In the global financial arena, investments fall into three categories: U.S. markets, international developed markets, and emerging markets, each with its unique prospects and challenges.

The Canadian market, noted for its strong banking and natural resources, is part of the international developed segment.

As of July 31st, 2023, Canada constitutes just 2.83% of the FTSE Global All-Cap Index (Source: FTSE Russell Fact Sheet July 2023). This highlights the importance of diversification; solely focusing on domestic investments could limit Canadians' growth potential.

For Canadian investors eyeing global opportunities, this article introduces international diversification, spotlighting the Franklin International Equity Index ETF (FLUR). Dive in to learn more about global investing.

Why invest outside of North America?

The S&P/TSX Capped Composite Index reveals a distinct Canadian market tilt towards specific sectors. As of July 31st, 2023, 31% belongs to the financial sector, largely due to the influence of Canada's "Big 6" banks and top insurance firms. Following that, the energy sector claims 17%, while industrial and materials sectors contribute 13% and 12% respectively (Source: S&P Global (NYSE:SPGI)).

This cyclical nature of the Canadian market, with its significant exposure to sectors that are highly sensitive to economic fluctuations, can translate to heightened volatility. This is especially true during economic downturns or global events impacting these industries.

Contrastingly, the U.S. market, specifically the S&P 500, as of the same date, had 28% invested in tech, dominated by giants like Apple (NASDAQ:AAPL), Microsoft (NASDAQ:MSFT), and Nvidia (Source: S&P Global). Though this tech-focus can yield significant gains, it also comes with its own set of risks, reminiscent of the 2000 Dot-Com Bubble's adverse effects.

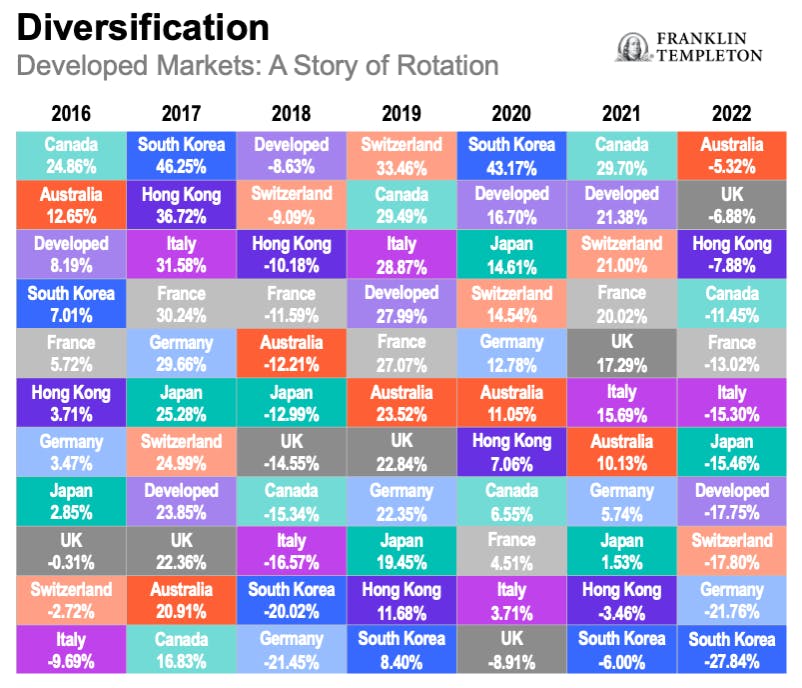

As seen below, the outperforming markets of each year historically have differed, with Canada and the U.S. leading for an extended period of time or consecutive years. This highlights the importance of looking outside North American equities, as winners rotate.

The attractiveness of developed market equities

Given these distinct concentration patterns in North America, the importance of geographical diversification in an investment portfolio becomes evident.

Investing outside of North America enables investors to tap into a wider range of industries, growth stories, and economic cycles that aren't always correlated with the Canadian and U.S. stock markets. Therefore, diversifying geographically can reduce risks associated with over-exposure to specific sectors, potentially offering smoother returns over time.

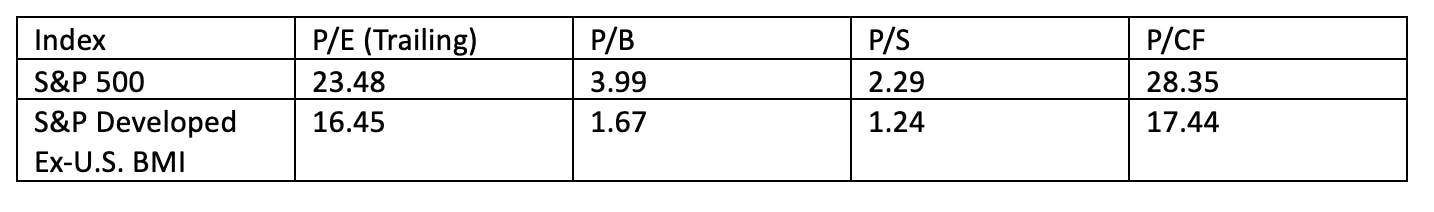

There's also the matter of lower valuations to consider. The following table compares the valuation metrics of the S&P 500 index (representative of the U.S. stock market) with the S&P Developed Ex-U.S. BMI index (representative of developed markets outside the U.S.) via four ratios: Price-to-Earnings (P/E), Price-to-Book (P/B), Price-to-Sales (P/S), and Price-to-Cash Flow (P/CF).

Source: S&P Global. Date as of July 31st, 2023.

What does all this mean for investors?

All in all, higher valuations, like those seen in the S&P 500, can sometimes signal increased risk. Overvalued markets might be more susceptible to price corrections. By diversifying into markets with lower valuations, investors might mitigate some of this risk.

The lower valuations in international developed markets might also reflect growth opportunities that haven't yet been recognized by the broader market. Investing in these markets can provide exposure to these potential growth opportunities.

Why consider FLUR?

For Canadian investors looking to broaden their horizons and tap into the opportunities of international developed markets, the Franklin International Equity Index ETF (FLUR) emerges as a possible choice. But what makes FLUR stand out amidst a sea of international funds?

At its core, FLUR boasts a passive indexing structure. Instead of trying to beat the market, it aims to mirror the performance of its benchmark index. This approach alleviates the challenges and costs associated with making constant active management decisions, thus offering a more straightforward investment path.

The benefits are twofold: simplicity in understanding what you're investing in, due to the transparent nature of passive funds, and cost efficiency. Passive funds, by virtue of their structure, often come with lower operating expenses.

Case in point, FLUR charges a management expense ratio (MER) of just 0.10%. Compared to other international developed ETFs, FLUR has the lowest management fee in Canada[1]. For the discerning investor, it's evident that a lower expense ratio can translate to substantial savings over the long haul, paving the way for potentially enhanced returns.

Another feather in FLUR's cap is its distribution yield. Clocking in at 2.32%[2] (though it's subject to change), this 12-Month yield can be a significant draw for those on the lookout for consistent income from their investments that can augment dividends from Canadian equities.

However, what truly differentiates FLUR is its portfolio composition. By tracking the Solactive GBS Developed Markets ex North America Large & Mid Cap Index, FLUR provides exposure to 880 international stocks from countries like Japan, the U.K., France, Australia, Germany, and more. Some of the most recognizable and influential in FLUR include:

- ASML Holdings: A linchpin in the semiconductor arena, it's a name that resonates powerfully in the tech sector, underpinning the world of electronics.

- LVMH (LVMH Moët Hennessy Louis Vuitton): Reigning supreme in the luxury domain, LVMH is a conglomerate whose brands define class across categories, from haute couture to premium beverages.

- AstraZeneca (NASDAQ:AZN) and Novartis AG: These pharmaceutical giants not only dominate the medical landscape but also mold it. AstraZeneca's recent endeavors, particularly its role in COVID-19 vaccine development, spotlight its global health influence.

- Toyota: Beyond being just a car manufacturer, Toyota is a testament to automotive innovation and reliability, with its vehicles being a common sight on Canadian streets.

- Unilever (LON:ULVR): This global consumer goods powerhouse touches lives daily, with its vast product range spanning essentials that cater to myriad consumer needs.

Wrapping up: Global horizons with FLUR at the helm

In the ever-changing realm of investing, diversifying beyond North America's boundaries is not just a strategy; it's a necessity.

Venturing internationally presents an avenue to mitigate risks associated with market concentration, cyclical vulnerabilities, and sector-specific downturns that might be more pronounced in North American markets.

Moreover, by embracing international equities, investors can tap into a multitude of growth stories, innovations, and value propositions that are shaping the future in different corners of the globe.

FLUR emerges as a possible vessel for this global journey. With its cost-effective passive indexing structure, competitive management expense ratio, and a promising distribution yield, FLUR offers a gateway to a diversified spectrum of global industry titans.

These aren't just any companies; they're entities like Toyota, LVMH, and AstraZeneca, which have etched their mark across the globe and continue to influence trends and consumer choices, including those in Canada.

Yet, as enticing as the international investment landscape may seem and as promising as instruments like FLUR are, it's paramount to tread with caution and diligence. Every investment carries its inherent risks.

Therefore, it's essential to delve deeper, conduct comprehensive research, and align any investment choice with one's financial goals, risk appetite, and long-term objectives.

REFERENCES

[1] Source: Morningstar Inc. as of August 18, 2023; International equity category

[2] Source: Morningstar Inc. as of July 31, 2023

This content was originally published by our partners at the Canadian ETF Marketplace.