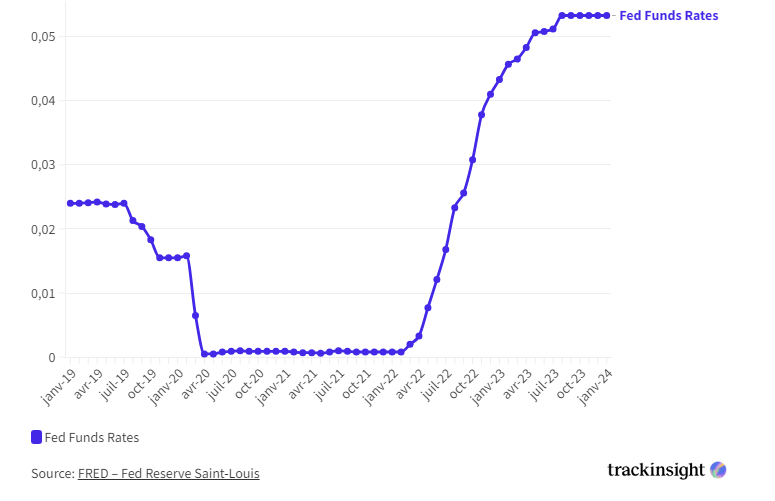

Fed Fund Rates

Real Interest Rate Peaks Since 2007

Amidst high interest rates and inflation fluctuating between 3% and 4%, real interest rates have become considerably appealing. As an illustration, real yields on the US 10-Year Treasury surpassed the 2% threshold between October and November 2023 - a level unparalleled since August of 2007, prior to the subprime crisis. Consequently, it could potentially be profitable to engage in low-risk investments like cash funds during the phases of rate escalation and more static inflation levels.

10-year Real Interest Rates

Are Cash ETFs truly risk-free?

The classification of these investment vehicles as 'risk-free' warrants scrutiny. The term 'risk-free' suggests an investment devoid of any risk to the investor, which is not entirely accurate in the context of cash ETFs. Despite their appealing returns, these funds carry what is known as counterparty risk—the risk that a bank could fail to fulfill its obligations to investors. In other words, the safety of Cash ETFs is equal to the reliability of the banks which hold your money. The collapse of Silicon Valley Bank and First Republic Bank in 2023 serves as a stark reminder of such risk, illustrating that even investments perceived as safe havens are not entirely devoid of vulnerability.

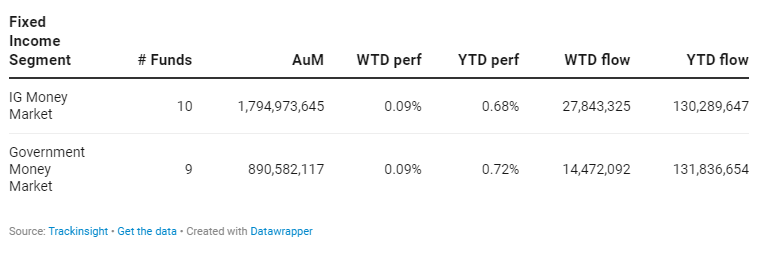

Group Data