CoStar Group (NASDAQ:CSGP) has the potential to deliver approximately 25% growth in its market cap over the next 12 months, despite its generally high valuation multiples making it prone to volatility in weak macroeconomic environments. The company boasts a robust subscription-based revenue model and is currently dominant in its field, with competitors capturing niche markets rather than leading with an expansive acquisition strategy like CoStar. The stock is quite economically resilient, and with low interest rates anticipated in 2025, substantial tailwinds are likely to improve its growth rates and moderately expand its valuation multiples.

Operational and financial analysisCoStar is a leading provider of information, analytics, and online marketplaces for the commercial real estate industry. Its platforms (including LoopNet, Apartments.com, and Homes.com) facilitate property listings for sale or lease and offer detailed information on properties, market conditions, historical trends, and key performance indicators. While CoStar's primary market is the United States and Canada, it also operates in Europe, Asia-Pacific, and Latin America. The company primarily generates revenue through a subscription-based model, with 96% of its revenue sourced from subscriptions and a 90% renewal rate as of Q2, 2024.

On April 22, 2024, CoStar announced its acquisition of Matterport (NASDAQ:MTTR) in a cash and stock deal valued at approximately $5.50 per share, translating to an equity value of about $1.6 billion. Matterport's advanced 3D digital twin technology and AI capabilities will enable CoStar to offer a more comprehensive digital viewing experience. The transaction is expected to be completed in Q4 of 2024 and is one of the core operational highlights I've noticed in CoStar's recent developments. The quality of the property digital twins is truly astonishing.

With the company's Q3 results approaching on October 22, I believe several key operational highlights are worth noting in this pre-earnings analysis. For example, in Q2 2024, the company achieved year-over-year traffic growth of 81%. In the Q2 earnings presentation, management emphasized its strong positioning in the digital transformation of the $300 trillion global real estate industry and the $70 trillion U.S. real estate market. Additionally, two of its brands, CoStar and Multifamily, currently have a run rate exceeding $1 billion.

I'm particularly bullish about the company's historical low volatility. It has achieved 53 consecutive quarters of double-digit revenue growth, even amid high volatility in commercial property transactions during the pandemic and post-pandemic high-inflation periods. This indicates that customers view its subscription services as essential in the industry's digital transformation.

This macroeconomic resiliency, combined with well-diversified revenue (58% from marketplaces and 42% from information and analytics estimated for FY24) and the fact that no single client among its top 1,000 accounts for more than 2% of total revenues, makes me very confident in the potential of its stock.

One of the most important aspects of CoStar's operating model is its focus on developing marketplaces that support an ecosystem of real estate agents. Unlike certain competitors' models, such as Zillow (NASDAQ:Z) and Redfin (NASDAQ:RDFN), CoStar Group provides agents with the ability to list properties on its platform, ensuring that any potential tenant or buyer becomes their lead. This is a similar strategy to that adopted by Rightmove (LSE:RMV), REA Group (RPGRY), and Scout24 (SCOTF). I consider this vital, as it is a key element CoStar employs to enhance agent satisfaction, thereby attracting more listings.

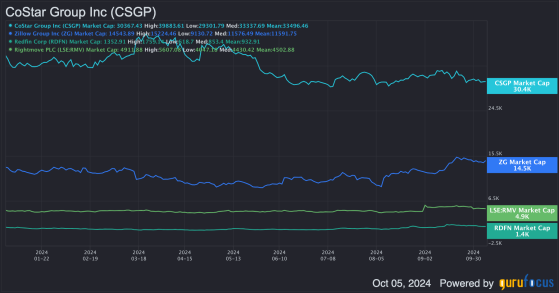

For the purposes of my peer and valuation analysis below, I will be focusing on Zillow, Redfin, and Rightmove alongside CoStar. The first element to note is how much of a lead CoStar commands in terms of market share.

Peer and valuation analysisFirstly, consider the operational differences among CoStar, Zillow, Redfin, and Rightmove. CoStar's acquisition of Homes.com and Homesnap positions it as a direct competitor to Zillow in the residential space. Redfin competes with CoStar's residential platforms by offering brokerage services that integrate technology, which is a slightly different domain from CoStar's focus on data and analytics. CoStar's initiatives to expand in the UK are increasingly positioning it as a potential competitor to Rightmove, currently the leading online real estate portal in the country.

In terms of valuation, CoStar is arguably not particularly attractively valued right now when compared to its peers. This is addressed in the EV-to-EBITDA comparison of the four companies in the chart below. However, CoStar is currently showing a contraction in some of its valuation ratios, including its EV-to-revenue ratio of 10.2 (down from a 10-year median of 11.9) and its P/E ratio without non-recurring items of 69.3 (down from a 10-year median of 80.7). Furthermore, the current consensus is that CoStar will achieve annual total revenue growth of 14.7% over the next three years, a moderate expansion from the 11.7% annual growth over the past three years.

CoStar does not pay a dividend, and management has given no indication that it will initiate dividend payouts soon. Therefore, investors must rely on CoStar's capital appreciation for returns. Over the past 10 years, the stock has returned 391.5% in price, but over the past five years, it has only appreciated 25%. However, CoStar's aggressive investment in Homes.com is turning it into a leading residential real estate portal in the U.S. Coupled with its high retention rates and further digital optimization from AI and the Matterport acquisition, this points to a stronger future than the past five years, which were affected by high inflation after the pandemic. In addition, a lower interest rate environment, which is already beginning and is likely to improve further in 2025, is expected to stimulate the real estate market significantly in the U.S. and broader Western markets. I anticipate this will create strong tailwinds for CoStar.

Based on consensus estimates, I anticipate that CoStar will generate total revenues of $3.15 billion for FY25, due to an improved macroeconomic environment and the company's consistent track record of surpassing expectations. This would represent a 15% revenue growth from the FY24 consensus of $2.74 billion. Given that the company's P/S ratio is currently contracting from historical levels but its revenue growth rates are likely to improve in the coming years, I find it plausible that the P/S ratio will expand slightly over the next 12 months.

At a P/S ratio of 12, CoStar could achieve a market cap of $37.8 billion, which is a 24.5% increase from the current market cap of $30.37 billion. This projection is further supported by the consensus that CoStar will achieve a three-year net income growth rate of 35.6% and a three-year EBITDA growth rate of 45.7%.

Risk analysisWhile CoStar has a formidable market position supported by numerous acquisitions that have consolidated its standing over time, I believe it is vulnerable to being outcompeted in certain niche markets in countries that aren't its primary focus. For example, Rightmove currently dominates the UK market, and competition risk is even more of a concern in Latin America and the Asia-Pacific region, where CoStar's presence remains significantly more limited than in North America. CoStar's expansion could be significantly hindered by local real estate portals or niche data providers catering specifically to regional needs and customs. Therefore, management should carefully monitor its margin efficiencies as it seeks to expand more aggressively overseas.

Furthermore, while CoStar is currently reasonably valued given historical market sentiment for the stock, its valuation multiples are still generally high. This opens up a greater risk that the stock could face significant downside volatility in the event of a major recession, which I believe may be on the horizon. Based on my analysis, after a lower interest rate environment stimulates economic growth in 2025, we could see inflation in 2026 leading to a stagflationary period in 2027 and beyond. In a worst-case scenario, this could also intensify geopolitical tensions in the Middle East, Asia, and Ukraine. A significantly weakened macroeconomy would have a knock-on effect on CoStar; while it remained resilient during and after the COVID-19 pandemic, it did experience a small revenue contraction of 1% in 2009. Therefore, a similar situation could occur here, and its high valuation multiples now could make for a risky medium-term investment.

ConclusionThis is a strong near-term and medium-term investment, with the most significant caveat being its generally high valuation multiples, which could lead to volatility if we experience a significant recession in the West in the next few years. Since the company does not pay a dividend, investors should be cautious about investing too heavily. I also believe international diversification is prudent at this time. Despite the risks, the company's market cap could appreciate by approximately 25% over the next 12 months, as a better interest rate environment in 2025 could boost the real estate market and create positive tailwinds for CoStar.

This content was originally published on Gurufocus.com