Ask economists how they forecast economic activity. It’s likely they will mention productivity, demographics, debt, the Fed, interest rates, and a litany of other elements. Economic confidence is probably not at the top of the list for most economists. It is tricky to gauge as it can be inconsistent. However, confidence can sometimes change quickly and often with significant economic impacts.

Look at the two pictures below. Can you spot a difference between them?

The difference is subtle. The restaurant on the left has 54 diners. While the one on the right is missing the three diners in the front.

What if the three missing diners decided to eat at home that day due to waning confidence in the economy and, ultimately, concerns about the safety of their jobs and investments? Could such an imperceptible difference matter to the restaurant? Now, imagine the restaurant represents the economy.

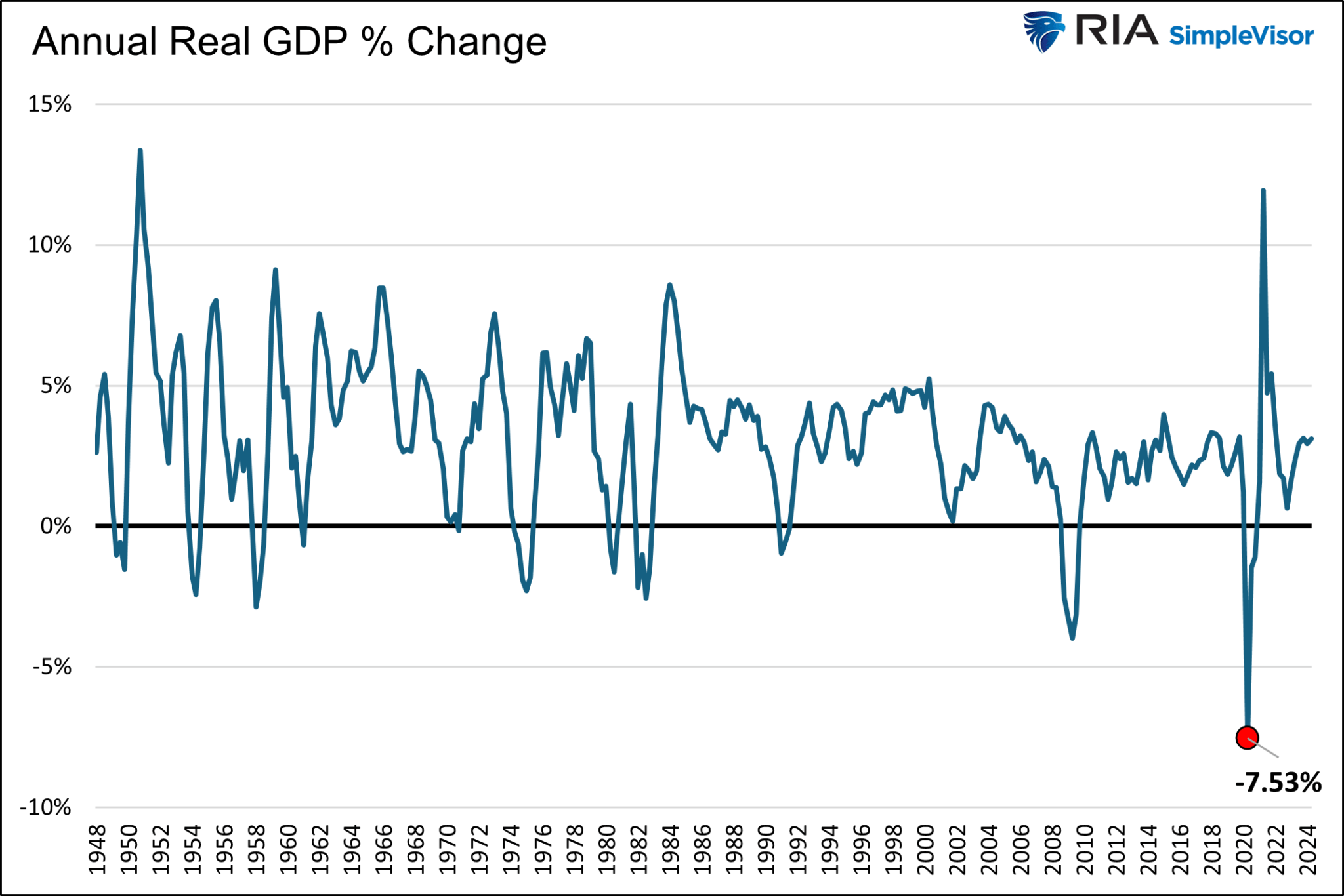

The “economy” on the left is operating at 100% of its capacity. Despite being packed, the “economy” on the right is only running at 94% capacity. A 6% decline in economic activity may not seem like a lot. However, since 1947, the nation’s annual real economic growth rate has declined by 6% or more only once.

Confidence Is Tricky

While we follow many business and consumer confidence surveys released regularly, we don’t write nearly as much on them as other economic topics. Like many investors and economists, soft sentiment/confidence data can sometimes be tricky to make sense of.

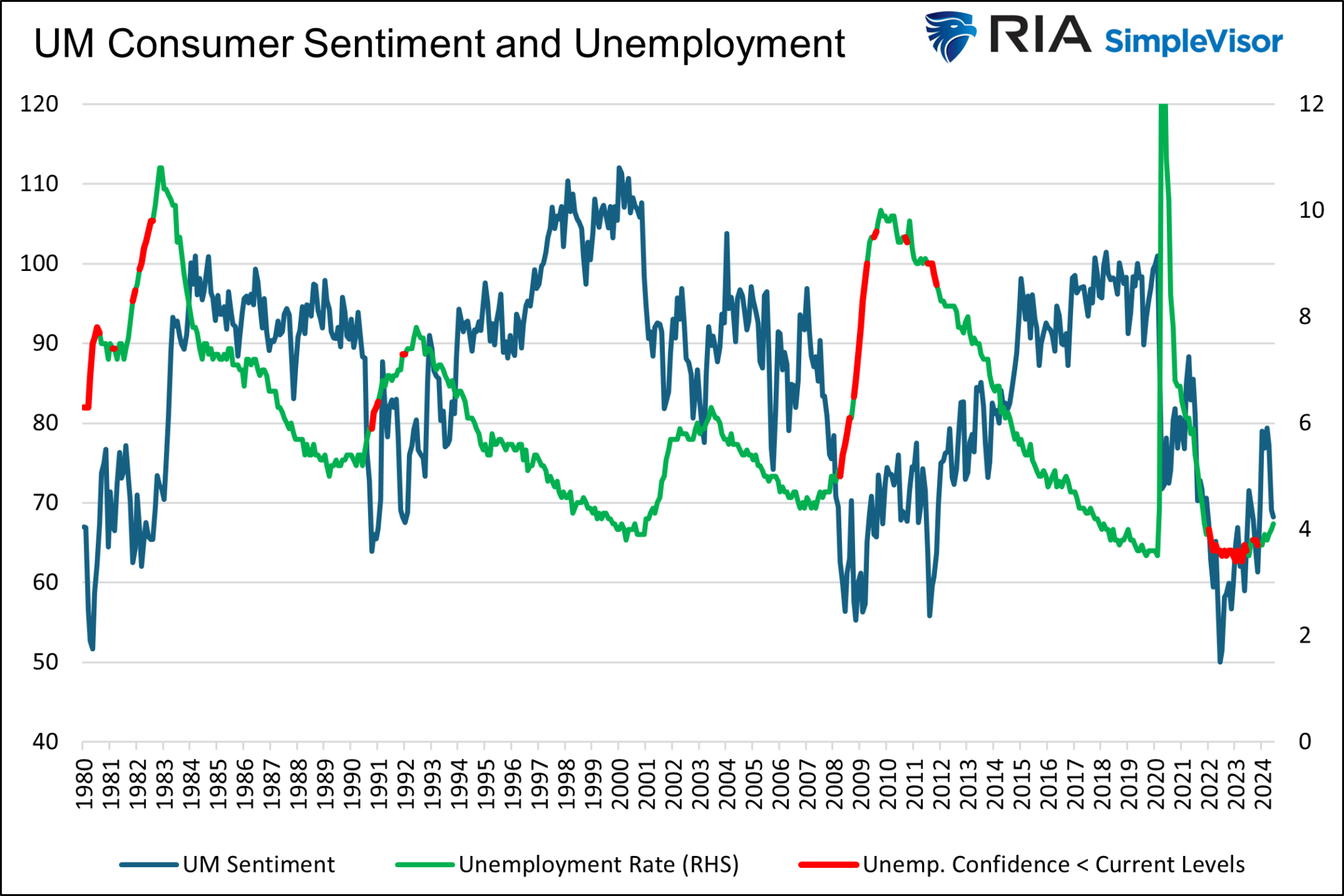

For example, the well-followed University of Michigan Consumer Sentiment Index is near its lowest level in the last 45 years. Note that confidence and the unemployment rate tend to have an inverse relationship. Not surprisingly, people are more confident when the unemployment rate is low and vice versa.

Before the recent experience, the average unemployment rate when the Michigan sentiment reading was at or below current levels was nearly 8%. Today, it is roughly half of that figure, yet sentiment is lousy.

The takeaway is that there is not always a direct correlation between confidence and the economy. If all we had to assess the economy was the confidence reading above, we would presume the economy has been mired in a recession for the last four years.

Confidence can be impacted by many economic and non-economic factors, thus making it hard to draw direct conclusions about the economy and how confidence may affect it. We share three important factors to appreciate influences that can boost or weigh on confidence.

Politics

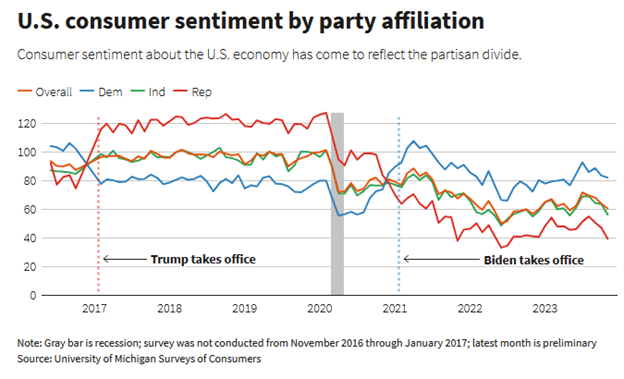

Political views can sway confidence, especially during mid-term and Presidential elections. For instance, the graph below, courtesy of Reuters, shows the distinct changes in economic confidence as the political party of the President changes.

It’s important to note that both parties’ survey trends are highly similar. Thus, the broader trend is more important to follow than the absolute level.

Stock Market and Real Estate

The stock market and real estate valuations can significantly impact our economic confidence. Any wealth you have in the market, be it a brokerage, retirement account, or property, is unrealized. In other words, it’s paper wealth until you sell said assets. Regardless, changes in our wealth, realized or unrealized, have an outsized influence on confidence.

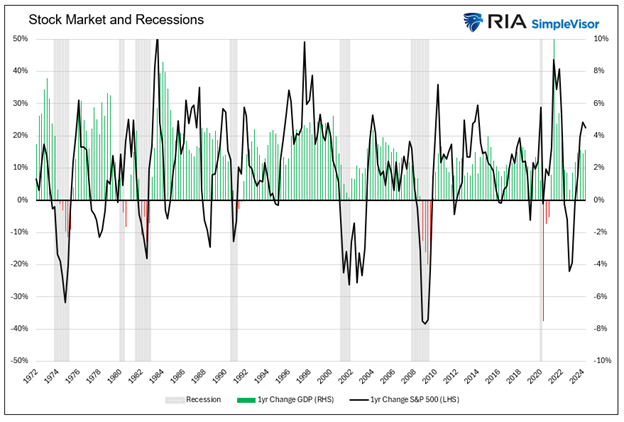

Consider a popular rule of thumb to appreciate better the interaction of the stock market with confidence and the economy. The stock market often leads the economy by six to nine months. Such a theory is based on the widely held belief that investors are forward-looking. Therefore, when stock prices rise, it reflects forecasts for more robust economic growth and vice versa.

The logic sounds correct, but what if it’s backward? Could lower stock prices for reasons other than economic pessimism reduce confidence, resulting in even lower prices? Moreover, as we discussed, might weaker confidence be due to the stock market feeding into economic confidence and causing more people to tighten their purse strings?

The graph below shows that, at times, the stock market declines before recessions or weak economic activity.

But is the market a good predictor, or is a weakening economy resulting from poor confidence induced by the market decline? Maybe it’s more of a chicken or the egg question than most economists think.

Common Knowledge

Ben Hunt recently wrote a very astute article, Joe Biden And The Common Knowledge Game. Despite being on politics, the article can be insightful for economic confidence.

The gist of his article is that, individually, we harbor concerns, but until we sense that many people share those same concerns, our sentiments or economic actions may not change. For many people, the moment of truth for Joe Biden was his dreadful debate, in which millions of Biden supporters and the media acknowledged that Biden was not fit to be President for another term. In Hunt’s words:

That’s the moment where we all saw what we all saw that Joe Biden is not mentally competent to be President of the United States.

To better appreciate common knowledge, we share the excerpt below.

Pretty much everyone in Hollywood knew that Harvey Weinstein was a rapist and a really bad guy, including his wife and his business partners and all the actors who wanted a role in one of his movies. It was widespread private knowledge, verging on public knowledge. I mean, if you’re making jokes about it on 30 Rock, it’s out there.

But it didn’t matter that everyone in Hollywood knew that Harvey Weinstein was a rapist. No one’s behavior changed. No one shunned the guy. No actor turned down a role. No politician turned down a donation. His wife didn’t leave him, and his business partners just upped the D&O insurance and paid out settlements.

They all knew, and I’m sure they cared a little and shook their heads in a tsk-tsk sort of way, but they didn’t care enough to change their transactional relationships with Harvey Weinstein. Because that’s the thing about private information, no matter how widespread. Even if everyone in the world believes a certain piece of private information, no one will alter their behavior. Behavior changes ONLY when we believe that everyone else believes the information. THAT’S what changes behavior.

Recent events, like significant stock market volatility and an unexpected jump in the unemployment rate, might be the moment common knowledge becomes evident to the masses. In an economic sense, it might occur when we realize that we are not alone in harboring concerns about the economy. When you confirm your fears are common, you are more likely to spend less, maybe opt for McDonald’s over a fancier restaurant.

As we led, it doesn’t take much of a change in confidence to tip an economy from running on all cylinders to a recession.

Summary

The market events of the last few days, coupled with a weak employment report, may weigh on confidence. But will it be enough to alter consumption habits? We will pay close attention to the next set of economic data to see if recent market events are changing consumption patterns.