China’s booming digital economy has led to a spike in demand for internet data centres (IDCs). The rapid development of new technologies and internet services has resulted in tremendous data volume and increased demand for data storage and computation, requiring more IDC services.

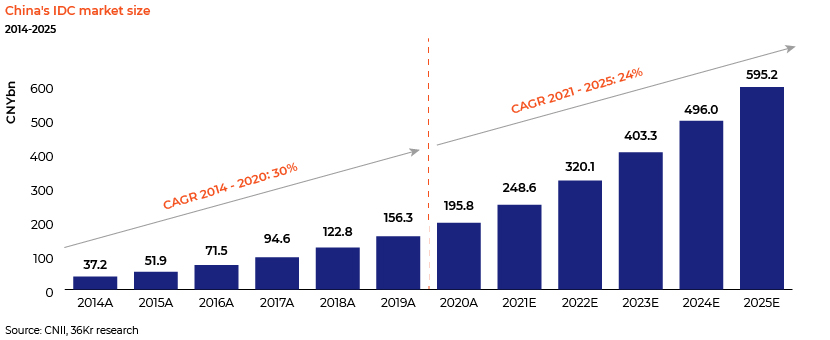

According to China Information Industry Network and 36Kr research, China’s IDC market grew at a 32% CAGR from 2014 to 2020 and is expected to continue to grow at a 24% CAGR from 2021 to 2025.

Incremental data traffic from internet giants and start-ups

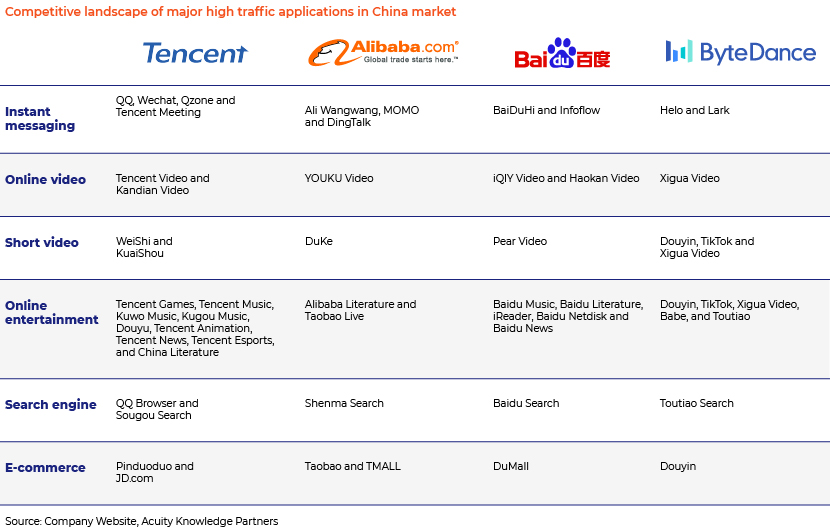

The pandemic has fuelled growth in online business, in segments such as livestreaming, e-commerce, medical and education services. The high-traffic applications of internet giants and start-ups also generate large amounts of data, increasing demand for IDCs.

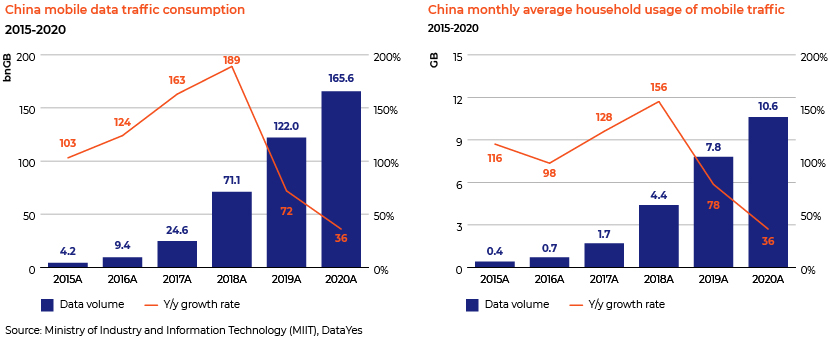

Remarkably, China’s mobile data use surged to 165.6bn GB in 2020 from 4.2bn GB in 2015, growing at a solid CAGR of 109%. Monthly average household use of mobile data reached 10.6GB in 2020, growing 36% y/y. With the increasing mobile data traffic trend, we expect China’s IDC market to thrive further in future.

Digitalisation increases IDC demand directly and indirectly

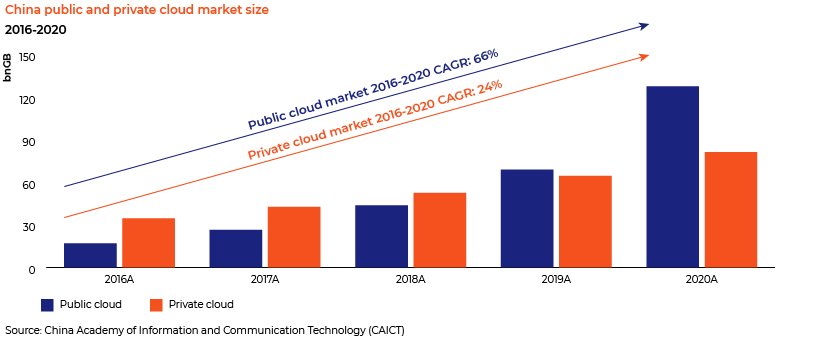

With the growing trend of digitalisation, traditional small and medium-size enterprises will likely move gradually to the cloud to reduce IT operating costs; key accounts also have a greater likelihood of moving to the cloud due to the reliability and high quality of cloud services versus those of IDCs.

In terms of data security, we believe demand for hybrid IDC services (the combination of self-owned or rented data centres and private clouds for confidential data or public clouds for non-core data) will continue. For example, large financial institutions and state-owned enterprises would save customer data and transaction information in their own IDCs or rented private clouds, supplemented by public cloud storage for general operational data. Such use has been evidenced by rapid growth in the size of China’s public and private cloud markets.

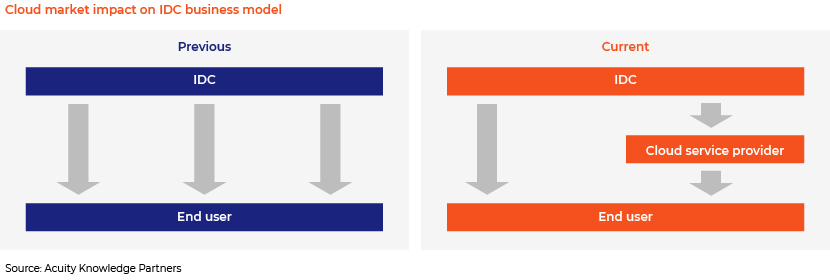

China’s cloud services market is, therefore, set to grow substantially and rapidly, significantly changing the IDC business model. In other words, cloud service providers will become the new cash cow, partially replacing end users.

Government policy support

As per Three-year Action Plan for the Development of New Data Centres (2021-2023), by end-2023, the MIIT estimates that (1) average annual growth rate of national rack number will be maintained at c. 20%, (2) total IDC processing power will reach over 200 eFlops, and (3) the average rack utilization rate will increase to over 60%. Local governments, including Fujian, Guangxi, Zhejiang, Yunnan, Shandong and Tianjin, are planning to construct large-scale data centres from 2020 to 2022.

However, to realise eco-friendly and carbon-neutral development, the government would need to promote green data centres with power usage effectiveness (PUE) lower than c.1.4 (nationwide PUE aims at decreasing to under c.1.3 by end-2023). Thus, support from local governments and regulators is critical for IDCs to obtain the large amounts of electricity they require. Tier-1 cities have imposed energy-consumption restrictions on IDC operators.

Overall, the Chinese government has been supportive of the IDC sector and cloud services market, and is implementing initiatives to promote new infrastructure including 5G networks and other facilities in search of technological leadership.

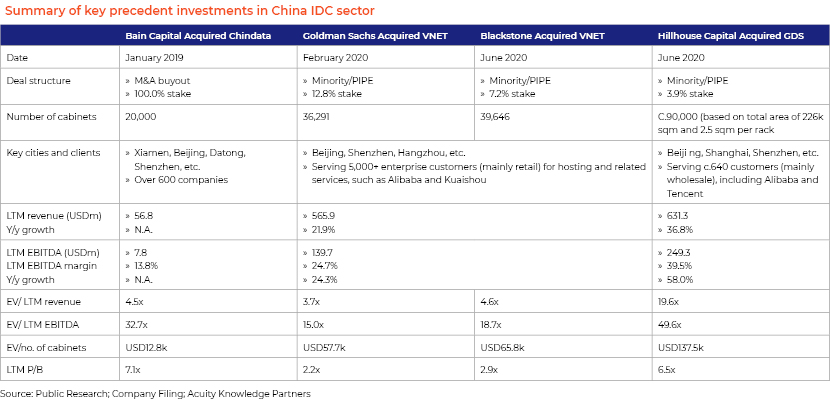

Investors setting up for an early-mover advantage

Although the environment and regulations continue to evolve, China’s IDC market remains appealing to global mega funds. Considering the significant market demand and government initiatives, they see the potential in the market and have invested billions of dollars in leading local companies, mostly at elevated valuations. The following table summarises the large transactions in the market.

Conclusion

We are positive on the outlook for China’s IDC market and recommend investment funds to focus on large-scale IDC assets located in or around tier-1 cities with low PUE. Given that the IDC sector is capital-intensive, investment funds and China’s domestic IDC companies have, in addition to seeking traditional equity or debt financing, been exploring innovative partnership to increase the liquidity of IDC assets and enjoy good returns; such ventures include REITs and the hotel operations management model (HOMM, where asset ownership and management are separated). China’s IDC service providers are moving towards greener, larger and lighter IDC assets for business expansion, and collaborating with local governments to tap into the digital economy development.