Let’s take a moment and talk about the things that have happened to the Canadian housing market over the past couple of months. Since January 2023, the Bank of Canada had kept the policy rate steady at 4.25%, creating an environment where both home prices and sales were reaching new heights every day, topping off in May when home sales alone exceeded the last two years’ numbers by 10%.

However, in April 2023, the inflation rate took an unfortunate turn, surging to 4.4%. This unexpected development proved to be a buzzkill, compelling the Bank of Canada (BoC) once again to increase the policy rate by 25 basis points, bringing it to 4.75%. Consequently, this left mortgage holders and aspiring homebuyers in a state of disarray.

This brings us to the present day, where the inflation rate has declined to 3.4%, bringing the Bank of Canada (BoC) much closer to its target of 3% inflation by the end of 2023. This development raises the question: what will the BoC decide to do in their upcoming rate announcement on July 13th? Additionally, it leaves us wondering about the direction of the Canadian real estate industry and where it is headed.

Well, let us break it down for you.

CANADIAN ECONOMY BEFORE AND AFTER RATE HIKE

Understanding the crucial role of rate hikes in curbing economic growth, it becomes evident that they can result in a subsequent increase in the unemployment rate. This is due to businesses encountering greater obstacles in obtaining loans, leading to reduced investment and hiring prospects. Consequently, this decline in economic activity often coincides with a decrease in GDP. Evaluating the economic conditions before and after the rate hike, it becomes clear that the intended purpose of the hike has been fulfilled, as evidenced by the decline in the inflation rate to 3.4%.

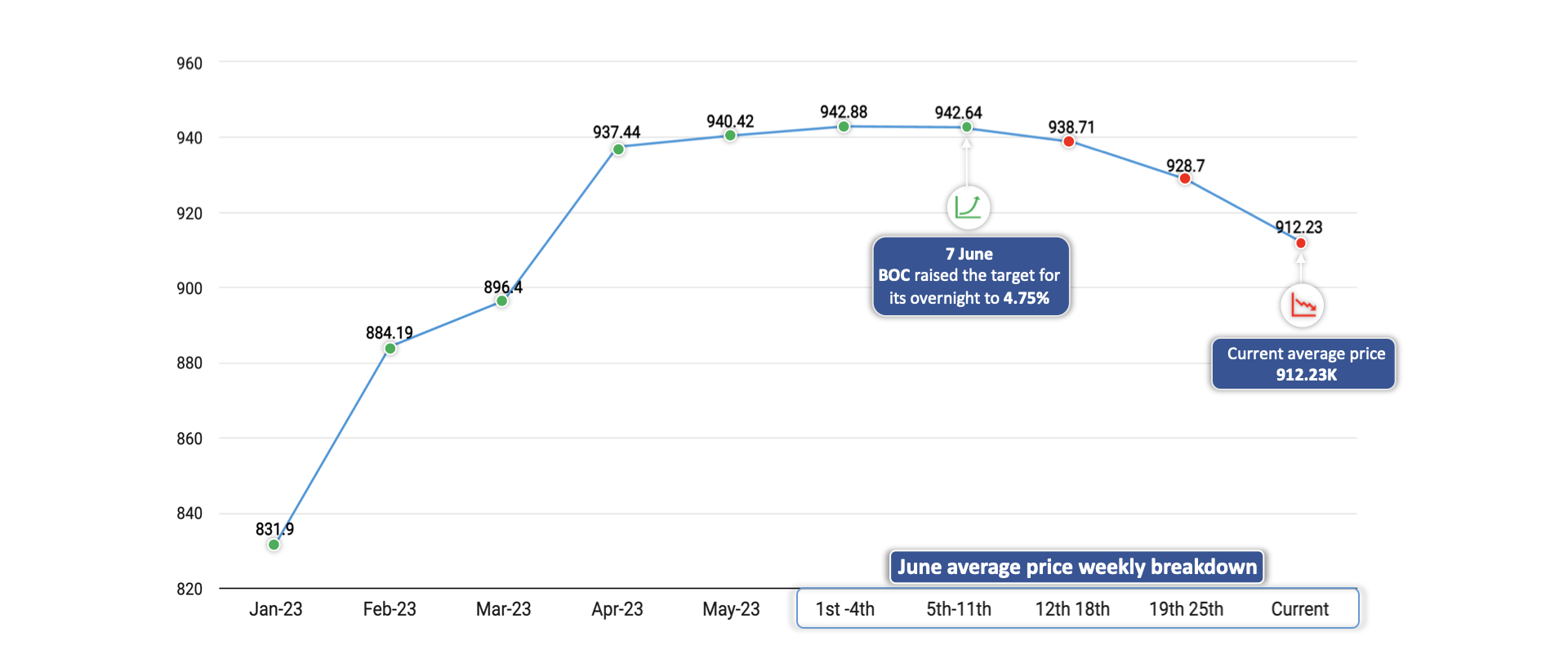

Average home prices after BoC rate hike

This brings us to the impact on the housing market, which can be analysed through the lens of supply and demand dynamics. Over the course of four months, from February to May, the Canadian housing market witnessed a remarkable surge in both home sales and prices, with no signs of slowing down. However, this trend changed when the Bank of Canada (BoC) intervened by implementing rate hikes in response to the looming threat of increasing inflation. As a result, there has been a noticeable decline in home sales and prices, a trend that is still ongoing. This situation presents a unique opportunity for first-time homebuyers, as the decrease in demand and the cautious approach of small-time investors due to market uncertainties have contributed to more favourable prices. Therefore, now is an ideal time for first-time buyers to secure amazing homes at budget-friendly prices.

According to Mr Manoj Karatha, Broker of Record for The Canadian Home, “Amidst every challenge lies an opportunity, and the current situation in the housing market is no exception. With decreased demand and cautiousness among small investors, home prices are now on a downward trajectory, offering a budget-friendly window for aspiring homeowners. If you are a first-time buyer, it is highly advisable to seek guidance from a knowledgeable real estate agent who can provide valuable insights on what and where to buy.”

THE ROAD AHEAD-MARKET PROJECTIONS

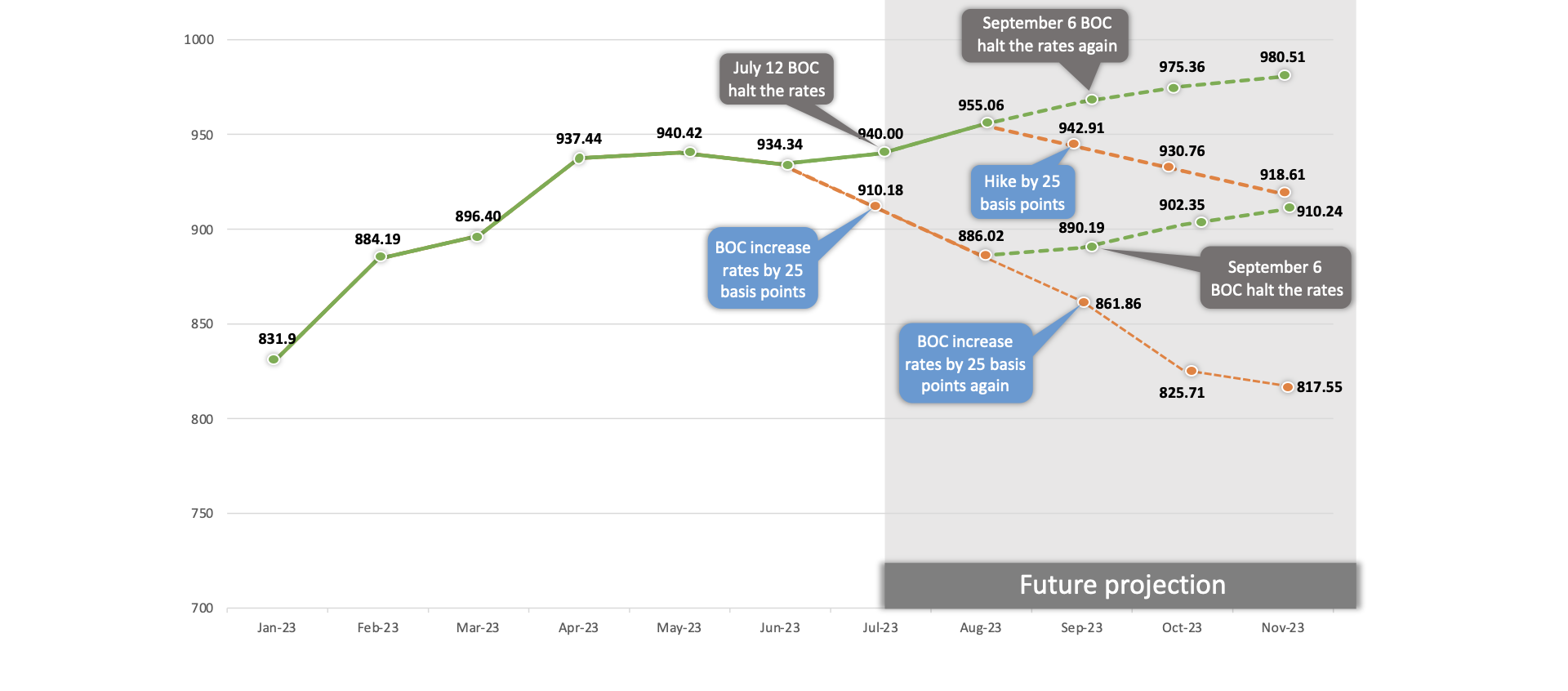

Will the Bank of Canada raise the policy rate again on July 12th?

This is the burning question currently circulating throughout the Canadian housing market. Considering that the inflation rate has already decreased to 3.4%, which was the primary motivation behind the BoC's initial decision to raise the interest rate, it appears highly unlikely. What would be the purpose of further increasing the interest rate when it would only result in a market crash that is currently unnecessary?

Therefore, it is highly probable that the BoC will maintain the rate at 4.75%, allowing potential buyers to pursue their dream of homeownership and, once again, driving up home prices. This indicates that the window of opportunity to purchase a desirable home at an affordable price in a less competitive market is relatively narrow. Hence, now is the optimal time to take action.

Market projection based on rate hike

What can you do now?

According to Robin Cherian, CEO of The Canadian Home, "I can confidently say that when you analyse the data over the past ten years and focus solely on the average prices, you'll witness a consistent upward trend. Real estate prices have shown remarkable growth during this period, making it a prime opportunity for buyers. Furthermore, the current market conditions present an advantage for buyers, as we are experiencing reduced demand and lower prices. Seize this moment to make a smart investment and secure your dream property at a more affordable rate. Don't miss out on this favourable buying window."

And we couldn't agree more, now is an excellent opportunity for first-time buyers and those on a budget to invest or upgrade without selling their existing home. The rental market is currently incredibly competitive, making homeownership an even more appealing option. Additionally, with the anticipation of an influx of immigrants and a limited supply of new homes, the demand for housing is expected to rise further.

Moreover, Canada boasts the lowest inflation rate among G7 countries, suggesting that significant rate hikes are unlikely in the near future. This favourable economic condition is likely to contribute to continued price growth in the housing market. Don't miss out on this ideal time to make a move in the real estate market.

This article was originally published by The Canadian Home

Which stock to consider in your next trade?

AI computing powers are changing the Canadian stock market. Investing.com’s ProPicks AI are winning stock portfolios chosen by our advanced AI for Canada, the US, and other exciting markets around the globe. Our top strategy, Tech Titans, nearly doubled the S&P 500 in 2024 - one of the most bullish years in history. And Beat the TSX, designed for broad market exposure, is showing +878% gains with 10 years’ back-tested performance. Which Canadian stock will be the next to soar?

Unlock ProPicks AI