Tech exchange-traded funds (ETFs) experienced a resurgence during the second week of January, recovering from their earlier losses at the start of the year. This marks a positive shift after a challenging period characterized by low trade volumes and declining prices.

Notably, the S&P Information Technology sector delivered an impressive performance, rallying by 4.86% and emerging as the top-performing sector for the week. This follows the previous week’s decline of -4.05%.

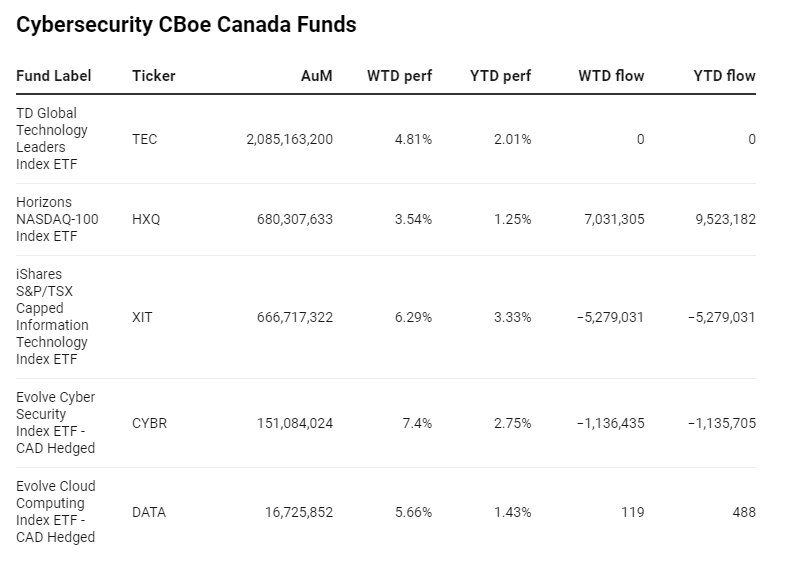

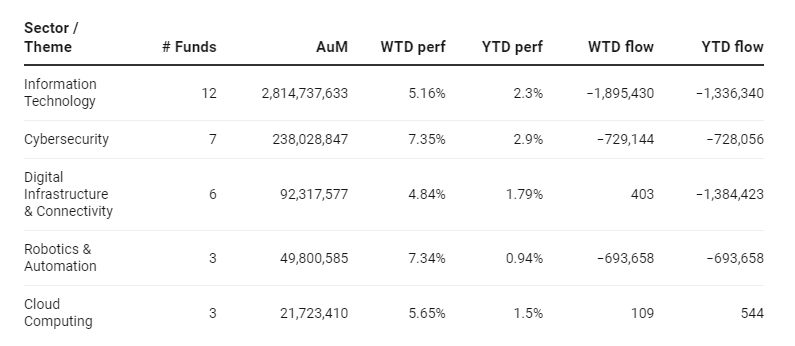

Further analysis of specific tech subsectors reveals even more positive results. ETFs focused on digital growth areas such as cybersecurity, cloud computing, digital infrastructure, and connectivity outperformed their broader counterparts. Cybersecurity funds saw a significant increase of 7.35%, while digital infrastructure and connectivity funds experienced a gain of 4.84%. Cloud computing funds also exhibited a noteworthy rise of 5.65%.

This rebound occurred amidst a backdrop of declining government bond yields. The 10-year U.S. Treasury yield dropped by 11 basis points, decreasing from 4.05% to 3.94%. Similarly, the 2-year U.S. Treasury yield plummeted by 26 basis points, falling from 4.40% to 4.14%.

Group Data

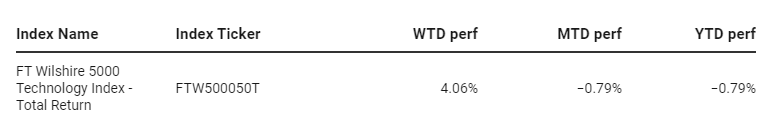

Index Data

Funds Specific Data