1: Introduction: Diamondback Energy is a powerful Permian player.

This article focuses on Diamondback Energy (NASDAQ:FANG), the second domestic oil producer in my portfolio, on Gurufocus. I trade this stock regularly, which is notable for being a pure play in the prolific Permian Basin.

FANG shares many similarities with Occidental Petroleum (NYSE:OXY), which I have recently covered, and EOG Resources (NYSE:EOG), among others. After completing my analysis of FANG, I plan to examine EOG Resources and a few other oil companies with strong ties to the Permian Basin.

Due to their significant success and substantial ownership of Permian production, the trioFANG, OXY, and EOGis one of the most powerful domestic players in the Permian Basin. They stand alongside super-major oil companies like Chevron Corporation (NYSE:CVX), ConocoPhillips (NYSE:COP), and ExxonMobil (NYSE:XOM), which, by the way, recently acquired Pioneer Resources, becoming the number one US producer by far.

While several other companies could be considered, including Apache Corporation (NASDAQ:APA), which had approximately 328,000 Boepd in the Permian in 3Q24, Devon Energy (NYSE:DVN), which had 488,000 Boepd in the Permian in 3Q24, Civitas Resources (CIVI), which had 189,000 Boepd in the Permian in 3Q24, and Permian Resources (NYSE:PR) with 151,000 Boepd in the Permian in 3Q24, these companies seem slightly less relevant in this context.

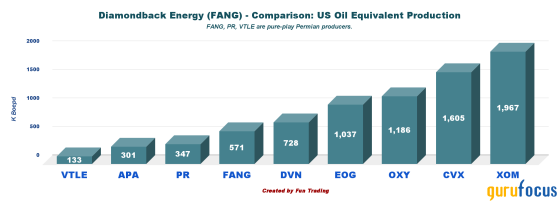

The oil equivalent production (US production only) in 3Q24 for the nine major US producers is shown below:

We can see that the trio FANG, OXY, and EOG produced 2,794K Boepd in 3Q24, mostly from the Permian Basin. By the way, OXY produced 729K Boepd in the Permian Basin during the 3Q24.

2: The Permian Basin: A prolific oil producer.

The Permian's contribution to US crude oil production is significant. In 2024, it was estimated to be 6.3 million barrels per day, accounting for 51.4% of the total output, estimated at 13.249 million barrels per day in 2024.

The Permian Basin spans New Mexico and Texas. While analysts anticipate a peak in oil production soon, the EIA predicts an increase of 4.8% yearly, equating to 6.6 million barrels per day by 2025.

Source: permianpartnership.org

As we enter 2025, it's an ideal time to assess this volatile sector and its potential by examining three reliable companies that provide low but secure dividends. Over the past year, FANG has outperformed both EOG and OXY, as illustrated in the chart below.

3: Diamondback Energy: A Focused Investment in the Permian Basin. 3.1: Oil Equivalent Production. Diamondback recorded a big jump in production this quarter after Endeavor's merger.

The company focuses exclusively on producing hydrocarbons and natural gas from its properties in the Permian Basin. The company operates in three sub-segments of the Permian Basin: the Delaware Basin, the Central Basin Platform, and the Midland Basin.

Source: From the Diamondback Energy website.

However, the company also owns 100% of Rattler Midstream Operating LLC, which:

Owns and operates crude oil and natural gas gathering systems that provide services to Diamondback Energy and third-party customers under primarily long-term, fixed-fee contracts.Furthermore, Diamondback Energy owns 92% of its subsidiary Viper Energy Partners LLC (NASDAQ:VNOM), which trades separately:

Viper is a corporation formed by Diamondback to own, acquire, and exploit oil and natural gas properties in North America, with a focus on owning and acquiring mineral and royalty interests in oil-weighted basins, primarily the Permian Basin.FANG's oil, natural gas liquids (NGL), and natural gas production averaged 571,098 barrels of oil equivalent per day (Boepd) in the third quarter of 2024.

Production increased by 26.1% compared to last year's quarter, exceeding analysts' expectations. However, it rose by 96.4k Boepd quarter over quarter due to the acquisition of Endeavor Energy Partners on September 10, 2024.

Oil production represents 56.2% of the total oil equivalent production.

The average realized oil price in 3Q24 was $73.13 per barrel, a decrease of 10.3% compared to the previous year. The average realized natural gas price fell significantly to a negative $0.26 per thousand cubic feet (Mcf). Overall, FANG achieved a composite price of $44.80 per barrel, down significantly from $54.37 a year earlier.

Diamondback Energy's cash operating cost increased to $11.49 per barrel of oil equivalent (BOE), compared to last year's cost of $10.51 per BOE. This rise in cost can be attributed primarily to lease operating expenses, which accounted for $6.01 per barrel this year. Diamondback's gathering, processing, and transportation expenses rose 10.9% year-over-year, reaching $1.94 per BOE.

3.1.1: Guidance 2024

Diamondback Energy's guidance includes the recent merger with Endeavor, finalized on September 10, 2024. The company expects to produce between 587,000 and 590,000 barrels of oil equivalent per day (Boepd) in 2024, up from the previous guidance of 462,000 to 470,000 Boepd.

Oil production is anticipated to range from 335,000 to 337,000 barrels per day, or 57%.

Additionally, Diamondback has revised its capital spending budget to be between $2.88 billion and $3 billion.

3.2: Third quarter results: The performance was weaker than expected due to lower price realization.Diamondback Energy reported adjusted earnings of $3.38 for the third quarter of 2024, representing a 38.4% decline year over year, primarily due to lower price realization. By the way, the natural gas was sold at minus $0.26 per mcf in 3Q24.

However, the company's revenue rose to $2,645 million, surpassing last year's revenue by 13%. The chart below shows Diamondback Energy's impressive accomplishments over the last decade.

Unfortunately, the company only paid its base dividend this quarter.

FANG declared a quarterly dividend of $0.90 per share, which translates to a yield of 2.12%.

Additionally, FANG repurchased $515 million worth of shares in the third quarter and another $185 million in 4Q24. Lastly, the company received board approval for an additional $2 billion share repurchases.

As of September 30, 2024, Diamondback Energy reported approximately $370 million in cash and cash equivalents and $13.114 billion in long-term debt, including current liabilities. This resulted in a debt-to-capitalization ratio of 25%. This total includes VNOM's $830 million in debt.

The company's consolidated net debt is $12.7 billion, with $1 billion scheduled for payment in 2025.

Diamondback presents an excellent debt profile. In September 2024, S&P and Fitch upgraded it to BBB and BBB+, respectively. Moody's has a Baa2 rating on FANG's debt. Liquidity on a standalone basis is approximately $2.6 billion.

Even if the debt appears manageable, it is essential to address the company's substantial debt before management considers using cash for share buybacks.

Source: FANG 3Q24 Presentation.

4: Technical Analysis: A new descending channel formed following the recent breakout.

Note: The chart has been adjusted to account for the dividend.

Diamondback Energy is operating within a descending channel pattern, with resistance at $179.35 and support at $163.25. The relative strength index (RSI) is currently at 56, indicating a possible test of the resistance level.

However, the 50MA is also resistance, and the stock will have difficulty crossing $171.72.A descending channel is generally considered a bearish continuation pattern. It forms when the price consistently declines between two parallel lines. Since this pattern emerges from an existing downward trend, I anticipate it will ultimately lead to a breakdown. This sentiment is strengthening, as I do not expect oil and gas prices to be bullish in 2025.

I recommend using a Last-In-First-Out (LIFO) short-term trading strategy for 5060% of your position. Aim for a target price below the 200-day moving average, around $187. Maintaining a high long-term position is not ideal due to lower dividends.

When developing a trading strategy, consider gradually taking profits between $175 and $183, aiming for a potentially higher resistance level at $187. Alternatively, if the pattern ends with a breakdown, a distinct possibility, you might wait for a price retracement between $165 and $161, with a possible lower support target at $155.

The TA chart must be frequently updated to remain relevant, as we operate in a constantly changing environment.

This content was originally published on Gurufocus.com