Traders long oil may boast about how spectacularly crude prices have snapped back from recent lows after this week’s easing of Omicron concerns.

But there’s a commodity that’s owed greater bragging rights for being in perfect sync with the highs and lows associated with fears over the new COVID variant.

And that’s cocoa—the confection and beverage material that has a 100% correlation rate with Omicron headlines.

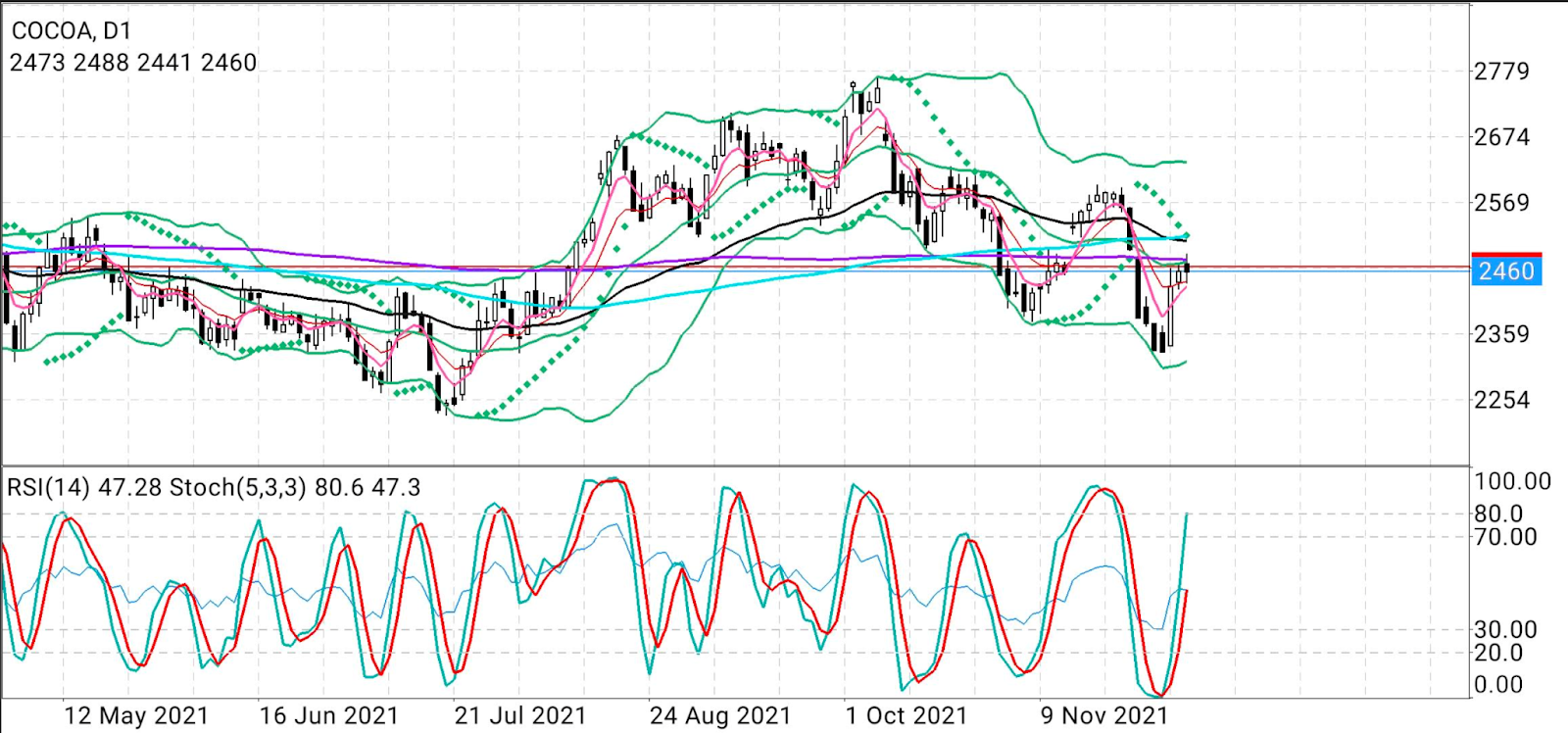

All charts courtesy of skcharting.com

Cocoa’s move in almost lock-step with the Omicron newsflow is reflected from when it first tumbled on the discovery of the variant in South Africa on Nov. 24. to its rally over the past four sessions after health officials said risks associated with the virus may not be as severe as first thought.

There’s good reason for cocoa to have tracked the newest COVID strain so closely.

The commodity is the chief ingredient for chocolates, ice-cream, baked goods and cocoa powder. These are luxury and festive products that typically see high demand during good economic times, and weak consumer appetite when things aren’t going so well.

Cocoa fell almost 20% in March 2020 during the first global COVID-19 outbreak. But it managed to squeeze in a gain of 2.5% by the end of last year on the back of the global economic recovery from the pandemic.

A Telling Track Of Omicron

Likewise, cocoa’s track of Omicron is just as telling.

From $2,456 a tonne on Nov. 24, it went to $2,314 by Nov. 30, after four days of intense selling. That accounted for a drop of $142.

From the Nov. 30 settlement of $2,314 on Dec. 1, it had reached $2,464 at the time of writing.

In final summary, the market had gained $150 versus its initial loss of $142. That was a perfect correlation with the news on the variant, with a slight bias to the upside.

While that may be the case, the gyrations in cocoa prices over the past week had been a major source of stress to commodity traders.

“Cocoa's wild price swings continue with momentum-driven traders feeling the pain,” Ole Hansen, head of commodity strategy at Denmark’s Saxo Bank, said in a tweet on Monday.

“The 9% Omicron-driven slump in (the) week to Nov. 30 triggered the second biggest week of selling (-26.9k lots) in ten years,” Hansen added.

“Since then, the price has recovered, with short-covering a major factor.”

Jack Scoville, chief crop analyst at Chicago’s Price Futures Group brokerage, concurred with that view.

New York and London closed higher on Friday but lower for the week. The down move showed signs of exhaustion late last week.

“The return of the coronavirus in Europe as well as the new variant found in Africa were the primary reasons to sell but are mostly part of the price now,” Scoville said.

“Much of the selling came on ideas of weaker demand caused by the reports” on COVID as a whole, and on the Omicron specifically, he said.

Fundamentally though, cocoa crops in top growing areas—Africa’s Ivory Coast and Ghana—were progressing well, with improved sunny weather and some rains, Scoville said.

Unless technical conditions were supportive, such ideal growing conditions typically would weigh on cocoa prices if demand was to slacken, he said.

So What Are Cocoa’s Technicals Saying?

Cocoa seems destined for a sideways price pattern, moving between the middle Bollinger® Band of $2,543 and the lower Bollinger Band of $2,331 which was also its most recent swing low, said Sunil Kumar Dixit, chief technical chartist at skcharting.com. Adding:

“Any next major move will depend on breaking either of the two trend key levels.”

Retrospectively, cocoa staged a strong recovery from a July 2021 low of $2,229 to an October 2021 high of $2,770, but failed to hold the upward trajectory thereafter, succumbing to bearish pressures that tested $2,331 in November, noted Dixit.

Currently, prices are above the 200-week Simple Moving Average of $2,425 but below the 1000-week SMA of $2,480, the 50-week Exponential Moving Average of $2,493 and the middle Bollinger Band of $2,543, he added.

Disclaimer: Barani Krishnan uses a range of views outside his own to bring diversity to his analysis of any market. For neutrality, he sometimes presents contrarian views and market variables. He does not hold a position in the commodities and securities he writes about.