- Crude oil's dramatic surge, predating OPEC+'s supply cut extension, hints at a week filled with potential market volatility.

- On the macro front, the week is brimming with impactful data releases and central bank decisions, including the eagerly awaited US nonfarm payrolls report.

- As crude oil prices broke through key resistance levels last week, technical analysis indicates potential for further gains.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

Crude oil is set to have an intriguing week, especially following Friday's breakout. Prices surged even before OPEC+'s weekend decision to prolong supply cuts, suggesting investors may have anticipated such an extension.

Additionally, indications of robust demand from Asia contributed to Friday's surge in crude prices.

A slew of significant data releases and central bank announcements scheduled this week includes the eagerly awaited US nonfarm payrolls report on Friday, so financial markets could be in for a bit of volatility.

Unless unforeseen weakness in global data signals a slump in oil demand, crude prices are likely to continue their upward trajectory, buoyed by last week's bullish breakout and a supportive macroeconomic environment, largely attributed to ongoing OPEC+ intervention.

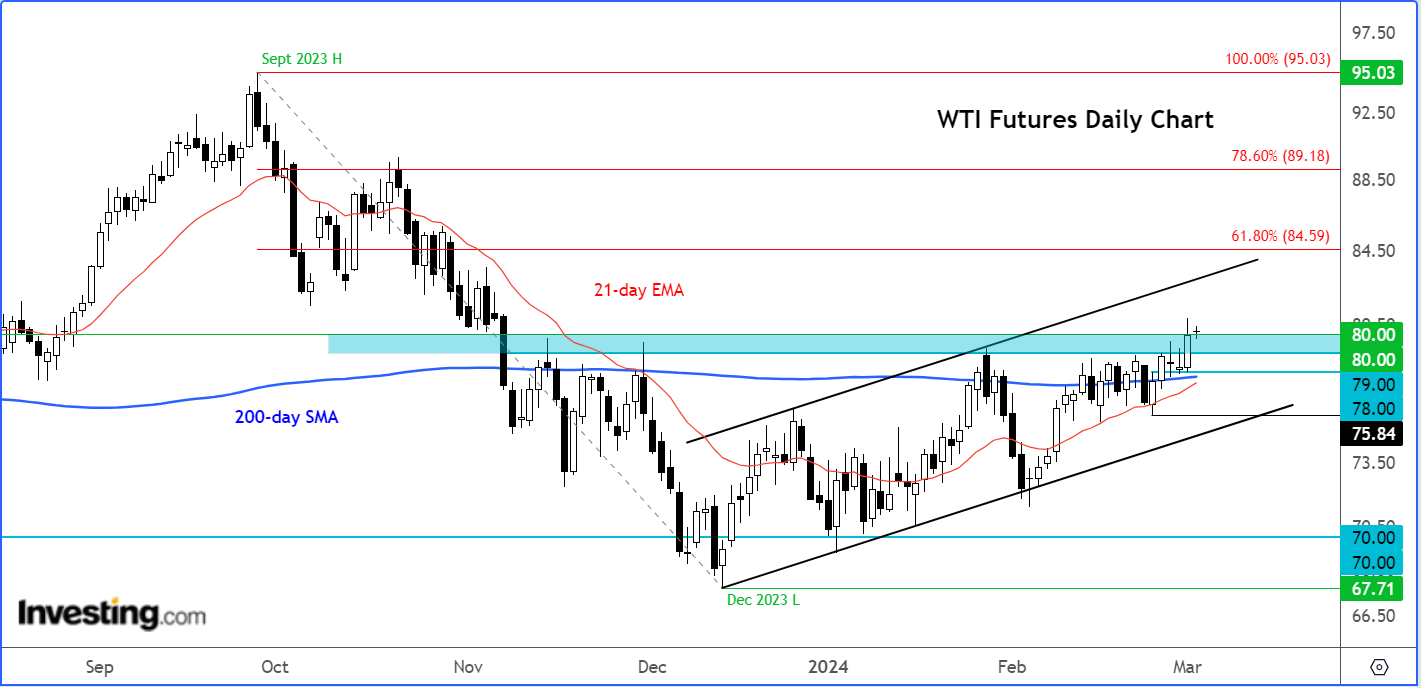

Before delving into OPEC's recent decision to bolster oil prices, let's briefly examine the WTI chart, which strongly suggests further gains could be on the horizon.

WTI technical analysis and trade ideas

During Friday's surge, crude oil successfully breached a significant resistance range from $79.00 to $80.00, a zone from which oil prices had consistently retreated since November.

With this clear breakthrough, the technical outlook favors further upward movement as we start the new week.

To sustain the bullish momentum, the bulls must defend this newfound ground. If they succeed, WTI may target the upper boundary of its channel, approximately around the $83.00 mark.

Another bullish objective lies at $84.60, aligning with the 61.8% Fibonacci retracement level from the September downturn.

The line in the sand for me now stands at $78.00, the level around which the last rally started in the latter half of last week.

A breach of this level would nullify the breakout signal from last week, potentially triggering a rapid reversal as bids withdraw sharply.

However, this is not my base case scenario, although one that cannot be ruled out given how previous OPEC decisions have failed to underpin oil prices in the way you would expect.

OPEC+ extends supply cuts by 3 months

In case you missed it, the OPEC+ extended oil supply cuts until the middle of the year to prevent a global surplus and (obviously) boost prices.

Leading the effort were once again Saudi Arabia and Russia. The decision to extend the supply cuts was taken to offset a seasonal dip in fuel consumption and increased production from rivals such as US shale producers.

Traders are now left wondering whether to pile in on oil following OPEC’s decision or wait and see whether the bulls will be happy to maintain control at the start of this week.

After all, the OPEC’s decision was fully expected while economic uncertainties in China also contribute to caution.

It is clearly in the interest of the OPEC+ countries to see higher oil prices. Yet, despite the Middle East conflicts disrupting regional shipping, abundant supplies have kept oil prices around $80 per barrel.

However, this may not suffice for many OPEC+ nations like Saudi Arabia and Russia, which require higher prices for economic and strategic reasons.

Saudis need oil prices above $90 per barrel to support the nation’s economic diversification, while Russia aims to maintain revenue for its activities, including the conflict in Ukraine.

Russia, which had been granted a unique exemption allowing a split between production and exports, will focus more on reducing crude production in the upcoming quarter.

This commitment might appease Saudi Arabia, which previously expressed disappointment in Moscow's reluctance to cut production directly. It will probably be more effective in supporting prices, too.

The key risk is rising US supplies offsetting the efforts by the OPEC+ group to lift prices. This is why investors have not been in a rush to buy oil every time OPEC has extended its supply cuts.

The International Energy Agency suggests ongoing cuts will be necessary beyond June due to slowing global oil demand growth and increased supply from the Americas.

***

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading. As with any investment, it's crucial to research extensively before making any decisions.

InvestingPro empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market.

Subscribe here for under $9/month and never miss a bull market again!

Don't forget your free gift! Use coupon codes OAPRO1 and OAPRO2 at checkout to claim an extra 10% off on the Pro yearly and bi-yearly plans.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.