On Tuesday, the Technology sector was sold off during the US session, making it the second worst sector performer on the day, after the 1.1% drop for Real Estate shares.

The market narrative says the tech selloff exposed investor doubts that US economic growth can withstand the headwinds of stimulus removal and the ongoing, and very persistent, pandemic. Maybe.

We, however, disagree. Popular opinion says investors were taking profits ahead of today's key US inflation data, which could be explosive for markets since investors remain worried that the Fed will begin tightening if inflation (and an improving labor market) remain in check.

On the other hand, we see yesterday's market activity—during which the best performing indices were those heavily skewed toward value shares, the Dow Jones and Russell 2000—as additional proof that tech sector valuations are significantly overstretched, a fact investors are now acknowledging.

In our view, the outperformance on Tuesday of the value indices projected investor faith in the recovery, since that's when cyclicals provide the best returns as opposed to growth shares which often underperform during expansion.

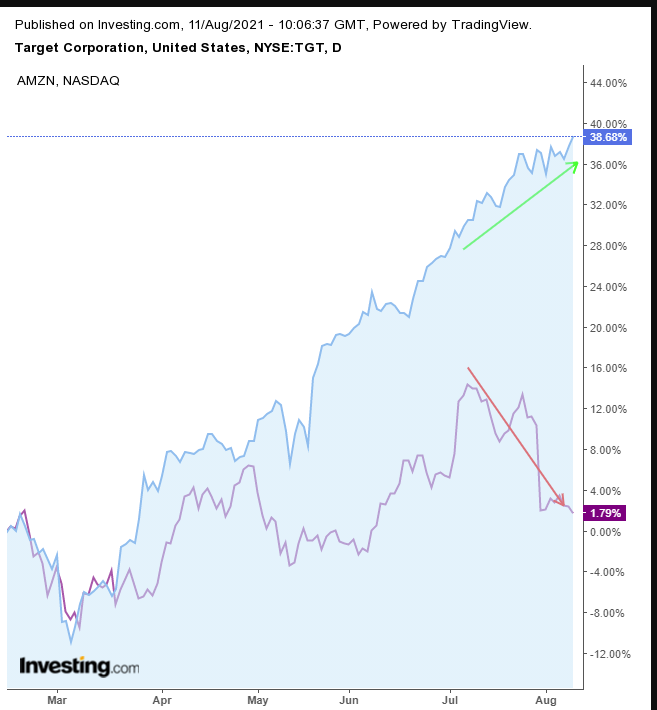

Here’s an additional, relevant factoid. Currently, Target (NYSE:TGT), the US discount, bricks-and-mortar retailer, is vastly outperforming e-tail behemoth Amazon (NASDAQ:AMZN).

AMZN benefited from pandemic lockdowns, while brick-and-mortar retailers suffered, for obvious reasons. TGT’s obvious outperformance supports the view for a recovering economy, which would of course boost its value shares.

Target has been outpacing its internet rival since the March bottom, but Amazon has been seriously lagging since July, when the stock began a more significant decline, while Target pushed higher to reach new records, levels near which the stock continues to trade.

Yesterday’s advance, which saw the stock close at $264.07, helped Target’s shares break free of a trading range, with implications for a continued push towards $270.

The stock completed a small H&S continuation pattern, allowing sellers to take profits. The fact that the price made a new high indicates anyone who wanted to sell at that level has, but that demand wanted more.

After absorbing all available demand in the high $250s, buyers upped the ante, raising their bids in search of new, more discerning sellers willing to let go of their shares at higher prices.

That caused the price to burst through the neckline of the H&S. It's also expected to trigger a market chain reaction of covered shorts and triggered longs, the perfect configuration for an additional rally, which could then attract speculators now sitting on the sidelines.

Trading Strategies

Conservative traders should wait for the price to develop at least one long, solid green candle, then retest the neckline, before committing to a long position.

Moderate traders would risk a buy on the dip.

Aggressive traders could enter now, provided they operate with a coherent trade plan. Here’s an example:

Trade Sample

- Entry: $264

- Stop-Loss: $262

- Risk: $2

- Target: $270

- Reward: $6

- Risk:Reward Ratio: 1:3