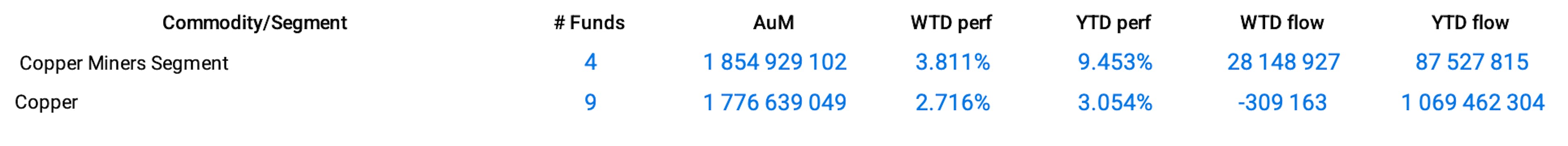

Copper futures stabilized at around $3.90 per pound on Friday, the highest in over one month, to finish the week with a 3% rebound and a year-to-date performance of +2.38%. The Global Copper Miners segment exhibited even more impressive performance, achieving a gain of +3.81% over the week and +9.45% year-to-date.

Market sentiment remains optimistic. On the one hand, there is a belief that there will be renewed demand in China following the country's decision to cut interest rates to bolster economic growth. This action points to further significant stimulus ahead and has had a positive impact on commodity prices, copper included, with the anticipation that improved economic conditions in China will drive an increase in the country's resource imports.

On the other hand, global markets are anticipating a significant copper deficit throughout 2023 as Chile, the top copper producer in the world, announced that this year's output is estimated to sink as much as 7% after the 10.6% decline in 2022.

Global Group Data

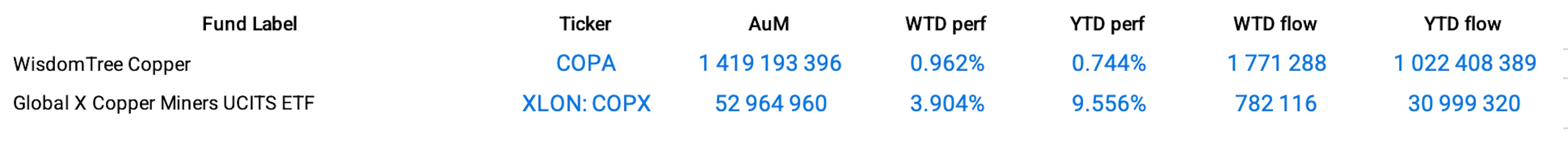

Funds Specific Data: COPA, XLON: COPX