This article was written exclusively for Investing.com

The GBP/USD has been creeping higher in recent days, although without making much progress. But is it about to break higher in a more decisive manner?

Although surging inflation in the US has boosted expectations about several Federal Reserve interest rate hikes and the removal of policy accommodation at a faster pace, this has not stopped the greenback from weakening. Indeed, the GBP/USD’s ability to edge higher in the past three weeks despite the increasingly hawkish Fed commentary is in itself a strong signal. What doesn’t break you makes you stronger.

Meanwhile, incoming data from the UK has been stronger, boosting the likelihood for more, aggressive, rate hikes from the Bank of England. This week alone, we have seen UK’s CPI inflation measure climbing to an annual rate of 5.5%, while average earnings have risen to 4.3% in the three months to the end of January compared to a year earlier. On top of this, the latest retail sales data showed a month-over-month print of +1.9% when +1.1% was expected.

Although we haven’t seen any major technical breakthrough in the GBP/USD, the pressure is building for a bullish breakout.

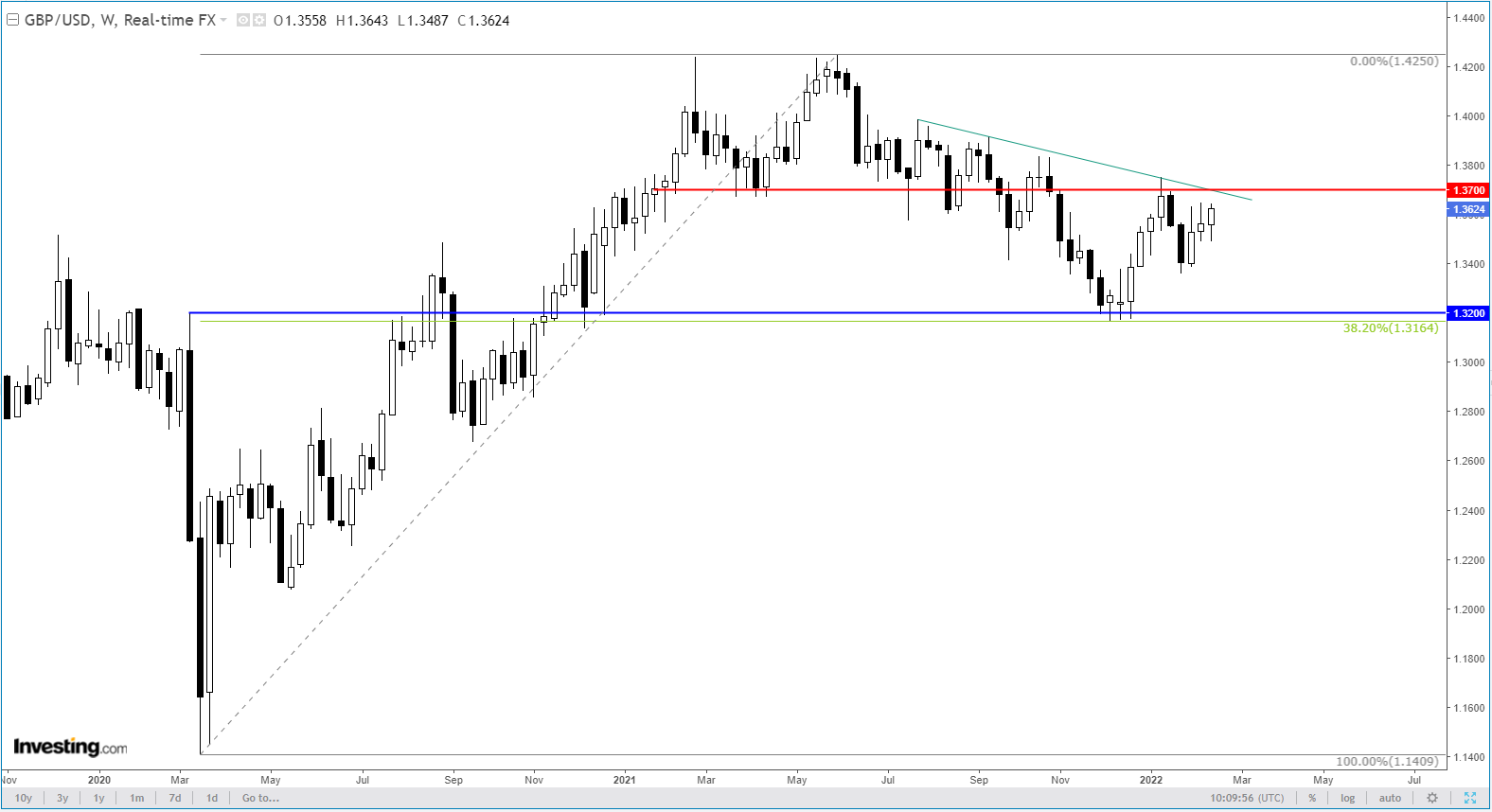

The weekly chart shows rates have been rising over the past three weeks, threatening to break out above 1.3700:

It is also worth pointing out that even after last year’s US dollar rally, the pound’s retreat was very modest, with the cable finding support around the relatively-shallow 38.2% Fibonacci level at 1.3200, which also happened to be the pre-pandemic high. Given these considerations, the GBP/USD is likely to break higher soon.

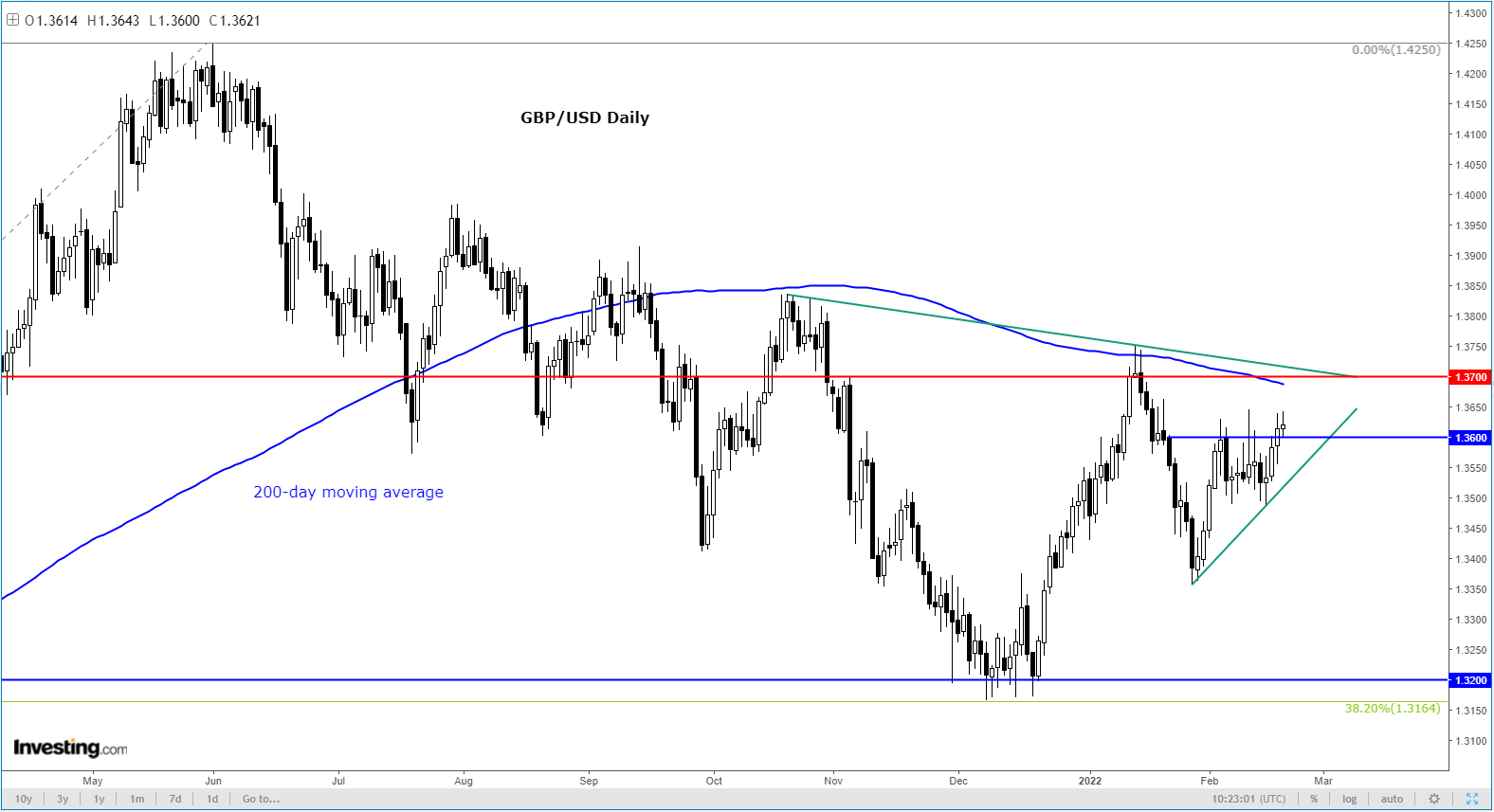

Zooming into the daily time frame, we can see a couple of tentative bullish signals. These include the bullish trend line and the closing break above 1.3600 resistance, which until Thursday had provided a ceiling on a closing basis.

With 1.3600 reclaimed a bit more decisively now, we are likely to see a move towards 1.3700 next. This is where the 200-day moving average meets the bearish trend line. A bit of profit-taking, should we get there, should be expected. Ultimately, though, the path of least resistance appears to be to the upside. So, I would favor looking to buy dips at support than sell into resistance.