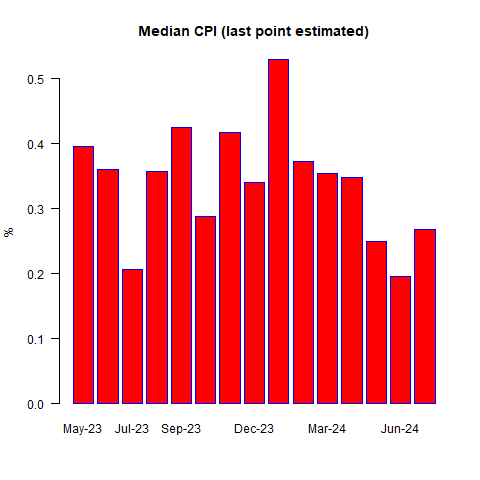

It was only a few months ago (with the March CPI report in April) that I was talking about a ‘Potential Pony Situation’ in my podcast when, after an unsettling Core CPI, I pointed out that the Median CPI was much less disturbing. Trying to tell the story of the economy is about figuring out where the underlying trends are, and trying to figure out what you can ignore as ‘noise.’

Back then, it was clear that inflation was heading lower, but not as fast as people were saying, so the bad core CPI was off-putting. It messed up that story. But because we were focused on Median CPI, that month was not so unsettling and we focused (successfully I think) on the fact that inflation was decelerating…but not collapsing back to target imminently.

Fast forward, and the story we are looking at coming into today’s CPI is that inflation is still declining, but people are probably getting a bit out over their skis in anticipating (again) a rapid collapse in inflation after a couple of weak CPI prints. Once again, that’s not the story the data is really telling, but deviations from that belief are likely to be painful.

For what it’s worth – I saw a lot of commentary this morning about how “PPI is encouraging,” or “PPI means this or that.” No one in the inflation trading community cares much about PPI. There are some elements of the PPI report that can help with some of the parts of other inflation reports, but the overall number has very little correlation (and no lead) with the CPI. You and I are exposed to CPI. The Fed looks at consumer prices. My best advice about PPI is to ignore it.

When CPI actually came out, it was a touch better than expected on the surface. Economists had been looking for +0.19% m/m on core and got +0.155% on the actual number. What was fascinating to me was the market reaction. Equity futures appear to be completely flummoxed by an as-expected number, vacillating around unchanged 20 minutes later as I write this.

I think this tells you something, actually – folks coming into today weren’t trading the actual number but rather planning to trade what other people thought about the number. Everyone thought everyone else knew what a higher-than-expected or lower-than-expected number would do. An as-expected print means you have to dig into the details, and equity guys don’t like details. They like big pictures. Thick lines. Crayons.

So let’s look at some pictures.

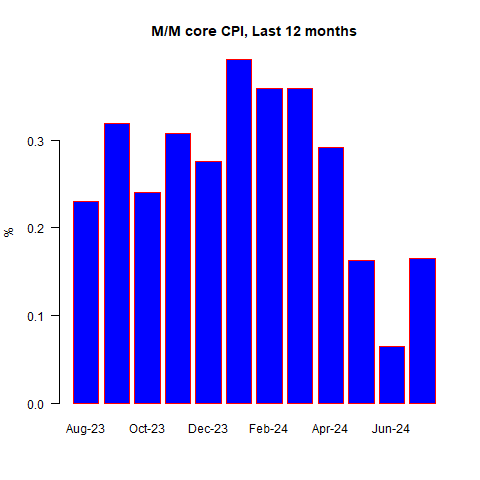

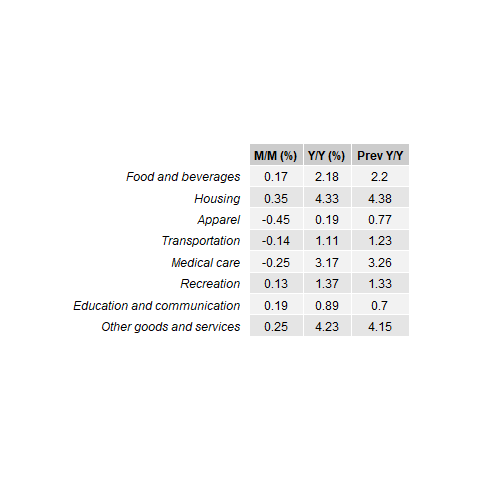

Breaking down the last 12 core prints and the 8 major subcomponent pieces:

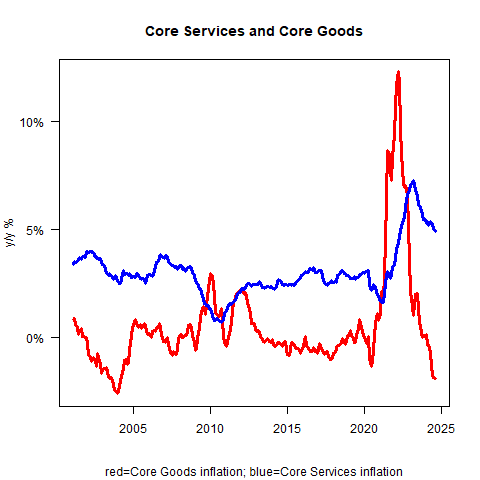

The first thing that jumped out at me was that core goods again plumbed new 20-year lows. Yes, that’s 20-year lows, as the following chart shows. -1.9% y/y.

Folks, I am still waiting for the turn and I say every month “surely, it can’t go lower than that.” So far, so wrong. The US dollar is no longer strengthening in a straight line, and hasn’t been for a while. If anything, it’s weakening. Apparel this month was -0.45% m/m, and only 1.1% y/y. Apparel is almost entirely imported, and at some point a steady-to-lower dollar will mean that core goods heads back to flattish. (Also, keep in mind that both Presidential candidates have expressed pro-tariff positions, but that’s a 2025 story at the earliest).

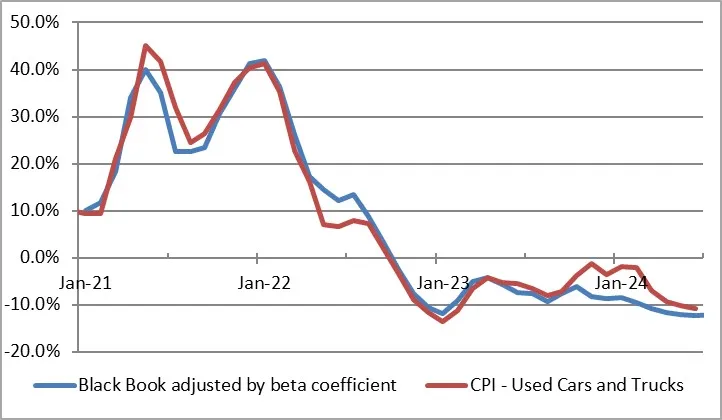

Within Core Goods, we also saw Used Cars decline yet again. This month it was -2.3%. CPI had diverged a bit from the private surveys, but with this month has basically converged back to the number implied by Black Book. That doesn’t mean Used Car prices won’t decline further, but there’s no longer a reason to expect “bonus depreciation” going forward.

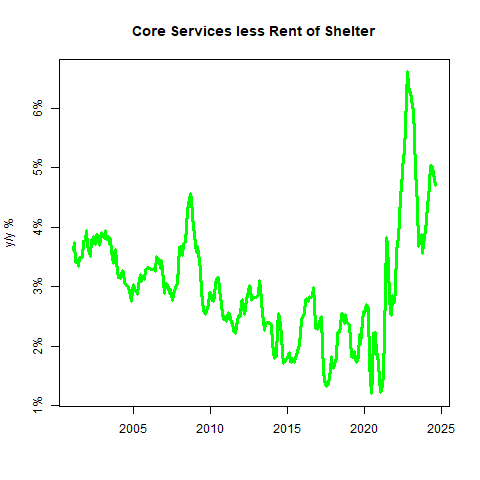

Now, in the first chart above note that Core Services dipped to 4.9%, the lowest it has been in a while also. Within core services, we saw Airfares decline again (-1.6% m/m after -5% last month), but the interesting thing is Hospital Services.

The other parts of Medical Care, that is Physicians’ Services and Medicinal Drugs, were both in line with recent trends and on top of last month’s figures. Hospital Services plunged -1.1% m/m. The y/y is still pretty high at 6.1%, but if this number is prologue (I sort of doubt it) then this upward pressure will abate.

The fact that services dropped so hard helped to bring “SuperCore” down a little bit. It is still elevated, and frankly the trend doesn’t look wonderful. You want 50bps in September? You need more than this, pal.

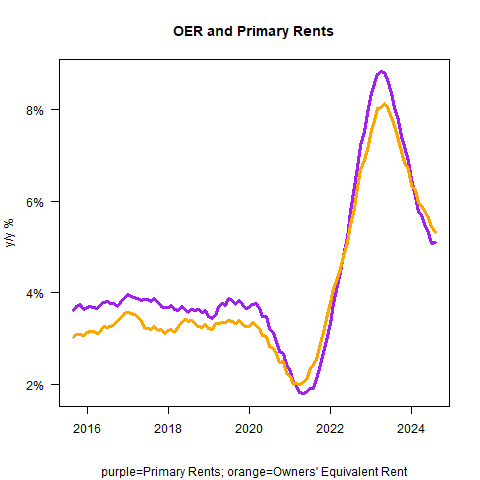

Do you know what I haven’t mentioned yet? Shelter. Shelter is the biggest and stickiest piece, and the foreordained deceleration of shelter is part of the religion of everyone who thinks we will decline to 2% core inflation and remain there (which is basically where breakevens are these days).

Bad news – this month, Primary Rents rose 0.49% m/m and OER rose 0.36%, compared to 0.26% and 0.28% last month. This is where it’s useful though to look at the y/y numbers. That big surprise in Primary Rents produced an unchanged y/y number and OER still decelerated to 5.30% from 5.45%. The wonder of base effects!

So let’s harken back to the beginning of this piece. In ‘A Potential Pony Situation,’ the Median CPI warned us to not get too worried about the surge in core because Median was pretty well-behaved. In the current circumstance, Median tells us to not get too excited by all of those people who will be talking about how low the 3-month average is (I guarantee that old chestnut will make a reappearance this month) because Median will be something like 0.268% (my early estimate). This will be the highest since April, if I am right.

The bottom line remains the same, and that is that inflation continues to decelerate but median is going to end up in the “high 3s, low 4s.” I keep thinking that we will dip below that for a little while when the base effects of shelter pass through, before reaccelerating to what I think is the new ‘normal’ level, but shelter is being persnickety and resistant to that deceleration.

Either way, there is nothing here that would encourage the Fed to aggressively ease 50bps. Or, for that matter, to ease at all. If the Fed eases in September (which I expect, even though if I were a member of the Board I wouldn’t vote for one), it will be because its members fear recession and not because there is evidence that inflation is licked. That evidence is still elusive.