Crude Oil: Potential For 2017's Highs As Eyes Are Set On the Bigger Prize

Crude oil surged +1.44 bp since Monday and clocked 51.86 high today boosted by potential positive outcomes as OPEC and Non-OPEC nations meet tomorrow yet again in Vienna on 25th of May.

OPEC has promised to cut supplies by 1.8 million barrels per day (bpd) until the end of June and is expected on Thursday to decide to prolong that cut to March 2018.

The meeting tomorrow could hold additional outcomes, other than extending the original deal, such as more compliance between OPEC and Non-OPEC counties and increasing cut-outputs with efforts to curb global supply demand and glut. If OPEC managed to nail such attributes, this could be added as additional boosters for an already expected outcomes.

Last deal that was struck in Vienna, oil levels managed to surge almost $10 bp, landing on $55.22 bp as 2017 high record. Fundamentally, if OPEC was able to extend the deal with additional cut-outputs and serious level of compliance, market should expect new records for 2017 as oil prices will rally using the shock news as a thrill to energize crude bullish forces.

On the other hand, U.S with relentless efforts trying to lower oil prices is set to release U.S inventories today. But eyes will be on the bigger prize (OPEC), so U.S inventories could slow the bullish trend, but tomorrow's meeting should beat U.S Inventories and OPEC's weight impact will be harder. On the other hand, any black smoke sent by tomorrow's meeting will result in intensive declines for crude levels as a disappointment.

Market should expect another strike by U.S as seen previously like when trunp threatened to add tariffs on oil imports or compliance between OPEC and Non-OPEC is not up to expectations. Increasing shale drills could always be used by U.S as a secondary weapon with efforts to glut market, trying to slow oil rising levels

Fundamentals:

U.S Crude Inventories today at 2:30 PM GMT.

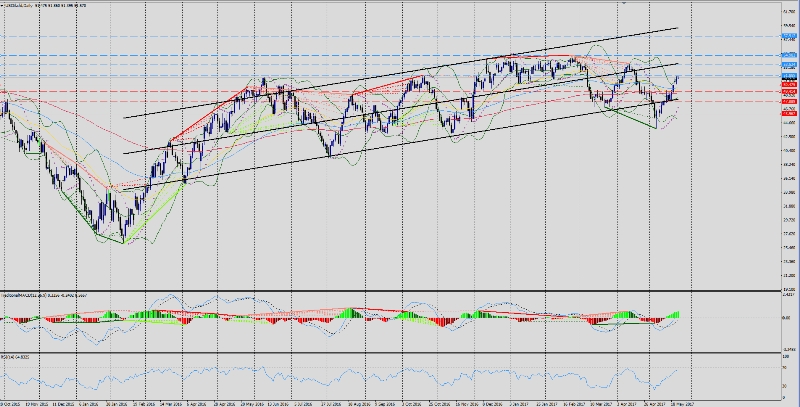

Technical Overview:

Trend: Bullish

Resistance Levels: R1 51.88 , R2 53.52 , R3 54.98, R4 57.91 (D1)

Support levels: S1 50.47, S2 49.41, S3 47.88, S4 45.96 (D1)

Comment: Currently the market is bullish, with higher levels on daily sessions, hence the bullish momentum. Due to the above fundamentals, expectations of high oil fluctuating levels. look forward for U.S Inventories today but dilate eyes on OPEC's meeting outcomes tomorrow.