Being a long-term investor provides individuals with the experience of participating in the expectant growth that will occur over time with a company’s maturity. Take for example Facebook (NASDAQ:META) (now Meta Platforms), which has been in existence for two decades as of February 2024 (please note: Facebook went public with its initial public offering on May 18, 2012) and has gone through many changes.

Beginning as a start-up that ushered in the ‘social media’ era, the firm has grown through acquisition over the years to become one of the most sophisticated media and digital advertising platforms, while also being among the largest companies globally by market capitalization. But Meta Platform’s growth is also reflective of a new change occurring with the company – its maturity – in that it is entering a new phase of its corporate life cycle and the value it will provide to investors now is much different than in years prior. A clear indication of this change is that Meta Platforms will now begin issuing a quarterly dividend of 50 cents per share to shareholders.

This article will showcase the importance of dividends within an investor’s total return and highlight dividend-focused ETFs that are worth consideration.

How Maturing Companies Add Value Over Time

The maturity of a company is similar in nature to that of a person, in that as people age, they develop new characteristics. Similarly, as companies age, they provide a newfound value to investors, such as a source of income via dividends. When looking at the landscape, many of the established tech companies are entering a stage of maturity that would lead them to become dividend issuers, Facebook and Salesforce being the most recent to make such an announcement.

The rationale for paying dividends is simply, rather than using cash to make an unnecessary acquisition that may have no accretive value to shareholders – the mid-life crisis yellow Lamborghini purchase – paying dividends returns value to shareholders and messages to their investor base, and broader market, that the firm is transitioning from the ‘hyper-growth’ years of the past to the ‘stable, consistent’ growth years of the present and future that come with an established firm.

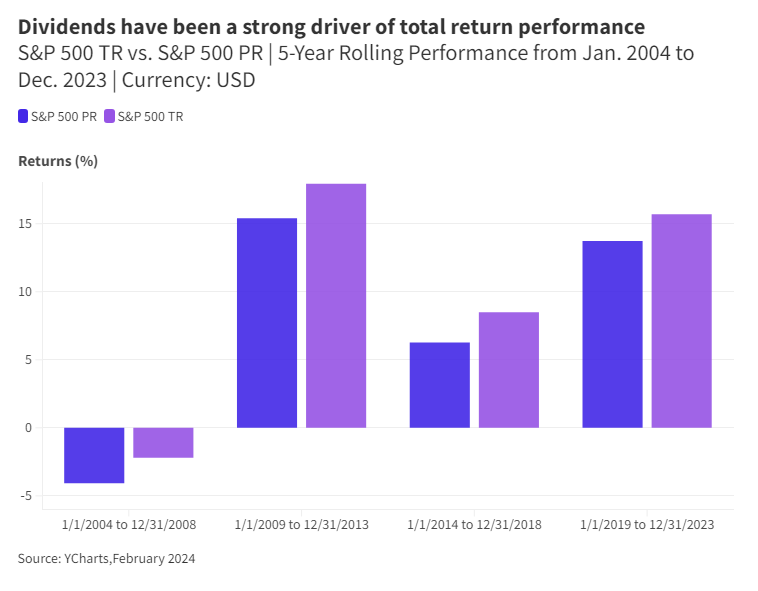

In examining the performance of the S&P 500 Price Return Index and S&P 500 Total Return Index over the past two decades, we can demonstrate the seminal importance of dividends across differing periods. As observed in the following chart, while the contributing impact of dividends does vary over each 5-year window, its additive component is unrefutably in nature.

How Dividend Policy Impacts Equity Performance

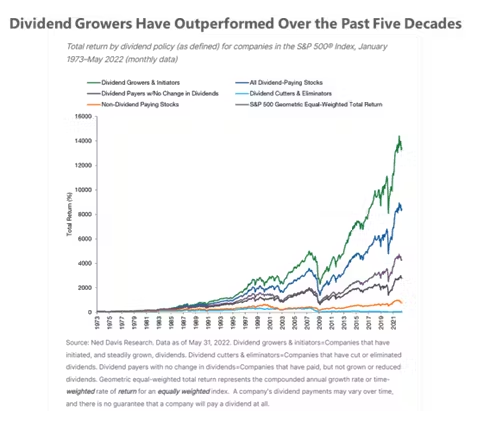

The importance of dividends in regard to total equity return performance has led to research examining the dividend policy actions taken by companies. In the US, Ned Davis Research (NDR), a global provider of independent investment research, conducted a research study to learn more about the relative performance of companies according to their dividend policies. In NDR’s study, they divided companies into two groups based on whether or not they paid a dividend during the previous 12 months; they named these two groups “dividend payers” and “dividend non-payers.”

The “dividend payers” were then divided further into three groups based on their dividend-payout behavior during the previous 12 months. Companies that kept their dividends per share at the same level were classified as “no change.” Companies that raised their dividends were classified as “dividend growers and initiators.” Companies that lowered or eliminated their dividends were classified as “dividend cutters or eliminators.” Companies that were classified as either “dividend growers and initiators” or “dividend cutters and eliminators” remained in these same categories for the next 12 months, or until there was another dividend change.

For each of the five categories (dividend payers, dividend non-payers, dividend growers and initiators, dividend non-payers, and no change in dividend policy) a total-return geometric average was calculated; monthly rebalancing was also employed.

As observed from the following chart, shares of companies that have initiated, and steadily grown dividends have outperformed companies with different dividend policies, including paying but not growing their dividend, cutting, or eliminating the dividend, or not paying a dividend at all. This long-term outperformance is attributable to the typical profile of a dividend grower: a stable business model, a strong balance sheet, a history of capital discipline, and management teams committed to returning value to shareholders.

Companies exhibiting both the willingness and ability to persistently grow their dividends have delivered value over a variety of market and economic cycles and through difficult operating environments.

How to Invest in Dividend Growers & Initiators

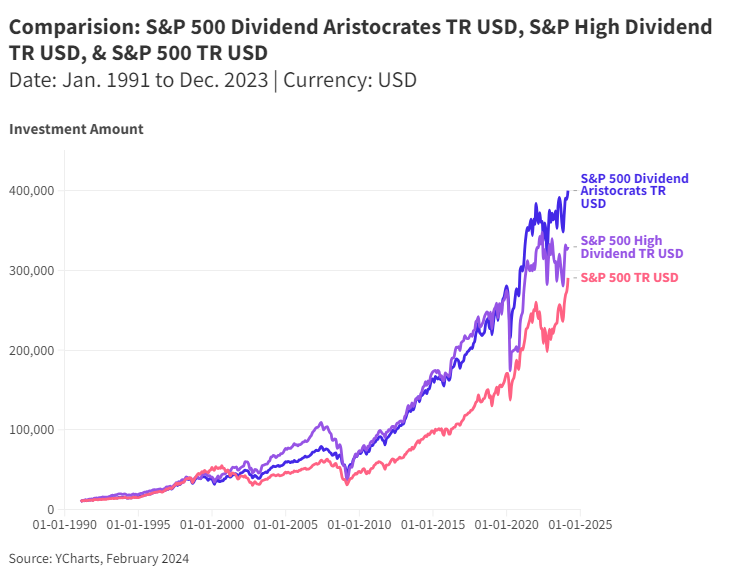

For investors interested in having concentrated exposure to companies classified as ‘Dividend Growers & Initiators, the S&P 500 Dividend Aristocrats Index is a good barometer for assessing overall performance. A Dividend Aristocrat is a company in the S&P 500 Index that has paid – and increased – its base dividend every year for at least 25 years consecutively. In looking at the long-run performance relative to the S&P 500 Index, the S&P 500 Dividend Aristocrats Index has clearly outperformed over the long term.

While some investors may choose to focus on companies that consistently grow their dividends over time, others may focus on companies that offer the highest level of dividend payout. The S&P 500 High Dividend Index reflects this ideology, as it provides exposure to the highest quintile of dividend-paying stocks in the S&P 500. While the absolute performance of focusing on high dividend equities is strong, the investment experience it provides over a long time frame is very different, as observed from the chart.

For dividend-focused investors, the message is clear, dividend growers and initiators have historically provided greater total returns with less volatility relative to companies that either maintained or cut their dividends. Furthermore, investors should only use yield as one consideration when selecting a dividend-paying investment – as a high yield does not always mean a smooth investment performance over the long run.

How to Invest in Dividend-Focused Solutions Through ETFs

For Canadian investors that have a dividend focus, there are investment solutions that provide exposure to companies specifically focused on growing their dividends over time. Provided below are solutions that have such a particular investment focus:

Bristol Gate Concentrated US Equity ETF

Bristol Gate is a Toronto-based investment manager that combines fundamental analysis with data science to identify companies with the highest predicted dividend growth over the next 12 months. Bristol Gate uses machine learning and other data science techniques in constructing portfolios aimed at reducing risk and improving returns while avoiding emotional bias in the investment process.

The Bristol Gate Concentrated US Equity (Ticker: BGU/BGU.U) is a concentrated portfolio of the highest predicted dividend growers in the S&P 500 Index. The fund has an annual dividend hurdle rate, if a portfolio company falls below the dividend hurdle rate, a full due-diligence process on the company will be triggered. For Canadian-focused firms, the Bristol Gate Concentrated Canadian Equity ETF (Ticker: BGC) also employs a similar investment methodology, selecting firms that have a history of dividend growth.

AGF Enhanced U.S. Equity Income Fund

The AGF Enhanced U.S. Equity Income Fund (Ticker: AENU) is an actively managed solution that invests in businesses with a history of a high, consistent yield and/or demonstrated dividend growth. The investment approach utilized by the manager will employ fundamental analysis and an in-depth evaluation of companies to determine their suitability as holdings within the portfolio. Central to this evaluation is assessing companies through the lens of quality, growth, and valuation investment factors. Simply put, AGF’s actively managed approach to dividend-focused investing seeks to create a high-quality solution capable of generating consistent income through varying business cycles by focusing on best-in-class, fairly valued companies.

The AGF Enhanced U.S. Equity Income Fund’s income focus is not limited solely to dividend investing, as an additive measure, the fund will also employ a dynamic option overlay strategy to generate additional income.

Dynamic Active Global Dividend ETF

The Dynamic Active Global Dividend ETF (Ticker: DXG) targets companies that are expected to initiate or grow their dividend, specifically focusing on large-cap companies, with some exposure to mid-cap companies, that are profitable, well-financed and attractively valued. Given the active investment management strategy of the manager, the fund will have a high active share that seeks to differentiate the portfolio from the MSCI World Index.

As companies mature, issuing dividends becomes a newfound avenue by which investors benefit. For investors in dividend-focused firms, the ability of the companies to grow their dividends over time has historically proven to be beneficial, as such investment solutions that have exposure to these companies are worth consideration for inclusion in one’s portfolio.

This content was originally published by our partners at the Canadian ETF Marketplace.