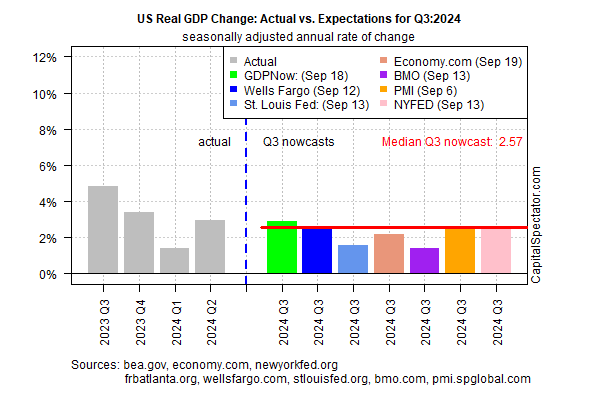

US economic activity remains on track to post a softer but still-solid growth rate in next month’s official GDP report for the third quarter. The analysis is based on the median estimate from several estimates compiled by CapitalSpectator.com.

Today’s revised median estimate ticked up to a 2.6% real annualized rate for Q3. That is slightly higher than the previous Q3 nowcast published on Sep. 13. For the second quarter, the Bureau of Economic Analysis reports output rose 3.0%.

Despite warnings from some sources in recent months that a US recession was imminent, or had already started, a broad reading of the data has consistently suggested otherwise.

In late August, for example, CapitalSpectator.com reported that Q3 recession risk remained low. A few weeks earlier on these pages I advised that the “Latest Economic Data Suggests US Expansion Continues.”

Although the economy increasingly looks set to escape an NBER-defined recession in Q3, the final quarter of the year and beyond may bring stronger headwinds.

For analysts searching for reasons to worry, yesterday’s August report for the US Leading Economic Indicator is on the shortlist. The Conference Board reports that this metric fell last month to its lowest level since October 2016.

“Overall, the LEI continued to signal headwinds to economic growth ahead,” says Justyna Zabinska-La Monica, an analyst at the consultancy. “The Conference Board expects US real GDP growth to lose momentum in the second half of this year as higher prices, elevated interest rates, and mounting debt erode domestic demand.”

Note, however, that LEI has been issuing recession warnings for some time – warnings that, so far, have been premature, to put it mildly.

Back in February, for example, CapitalSpecgtator.com noted that LEI “has been signaling a US recession for more than a year but the economy has continued to expand.”

Seven months later, LEI is still predicting a recession. It may be right eventually. Meantime, the evidence continues to accumulate that Q3 is unlikely to mark the start of a recession.