After last week’s decline in cryptocurrency prices due to the SEC suing Binance and Coinbase (NASDAQ:COIN), it was another wild week for cryptos in the wake of the Federal Reserve’s decision on interest rates. The U.S. central bank has maintained its benchmark fed funds rate range of 5.0-5.25%.

The previous aggressive series of interest rate increases had contributed to the bear market for Bitcoin, and the Fed’s recent decision to pause its tightening efforts could be viewed as a potential bullish catalyst for the cryptocurrency in 2023 and beyond. However, in the short term, Bitcoin witnessed a notable downturn, plunging below $25,000, as the Federal Reserve’s economic projections also signaled the likelihood of two additional interest rate hikes by the end of the year.

Surprisingly, Bitcoin made a remarkable resurgence – returning to its early June level of around 26,500 and offsetting the impact of recent market turbulence - following Jerome Powell's press briefing, where the Federal Reserve Chair underscored that the projections presented were mere estimates. Market participants anticipate an additional interest rate adjustment within the current year, with the forthcoming Federal Reserve gathering on July 25 and 26 emerging as a potential juncture for such a move.

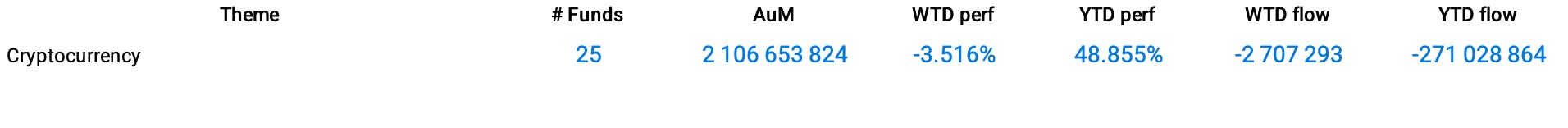

Canada Group Data

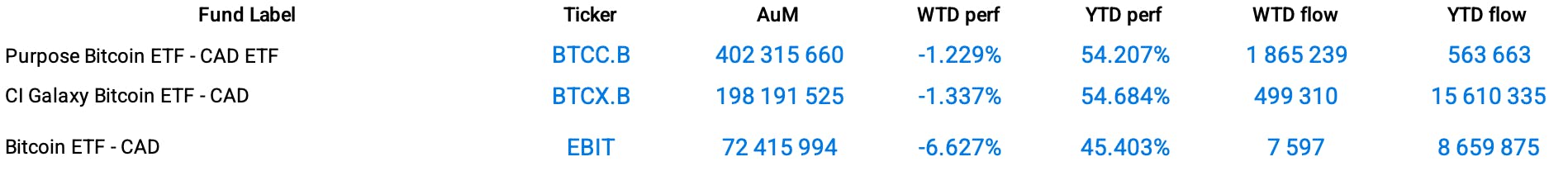

Funds Specific Data: BTTC.B, BTCX.B, EBIT

This content was originally published by our partners at the Canadian ETF Marketplace.