US Crude is showing strong movement on Tuesday, as the pair trades at $42.26 a barrel in the European session. In the US, all eyes are on US Preliminary GDP. As will the US will release CB Consumer Confidence. On Wednesday, there are two key major events – Core Durable Goods Orders and Unemployment Claims.

Oil prices posted gains on Monday, after Saudi Arabia expressed willingness to cooperate with OPEC and non-OPEC members to stabilize oil prices. This was a notable development as the Saudis have previously opted to allow market forces to squeeze out the higher cost producers, rather than act to reduce production levels in order to raise the price of oil. Since August, oil prices have dived, as OPEC members and other oil producers continue to pump out oil at high levels, which has resulted in a global glut, as supply has far outstripped demand. If the current situation continues, analysts say that we could see oil drop below $30 a barrel as early as next year. The markets will be keeping a close eye on the OPEC meeting on December 4th. It’s doubtful that we’ll see oil move much higher before then, as the economic slowdown in China and other emerging countries continues to have a negative impact on global markets and has led to a sharp decline in commodity prices.

The guessing game continues, as the markets hunt for clues as to what we can expect from the Federal Reserve’s policy meeting in early December. Last week’s Fed minutes did not confirm a December rate hike, but most analysts feel that the long-awaited move will indeed occur next month. Market expectations have risen to 66% that the Fed will make a move next month, and recent comments by Fed policymakers have hinted that a rate move is a strong possibility. At the past two policy meetings, the vote against a rate hike was 9-1, but that clearly will not be the outcome at the December meeting. With the US economy showing improvement and employment and consumer indicators pointing upwards, the markets appear prepared for a small hike of 0.25% or 0.50%, and there is a growing view that modest, incremental moves would not cause unwanted turbulence on the global markets. One remaining question mark in the rate move puzzle is that of inflation levels. Recent inflation readings have been weak, and the Fed has repeatedly stated that inflation is a key consideration in any decision to raise rates. The markets will get a look at key inflation indicators shortly before the critical Fed policy meeting on December 16.

WTI/USD Fundamentals

Tuesday (Nov. 24)

- 13:30 US Preliminary GDP. Estimate 2.0%

- 13:30 US Goods Trade Balance. Estimate -61.8B

- 13:30 US Preliminary GDP Price Index. Estimate 1.2%

- 14:00 US S&P/CS Composite-20 HPI. Estimate 5.2%

- 15:00 US CB Consumer Confidence. Estimate 99.3 points

- 15:00 US Richmond Manufacturing Index. Estimate 0 points

Upcoming Key Events

Wednesday (Nov. 25)

- 13:30 US Core Durable Goods Orders. Estimate 0.5%

- 13:30 US Unemployment Claims. Estimate 273K

*Key releases are highlighted in bold

*All release times are GMT

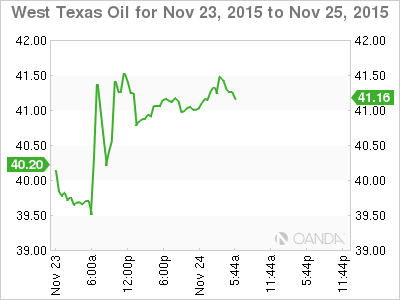

WTI/USD for Tuesday, November 24, 2015

WTI/USD November 24 at 10:05 GMT

WTI/USD 42.26 H: 42.52 L: 41.75

XAU/USD Technical

| S3 | S2 | S1 | R1 | R2 | R3 |

| 35.09 | 37.75 | 39.87 | 42.59 | 44.30 | 47.04 |

- 39.87 is providing support.

- 42.59 is a weak resistance line and could be tested during the day.

Further levels in both directions:

- Below: 39.87, 37.75 and 35.09

- Above: 42.59, 44.30, 47.04 and 49.06