Third Quarter 2024 Review

Volatility increased significantly in the third quarter as we transitioned from July into August and again into September. The run-up in volatility led to sharp declines that quickly recovered in some indexes, while others, like the NASDAQ 100, remained below their mid-July highs. The volatility stemmed from the uncertainty surrounding the economic outlook and the confusion surrounding the financial data presented to the market.

Strange Data, The Fed, and Rising Rates

In August, a weak July jobs report caused concern that the economy was rapidly slowing, followed by another weak August jobs report. However, when the September jobs report was released in early October, it was better than expected and showed significant upward revisions for July and August, dramatically changing the tone. There was only more confusion when the October job report showed that non-farm payroll rose much less than expected, and August and September numbers were revised lower. However, other economic data has been robust, and third-quarter GDP grew by 2.8%.

Amid these confusing signals, in mid-September, the Fed cut overnight rates by 50 basis points to prevent a potential economic slowdown. Ironically, in a clear example that the Fed can theorize but the market will decide, the 10-year Treasury rate has increased by about 60 basis points since then because investors are looking for more of a premium to commit to long-duration positions.

Any view of the fixed-income market is tricky because the economic data has been inconsistent, with some figures subject to substantial revisions. However, if the economy continues to exceed expectations, it will likely lead to further market-driven rate increases, a stronger dollar, tighter financial conditions, and possibly fewer rate cuts by the Fed.

Earnings Outlook

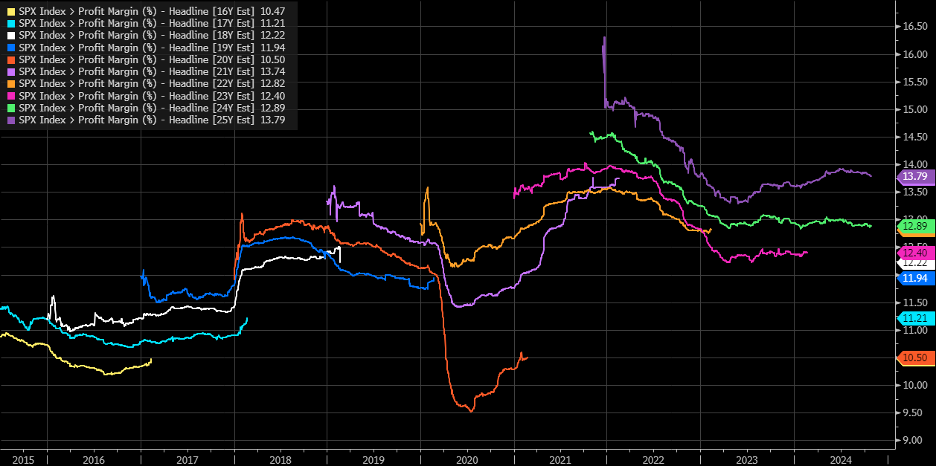

On the equity front, earnings estimates for the S&P 500 are being revised downward for 2024 and 2025—not because the economy is struggling but likely because of overestimated gross margin estimates in historical terms and because analysts seem not to recognize the effect a strong dollar can have on lowering earnings and sales estimates.

Source: Bloomberg

Historically, margin estimates have tended to start high and decline over time. Initial estimates were set at approximately 12.5% for 2023 and 13.0% for 2024. However, for 2025, margin estimates start at a historically high 13.8%, an elevated level that seems unlikely to be achieved

The only year gross margins rose by more than 13% was 2021 when the economy and inflation rates differed significantly from today. It is doubtful that margins will increase by 100 basis points in 2025 to 13.8%.

Source: Bloomberg

Assuming sales of around $2000 per share and margins of approximately 12.75%, closer to the average of 2023 and 2024 estimates, earnings for 2025 would fall from $250 to $260 per share from $272.85, the value implied from current margin estimates.

This lower EPS valuation would impact and raise the S&P 500’s PE ratio. More importantly, it would also reduce the expected growth rate for the index in 2025, lowering it to 4.5% to 8.5% from around 14%.

This may mean that stocks are even more expensive than they appear at current levels. This is concerning because growth rates are relatively low compared to the PE ratio, which has been at the upper end of its historical range since 1990.

Source: Bloomberg

Portfolio Update

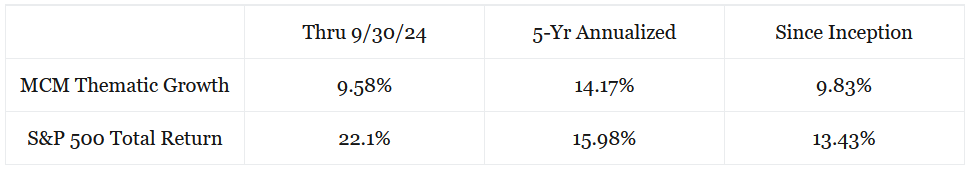

In line with my ongoing perception that the equity market is overpriced at today’s values, I carefully assess the landscape and adjust the portfolio when necessary. Caution sometimes has its short-term cost, though, and we have continued to underperform the S&P 500 Total Return Index in 2024.

Through 9/30/24, the Mott Capital Thematic Growth Portfolio had risen by 9.58%, including dividends and net of fees, versus the S&P 500 Total Return Index’s gains of 22.1%, inclusive of dividends.

There is little new to report for the portfolio in general, and updates on our positions remain reasonably unchanged.

3Q’24 Stock Performance

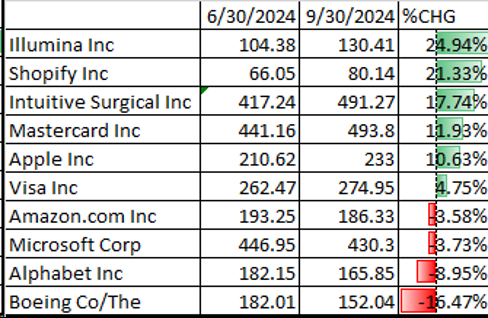

Concerning specific names, the addition of Illumina (NASDAQ:ILMN) has been beneficial thus far, with the stock rising by nearly 25% during the quarter, followed by Shopify’s (NYSE:SHOP) gains of 21.3% and Intuitive Surgical’s (NASDAQ:ISRG) gains of 17.7%.

On the loss side, Alphabet (NASDAQ:GOOGL) declined 9.0% and Microsoft’s dropped 3.7%. Some more prominent technology companies have struggled since mid-July as the market started to examine their spending on new Artificial Intelligence projects more closely. Among our holdings, Apple (NASDAQ:AAPL), Alphabet, Microsoft (NASDAQ:MSFT), and Amazon (NASDAQ:AMZN) have indicated they plan to spend more in 2025 to stay ahead in the AI race. However, to this point, the payoff has not materialized.

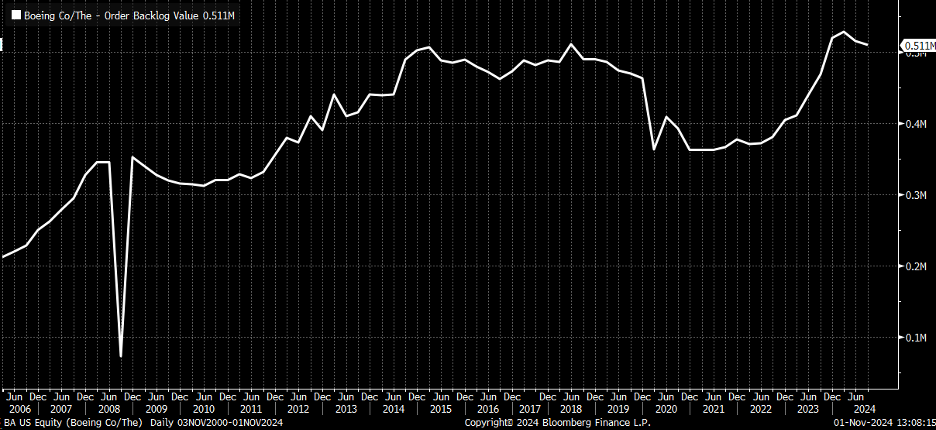

Boeing (NYSE:BA) was the worst performer, falling by 16.5%. The company continues to struggle and recently raised cash through an equity offering to shore up its balance sheet. Now that there is a new CEO, Boeing’s stock may have reached a bottom. They are very close to ending the workers’ strike. The latest quarterly results were not impressive, but the stock has been holding around $150, roughly the price we bought it at in 2022.

Boeing operates in a duopoly, with Airbus as its only true competitor. Boeing still has an order backlog valued at over $500 billion, which has also improved in recent quarters. I believe it will perform over time, and I see no need to exit the holding.

Overall, our cash positions remain unchanged and, for most portfolios, are in the 25% to 30% range. This margin of liquidity provides ample cash to take advantage of any significant pullback in the coming months as long as valuations make sense.

Until next time,