Consumer goods giants PepsiCo Inc. (NASDAQ:PEP) and The Coca-Cola Co. (NYSE:NYSE:KO) don't need any introduction and are common in many investor portfolios. The reason is simple: these are stocks of resilient, non-cyclical companies and are formidable bets in market downturns.

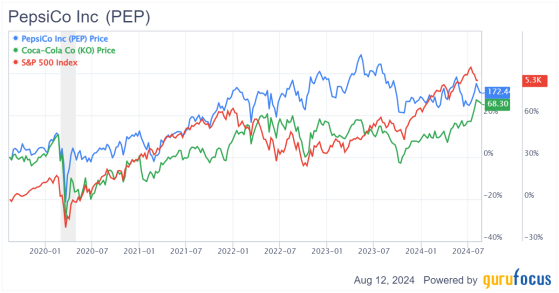

PepsiCo continued to rise steadily during the bear market with a 6.77% gain in 2022 while Coca-Cola achieved 10.61% growth. The S&P 500, which includes both stocks, was down 19.44% that year.

PEP Data by GuruFocus

Although both stocks are defensive plays, PepsiCo looks relatively more attractive. From business, financial, valuation and dividend perspectives, PepsiCo has slight or even minimal advantages over Coca-Cola currently.

Same businesses, different focuses Coca-Cola is known for its star namesake beverage, but also a number of other brands like Fanta, Sprite, Aquarius, Powerade, Fuze Tea, Minute Maid... the list of popular drinks goes on. Both beverage giants control over 70% of the U.S. beverages sector, with a slight advantage to Coca-Cola.

Despite the market share advantage for Coca-Cola, PepsiCo might be more attractive because its business is more diversified. It also has a highly successful snack business, which represents roughly half of the total company's U.S. revenue. Indeed, it counts among its ranks drink brands like Pepsi, Lipton, Mountain Dew, 7UP and Gatorade as well as popular snack brands like Lay's, Doritos and Cheetos.

Strictly from a diversification perspective of product sales, PepsiCo has more potential for growth as it can play on both segments at the same time. Additionally, PepsiCo's revenue is concentrated in the U.S. with 57% of total revenue made in the U.S., while Coca-Cola generated only 36.60% of its revenue in the whole of North America (including the U.S., Canada and Mexico). The U.S. consumer is perhaps the most resilient at the moment with a tight labor market and rising wages. PepsiCo stock is also a bet on the U.S. consumer.

PepsiCo has a financial advantageFrom a financial perspective, PepsiCo again has a narrow advantage over Coca-Cola. Its annual revenue growth rate for the period between 2019 and 2023 averages 7.24% (no negative growth year), while Coca-Cola's lies at 6.40% revenue growth in the same period (one negative growth year in 2020). PepsiCo's growth has overall been more resilient over the last five years and also in 2020, a year marked with a pandemic and recession where it managed to grow 4.80% while Coca-Cola's revenue crashed 11.40%.

Revenue is expected to grow in the next several years at an average of 4% to 5% for both companies, but, in case of recession, it is likely that PepsiCo might outperform financially again.

Going one level down, Coca-Cola has a healthier free cash flow margin of 21.70% relative to PepsiCo's low 7.90% margin. However, looking at what each company manages to achieve with the shareholders' cash through the analysis of the return on equity, PepsiCo's 51% far exceeds Coca-Cola's 39.30%. The company also makes better use of the smaller amount of cash it has at hand. That is corporate efficiency, which, in the long term, is often the primary growth factor.

DividendsFrom a dividend perspective, PepsiCo is more attractive to an income investor than Coca-Cola.

Coca-Cola has increased its dividend payments six times since 2019, including one increase this year, and achieved an average increase of 3.70%. PepsiCo has yet to increase its dividend payments in 2024 (perhaps explaining in part its negative year-to-date performance at 6% while Coca-Cola stands at a 6% gain).

However, PepsiCo boosted its dividend payments five times between 2019 and 2023 with the average increase standing at a whopping 6.44%. There is speculation the company might not increase its dividend payments this year. I believer there will be a dividend increase, but perhaps not as large this time while PepsiCo is trying to improve its free cash flow margins.

Dividend History for Coca-Cola (StreetInsider.com)

Dividend History for PepsiCo (StreetInsider.com)

The current dividend yield is again at PepsiCo's advantage with a 3.30% yield against Coca-Cola's 3.10% yield.

Valuation and upsideLast but not least, PepsiCo is clearly the cheaper stock of the two, trading at a heavy discount relative to Coca-Cola, which does not seem to be justified in light of the business strength and the rising dividend payments.

Indeed, PepsiCo is trading at a multiple of 2.40 times sales while Coca-Cola is trading at 6 times sales. The differential in multiples makes little sense given the similarity in stock performance, dividend payments, business growth, branding and forecasted growth. For this reason, Wall Street analysts give PepsiCo 13% upside with an average price target at $185, while Coca-Cola is given a mere 7% upside with an average price target of $68.

Risk factors to my caseThe main risk for both stocks is, at first glance, somewhat contrarian.

The risk consists of a prolonged period of bull market. Indeed, both stocks are defensive plays and tend to outperform the broader market in periods of market trouble. Coca-Cola tends to perform better when the U.S. stock market is down because its revenue sources are more diversified than PepsiCo's. This was confirmed in 2022 when it performed slightly better than PepsiCo.

In any case, these companies have solid fundamentals, and PepsiCo's undervaluation might this time play in favor of its shareholders in a time where the U.S. consumer seems to be more resilient and stronger than consumers abroad, ultimately benefiting PepsiCo over Coca-Cola. Further, PepsiCo's higher and rising dividend yield rewards its shareholders for their patience.

Bottom lineBoth companies have solid fundamentals, but PepsiCo is more attractive given recent years' financial performance and high growth rates, regular yearly dividend payments increases, relatively cheap valuation and the resilience of the U.S. consumer relative to other regions of the world. The stock is an attractive defensive play in a high interest rate environment within a diversified portfolio or within an income-oriented portfolio, with consistent revenue growth and steadily rising dividend payments.

This content was originally published on Gurufocus.com

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI