Comcast: From International Staple to Stagnation and Decline

Comcast Corporation (:NASDAQ:CMCSA), has long been a dominant force in the telecommunications and media industries. Starting as a regional cable provider through the purchase of American Cable Systems in 1963, Comcast rose to become a global powerhouse. The company continually adapted to the evolving market landscape for decades, establishing itself as a staple for millions of consumers worldwide.Today, Comcast provides a wide range of services, including broadband internet, cable TV, and streaming through Xfinity and Peacock. Historically, its significant stake in the broadband and media markets made it a formidable player. However, the landscape has shifted dramatically in recent years. The growing dominance of streaming services and increased competition from both traditional cable companies and tech firms have placed immense pressure on Comcast. These challenges have led to stagnation in market valuation and are poised to drive a significant downturn in the company's future stock performance.

In order to get a grasp of these downward probabilities It is worth exploring the financial, economic, and competitive factors driving this shift and why these pain points could lead to Comcast's continued decline.

The Financial Strain: Declining Revenues and Increased Debt

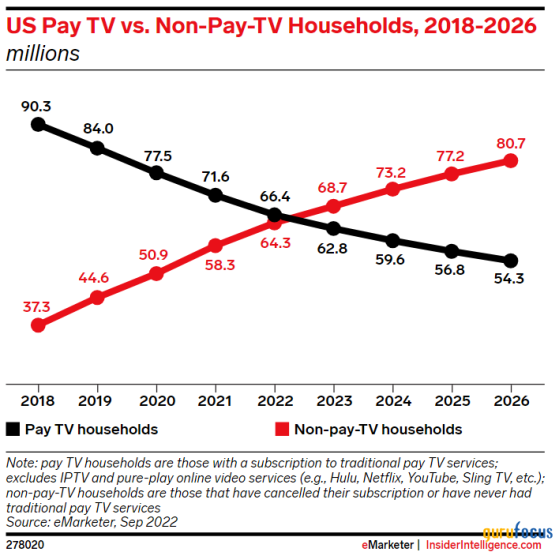

Comcast's financial trajectory has been hindered by several issues, most notably the steep industry-wide decline in cable subscriptions over the past several years. According to data from eMarketer (formerly Insider Intelligence), U.S. households with paid traditional TV subscriptions fell from 90.3 million in 2018 to 62.8 million in 2023, representing a 30.5% decrease. Meanwhile, households without traditional TV subscriptions rose 84.2% from 37.3 million to 68.7 million during the same period with further substantial declines in cable subscribers being projected for the future.This industry trend has been mirrored in Comcast's own figures. Between 2018 and Q3 2024, Comcast reported a 41.63% decline in its Video Customers (TV Subscribers), falling from 21.98 million to 12.83 million. The Voice Segment was cut nearly in half dropping from 11.5 million to 7.5 million customers. While its Broadband Internet Segment on saw a 17.48% growth during the same period, increasing from 27.22 million to 31.98 million customers;

Source: Comcast Q4 2018 & Q3 2023 Quarterly Presentations

This growth in broadband has not been nearly enough to offset the losses in its cable services segment which have left revenues stagnate over the last 8 years. This stagnation in Comcast's revenue and sales growth has led to a steep decline in its Net Profit Margins. In 2018, the company boasted net profit margins of 27.34%, but this figure plummeted to just 4.42% by 2023. While margins showed some recovery in Q1 2024, reaching 12.66%, they have since stagnated and fallen below 12% as the year progressed.

Source: MacroTrends.net

These declines are closely aligned with the broader industry trends of cord-cutting and the rise of non-subscribing US households, which grew to over 60% by 2023 with forecasts putting this number near 80% by 2026.

Source: Julia Stoll, Statista

Competitive Pressures: The Rise of Streaming and 5G Alternatives

Comcast faces fierce competition from streaming services such as Netflix (:NASDAQ:NFLX), Hulu (:DIS), YouTube TV (:GOOGL), and FuboTV (:NYSE:FUBO). These platforms offer consumers greater flexibility, more content, and often lower costs compared to traditional cable packages. Despite Comcast's efforts to counteract this trend through its own streaming service, Peacock, the company has struggled to keep pace according to data gathered by Nielsen Research, Peacock has only managed to corner 1.5% of the streaming market share while YouTube, Amazon (NASDAQ:AMZN) Prime Video, Netflix and others remain exponentially higher with YouTube becoming the first streaming platform to break above 10% as of July, 2024.Source: Nielsen

Furthermore, Comcast's Internet and Voice segments face increasing competition from 5G providers like T-Mobile (:TMUS) and Verizon (:NYSE:VZ). These companies offer cheaper and more flexible alternatives to Comcast's broadband services as according to a 2024 study done by Broadband Search, Price was cited as the number one reason by consumers for cutting the cord:

This recent trend of consumers seeking lower prices and more flexible offers has contributed to the stagnation and decline of Comcast's market share in the Voice and Internet Segments just as it has the Video Segment;

This triple-fronted competitive threat from streaming services on one end and 5G providers on the others has exacerbated Comcast's struggles to maintain growth and profitability.

The Sky Group Acquisition: The Snowballing of Mistakes

In 2018, Comcast acquired Sky Group Limited, Europe's largest TV provider, for $40 billion in an auction Comcast won against 21st Century Fox in a 3-round auction. To finance the deal, Comcast raised approximately $31 billion in long-term debt through revolving credit facilities, bridge loans, and term loan agreements. As a result, the company's reported net debt surged by over 80%, from $60 billion in Q3 2018 to more than $107 billion in the following quarter.Source: MacroTrends.net

The acquisition also added $4.5 billion in annual interest expenses to Comcast's income sheet, further straining its bottom line.

Source: TradingView.com

This acquisition had added approximately 23 million customers to Comcast's international subscriber base and was intended to bolster its global presence.

In the Q4, 2019 report Comcast confirmed Sky's numbers neared 24 million.

However, this strategy for international growth has not held strong and has delivered weaker the expected results; as of Q3 2024, Comcast's international customer base has declined to 17.716 million, representing a 21% drop since the acquisition.

Total (EPA:TTEF) Operating Expenses have continued to rise as well, increasing from $75 billion in 2018 to over $100 billion on a trailing twelve-month (TTM) basis and has steadily been closing the gap between Operating Expense and the Total Revenue which has remained stagnate:

Source: TradingView.com

These factors combined with the declining performance of Comcast's 2018 investment Sky, have contributed to the company's declining profit margins and constrained its ability to generate sustainable growth. The Sky acquisition was intended as a growth driver, but has instead amplified Comcast's financial pressures and operational challenges.

The economic environment has further compounded Comcast's struggles. Rising interest rates have made debt servicing more expensive, while rising inflation has increased expenses, reducing profitability and limiting the company's ability to invest in smarter growth initiatives. Additionally, inflationary pressures have weighed on consumer spending, particularly for discretionary services like cable TV. This macroeconomic condition has exacerbated the challenges already posed by shifting consumer preferences and increased competition and is likely to continue into the foreseeable future.

Looking ahead, Comcast will have to rethink its strategies to remain competitive while optimizing its cost structure, improving its streaming offerings, and finding ways to compete effectively in the broadband market. Comcast will have to find a way to do all this as discretionary spend contracts, and the impacts of inflation and higher rates hit the market. Without decisive action, Comcast's current trajectory suggests continued stagnation and if left undone, a significant decline in stock valuation.

Financial Metrics:

Looking at this table of Comcast's Cash Flows we can see that the company has failed to grow its Free Cash Flow on a non-adjusted basis, with the current TTM reading at $2.35B which is around the same as it was in 2014 in between that time FCF only expanded for one year which was during 2020 but it has since contracted back down to the mean, further confirming Comcast's inability to stray away from its trend of stagnation.Source: Arthur

In addition to falling Cash Flows, CMCSA's Debt to EBITDA remains on the higher end of the industry sitting in at 2.69x putting it 0.295 points above the industry median of 2.395x.

Source: GuruFocus.com

While it is normal to see high debt to EBITDA in this industry I find it quite concerning that CMCSA manages to have a worse debt ratio than the better 54.4% especially considering their general inability to grow their profit margins over the last 10 years.

Lastly, we have CMCSA's PE Ratio, currently trading at 10.11x which right now looks deceptively good when compared to the industry median of 16.17x making Comcast's PE ratio appear better than 74.21% of the industry, but it must be noted that CMCSA at its 10 year highs were trading at 33.59x and at the lows it was just a 6.38x.

Source: GuruFocus.com

At its highs were around the 2018 period which was when CMCSA still had high growth prospects but the PE Multiple has been contracting and making the company appear to be a value as the market has contracted and priced out that growth, so the main concern here would be that the PE ratio has not gotten lower because Earnings have caught up with Price but that its only gone down because the price is now mean reverting back down to the EPS as the company fails to keep investors engaged. This action here seems to be indicative of a Value Trap and I personally wouldn't feel too good about investing in that value until Comcast trades back near the 10 year PE lows at around 6.38x as that is what it was prior to 2018 and prior to the major declines in customers. With EPS currently sitting at $3.75 that would put CMCSA's price target at approximately $23.73 per share before it could then be seen as a value opportunity relative to its history.

Technical Outlook

Source: TradingView.com

CMCSA after topping out at $56.05 in 2021, attempted a rally in 2024 which met resistance at the High to Low, 0.618-0.786 Fibonacci Retracement zone aligning with $44-$50, upon hitting this resistance and getting rejected the first time, it tried to break above it a second time but was rejected again, it then tried one last time and got rejected a third time, this time even faster than the lasts followed by breaking below the 21-month EMA. This activity can be viewed as an early confirmation of a Shortening of the Thrust, signaling distribution at a resistance zone. If CMCSA continues down and breaks the previous swing low of $26.55 the 0.618 tests would be confirmed as a lower Swing High. We would then typically extrapolate out the price action from here and start looking to project a technical Harmonic AB=CD movement downwards which would likely take price down to the next support between the 0.786-0.886 Low to High Fibonacci support zone between $9.90 and $15.15.

This content was originally published on Gurufocus.com