After three days of selling it was hardly surprising to see bulls take a peak from under the blanket. Having said that, it was all fairly tentative, with only half the volume of prior selling days.

But buying is buying and there is probably more in the tank for the next couple of days, although don't be surprised if most of the gains are booked premarket.

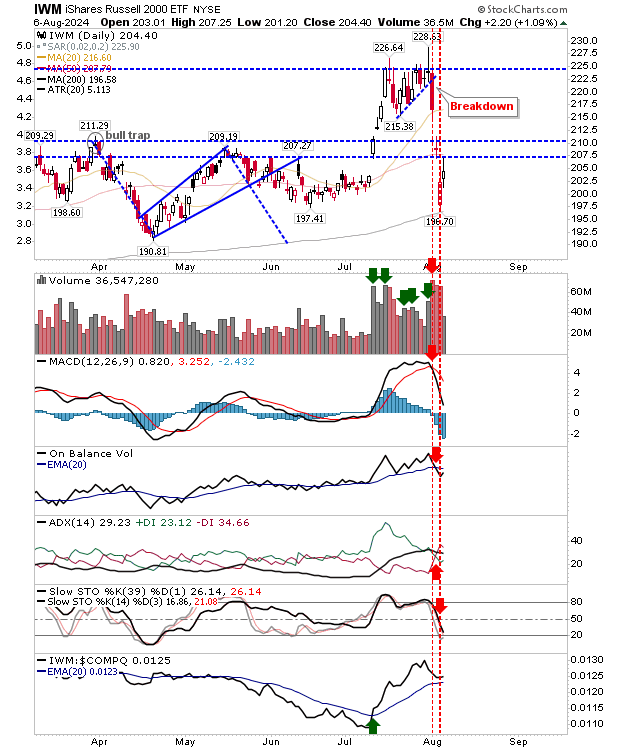

The Russell 2000 (IWM) gapped higher, nearly getting to the 50-day MA before losing some ground into the close.

I would look for another challenge of the 50-day MA, although it's hard to see it regain this average. Technicals are now net bearish, which means any gain from here is likely to be temporary.

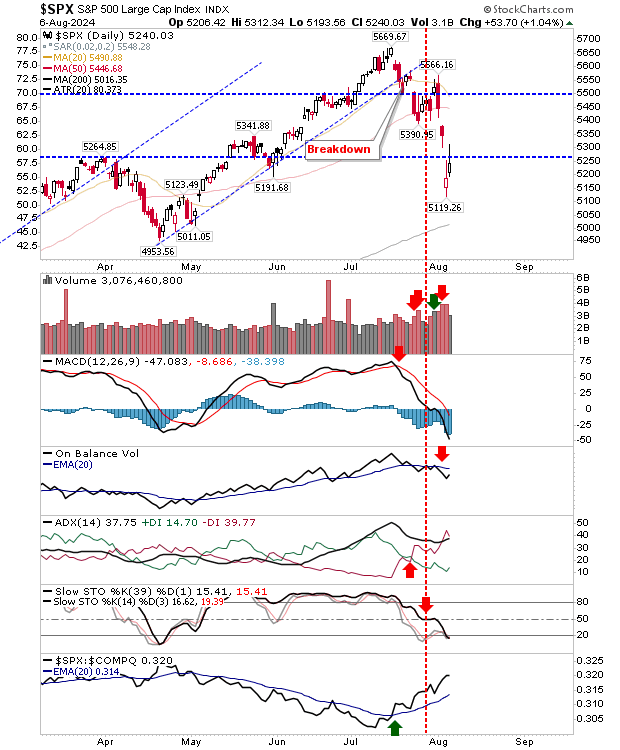

The S&P 500 is caught more in a no-mans land. It's trading between 50-day and 200-day MAs, but there is a big gap between them.

As with the Russell 2000 ($IWM), technicals are net bearish, but the index is the relative out-performer (vs the Nasdaq) and is oversold on intermediate stochastics.

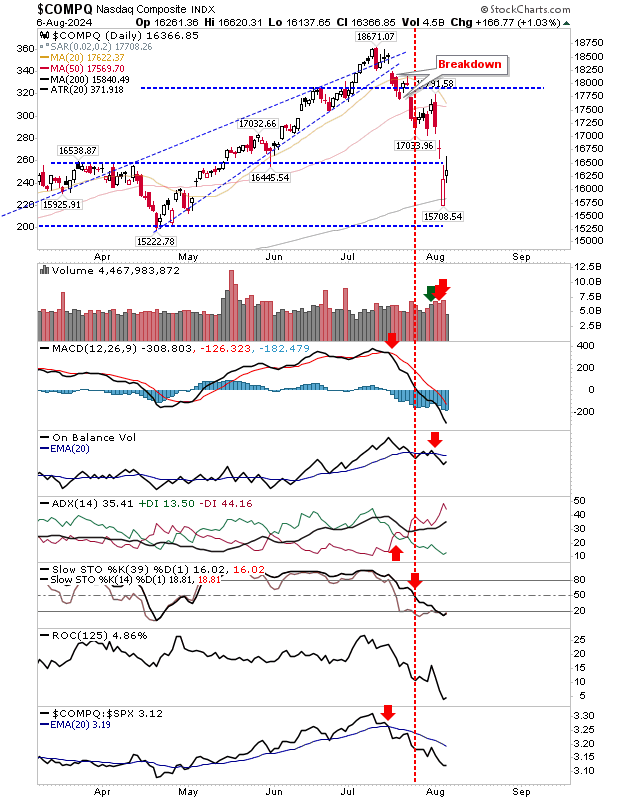

The Nasdaq mounted its challenge from its 200-day MA yesterday. It finished the day up around what was once resistance in the May swing high.

As with other indexes, when it reached yesterday's lows it began to struggle. As the index that has lost the most ground since the July swing high there may be room for more upside, but buying volume suggests a pause is more likely.

As with other indexes, technicals are net bearish.

For today, I think bulls will be more cautious and I would be looking for doji or a narrow range between open and close price. If, after the first hour of trading, buyers keep the pressure on, then look for a larger test of 20-day MAs, maybe by end-of-week.

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI