The traditional "balanced" 60/40 portfolio fell short in 2022 as rising interest rates and high inflation caused bonds to post their worst losses in a decade. Investors who relied on the traditional "stocks and bonds" portfolio design principles found themselves floundering as both assets ended in the red.

As a result, investors in 2023 are turning their attention to "all-weather" portfolio solutions designed to chug along with good risk/return profiles regardless of the economic or market environment. We've covered variants from Ray Dalioand Harry Browne before, so give those a read if you're unfamiliar with the concept.

To create an "all-weather" portfolio (hereby referred to as the "AWP"), investors can use a variety of ETFs. For a combination of low costs and high diversification, I suggest using Vanguard ETFs, which are highly popular, accessible, and boast high assets under management. Let's start building our AWP!

The concept of the AWP

The strategy of the AWP is based on the theory of "economic seasons", which is established around two variables: inflation and growth. Both inflation and growth can either be rising or slowing. When combined, we end up with four distinct economic seasons:

- Rising inflation + slowing growth.

- Slowing growth + slowing inflation.

- Slowing inflation + accelerating growth.

- Rising growth + rising inflation.

Now, each of these economic scenarios will be beneficial to the performance of some asset classes, while being hurtful to others. Historically, the results have been:

- Rising inflation + slowing growth: Commodities, TIPS.

- Slowing growth + slowing inflation: long-term Treasurys.

- Slowing inflation + accelerating growth: REITs, equities, small caps.

- Rising growth + rising inflation: equities, gold.

The allocation of such a portfolio is usually constructed on a risk parity basis, where each asset is weighted to contribute the same amount of volatility. The hope is that each of these assets pose a less-than-perfect correlation with each other while possessing long-term positive expected returns. Thus, when combined, the end result is a portfolio with better risk-adjusted metrics.

Building the AWP with Vanguard ETFs

Right off the bat, we run into some limitations. As of today, Vanguard does not offer a commodities or gold ETF. For the former, we can substitute energy sector equities, which are correlated to commodity prices and have performed well during inflation. For the latter, we will use TIPS.

The following ETFs might be suitable for constructing a Vanguard-only AWP. Clicking on each link will take you to a page where you can see their details.

- U.S. equities: Vanguard S&P 500 ETF (VOO)

- U.S. small-cap value equities: Vanguard S&P Small-Cap 600 Value ETF (VIOV)

- U.S. REITs: Vanguard Real Estate ETF (VNQ)

- Long-term Treasurys: Vanguard Long-Term Government Bond ETF (VGLT)

- Short-term TIPS: Vanguard Short-Term Inflation-Protected Securities ETF (VTIP)

- Commodity producers: Vanguard Energy ETF (NYSE:XLE) (VDE)

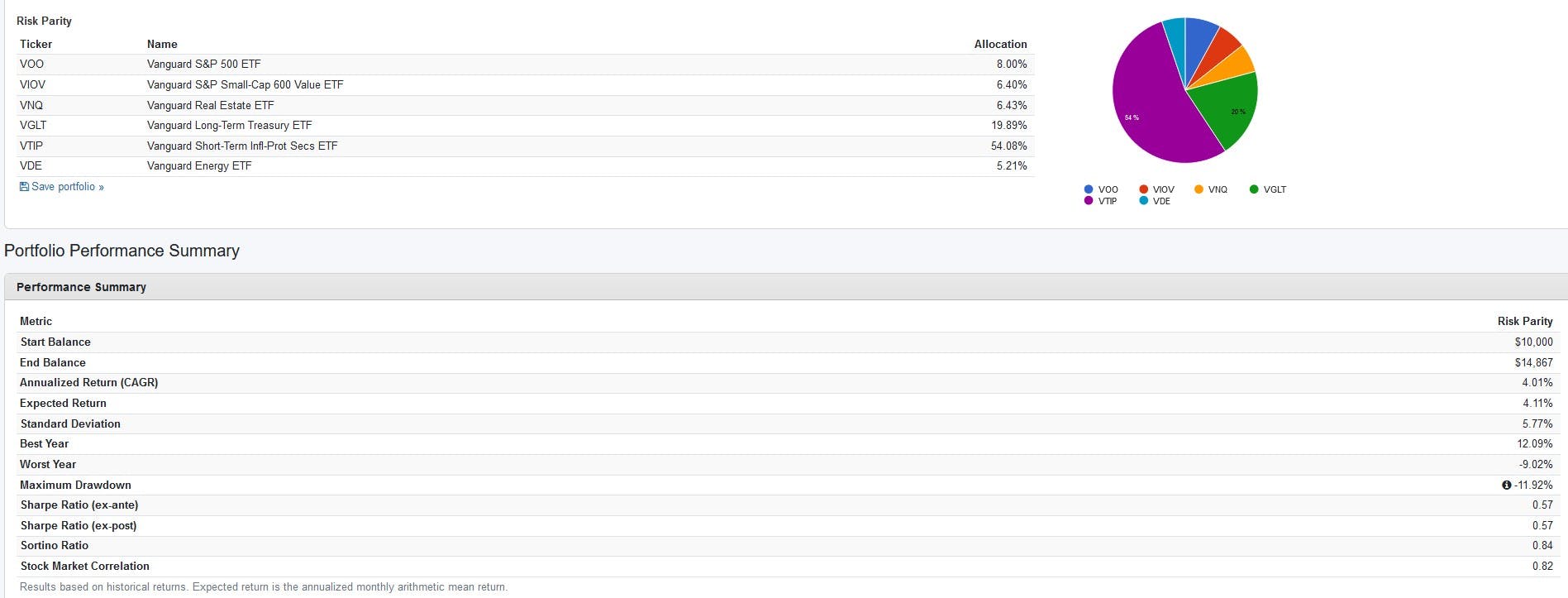

I backtested this portfolio first by optimizing it for risk parity from 2012 – 2023 (limited by VTIP):

The results aren't that impressive. Due to the risk parity approach, the Vanguard AWP ended up with a heavy allocation in VTIP and VGLT due to their comparatively lower volatility.

When I tried optimizing for the historically highest Sharpe ratio, I ended up with a portfolio of just VOO and VGLT due to the outperformance of both these ETFs over the last decade.

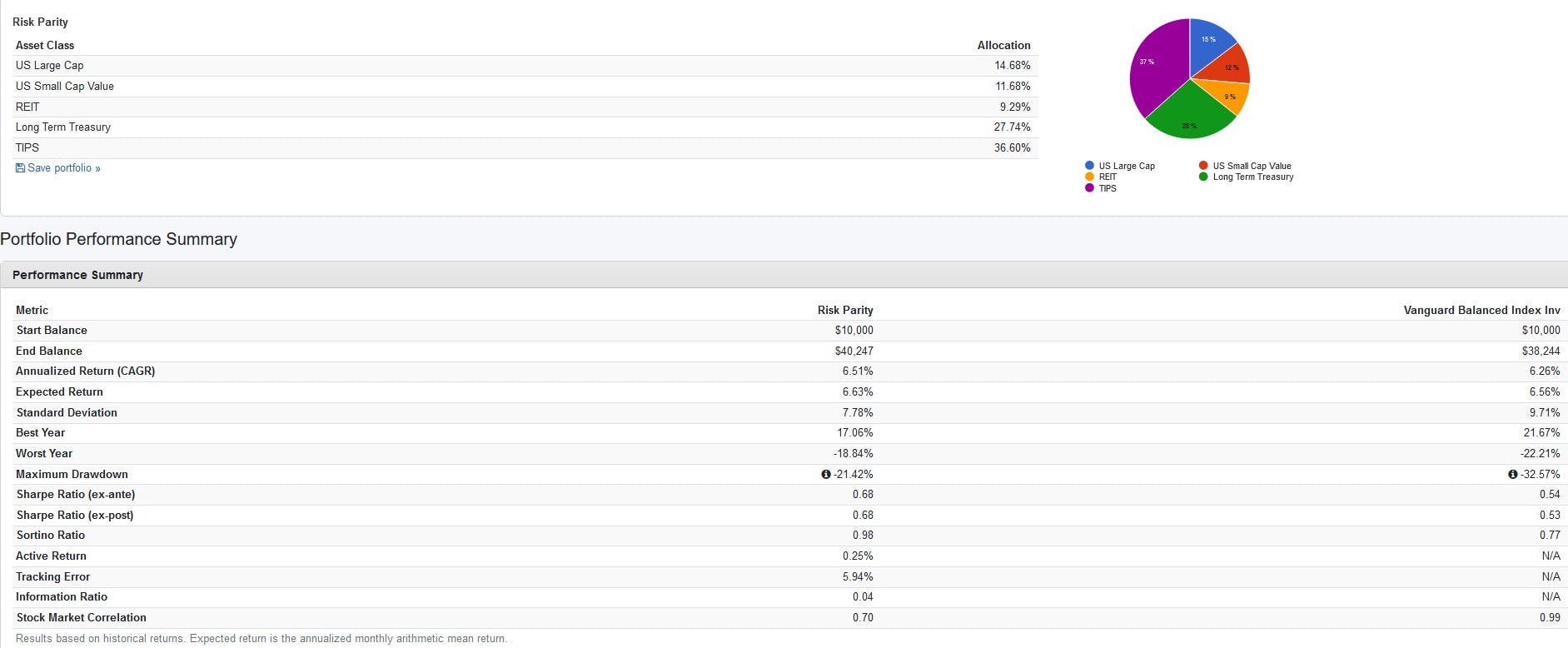

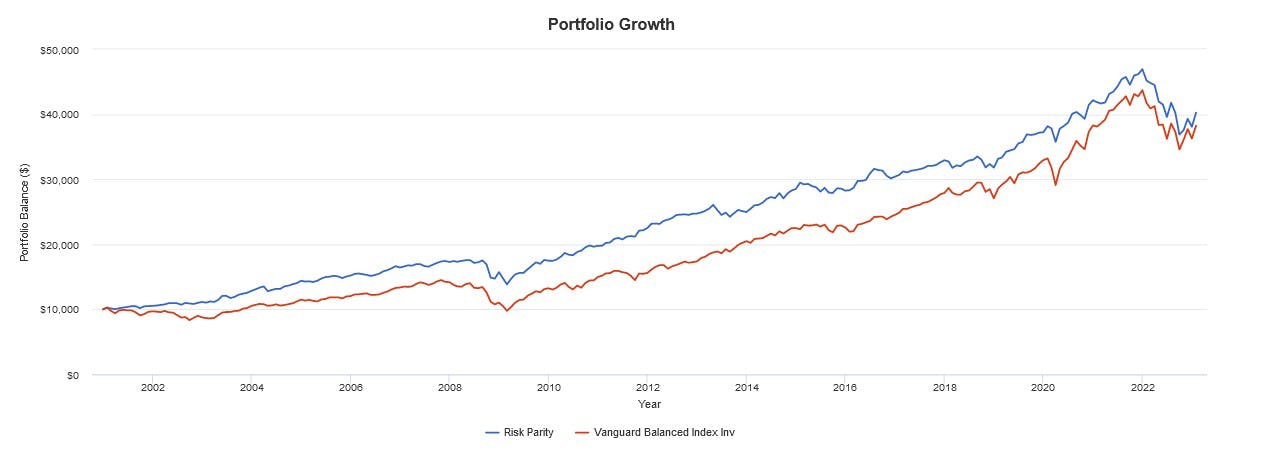

To remedy this, I conducted a second backtest not using the ETFs, but instead the returns of their asset classes, which allowed me to go further back in history. For this, I swapped VTIP with intermediate-term TIPS. I excluded VDE entirely as commodities data only went back to 2007 (and they're not that great as a long-term hold, see this article). The results compared to a 60/40 portfolio are below:

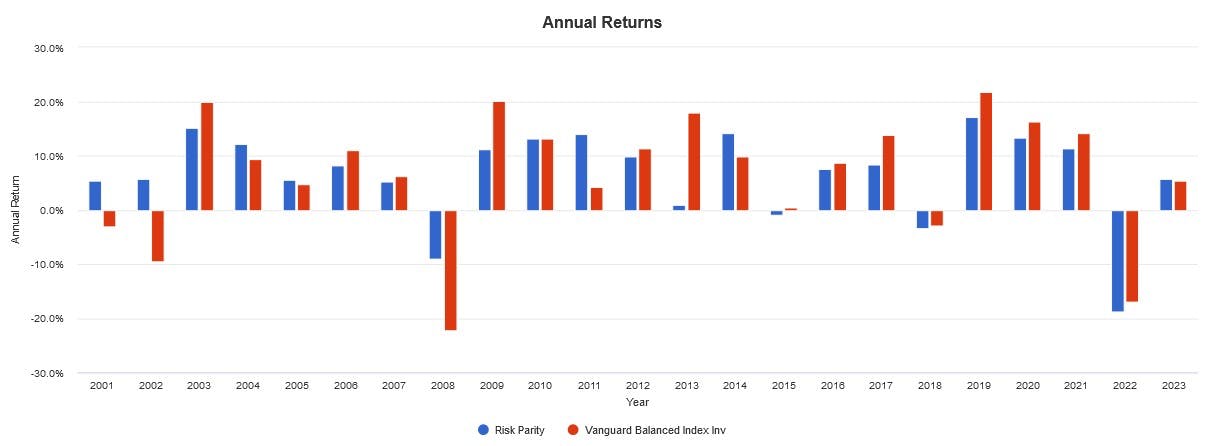

Compared to the 60/40, the AWP had marginally better returns, but with much lower volatility, maximum drawdowns, and worst year, along with a lower correlation to the market. It did far better during the market downturns of 2001, 2002, and 2008, but fared poorly in 2022.

This content was originally published by our partners at ETF Central.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.