Stocks fell sharply yesterday, ahead of Jay Powell’s testimony today. It would be great if Powell acknowledged how much financial conditions have eased and that easing conditions could undermine the Fed policy path and, more critically, delay future rate cuts.

It would undoubtedly make yesterday’s price action in risk assets seem tame. Because the rally in risk-assets certainly puts the Fed’s objective for inflation at risk. Let’s face facts: rising asset prices are inflation.

Credit spreads have melted lower following the December FOMC meeting. Given how much spreads have contracted, you’d think the Fed had already cut rates.

This is probably why there is no need for the Fed to cut rates at this point. The more credit spreads the easier financial conditions get.

Maybe the stock market got a bit worried and thought if it went down a little the day before Powell was due to speak, he might take it a little easier.

Maybe he will; I have no clue what he will say. But if Atlanta Fed’s Bostic is a guide, Powell may be talking about the potential to cut rates later this year, in slow and methodical pace, if the data allows it.

What seems surprising to me is that there are still people on TV who think the Fed will cut rates 6 to 7 times this year.

I’m not sure what planet they are living on, but if GDP is still growing at a nominal rate of about 5%, and the Fed is struggling to get inflation back to 2%, why should the Fed cut at all?

In the meantime, Bitcoin created a mere 9% bearish engulfing pattern on the day, I can’t say I have ever seen something that impressive.

Stuff like this is probably a good reason why Bitcoin will never have any place as a “real” currency in the world.

Also, the S&P 500 fell by around 1% on the day and managed to bounce right off the 5,060 level, which has held now several times and is a level not breached since Nvidia’s results back on February 22.

Speaking of Nvidia (NASDAQ:NVDA), it managed to rise 1.5% in the last 30 minutes of trading to finish up on the day.

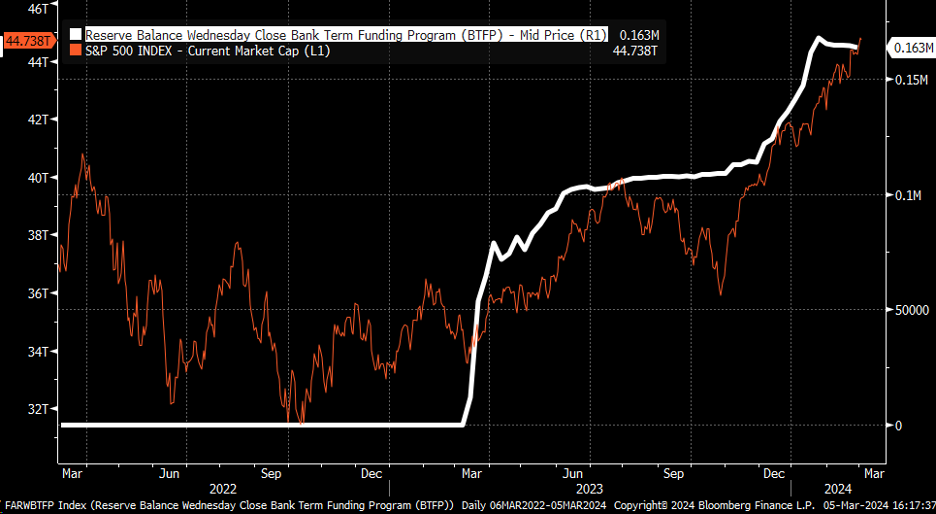

Finally, we have just a few more days until the Bank Term Funding Program is retired. The program allowed banks to use the Treasury as collateral at par with the Fed in exchange for cash for one year.

So between now and sometime around April 5, I imagine we see the balances in the program shrink by around $80 billion, while the rest remains until the 1st anniversary date.

I guess that we should see reserves shrink by that $80 billion and the Fed Balance sheet shrink once the unwind begins.

Some people have speculated that stocks have risen because of this program, but I am a bit more skeptical. I don’t see how $160 billion in expanded reserve balances translates into a $10 trillion increase in the S&P 500 market cap.

I certainly would hope there is not that much leverage deployed. When looking at the comparisons of the charts, I can see why someone might think that way.

I guess we will only find out if the market starts to drop like it rose. If that happens, perhaps that little program the Fed created had much more impact than I thought.