In two trading days, the Dow Jones Industrial Average lost more than 1,300 points and the S&P 500 fell over 5%.

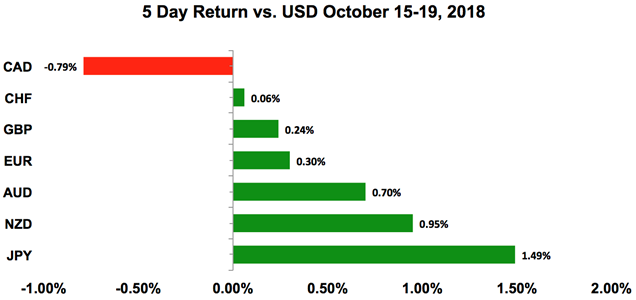

The last time there was a decline of this magnitude was in February and on the day when the UK voted to leave the European Union. Both times the declines were short-lived and with stocks rebounding on Friday, many investors are wondering if buyers will return just as quickly this time around. We’ll discuss this in further detail in the US dollar portion of our note but the sell-off in stocks last week drove the greenback lower against most of the major currencies. The biggest beneficiary was the Japanese yen, which isn’t a surprise because the yen is a safe-haven currency. However the gains in the New Zealand and Australian dollars are unusual because risk aversion tends to be negative for these currencies. There are a number of reasons why they outperformed but the main one is that investors saw the recent decline in stocks as a US dollar story and the greenback’s weakness was compounded by softer data. Looking ahead, the big question is whether the meltdown in stocks changes the course for currencies because the US dollar had a great run this year and is vulnerable to a correction.

US Dollar

Data Review

- PPI Final Demand 0.2% vs 0.2% Expected

- PPI Ex Food and Energy 0.2% vs 0.2% Expected

- PPI Ex Food Energy and Trade 0.4% vs 0.2% Expected

- CPI 0.1% vs 0.2% Expected

- CPI Ex Food and Energy 0.1% vs 0.2% Expected

- University of Michigan Current Condition 114.4 vs 115.2 Expected

- University of Michigan Expectations 89.1 vs 90.5 Expected

- University of Michigan Sentiment 99 vs 100.5 Expected

Data Preview

- Empire Manufacturing Index and Retail Sales - Potential for upside surprise given rise in Redbook retail sales and steady wage growth. Gas prices also remained steady

- Industrial and Manufacturing Production - Will have to see how Empire State fares

- Housing Starts and Building Permits - Potential for downside surprise given rising interest rates which should dampen housing activity

- FOMC Meeting Minutes - Fed minutes likely to be hawkish

- Philadelphia Fed Business Outlook - Will have to see how Empire State fares

- Trade Balance - Potential for downside surprise given a stronger dollar

Key Levels

- Support 111.00

- Resistance 114.00

The US dollar is falling because investors are looking at the decline in stocks as a US dollar story. The Federal Reserve raised interest rates by 75bp this year and is expected to tighten again in December. For next year, the market is starting to price in 3 rounds of tightening as even the dovish of doves (Fed President Evans) feel that the central bank needs to take rates 50bp above neutral. No one including the Fed really knows what the neutral rate is but earlier this month, Fed Chair Powell said we are a “long way from neutral,” which suggests that it is at least 3%, so 50bp above neutral would mean 3.5%. While getting to this rate will take some time, investors are worried that these rate hikes will create an economic crisis. We know that rising rates is a big problem for the housing market but trade wars combined with higher interest rates make businesses and investors more conservative, which could lead to lasting weakness in US equities. The past 2 years have been great for US stocks and the recent decline gives investors a good reason to lighten up on their positions. For all of these reasons, buyers may not return as quickly because US interest rates were 75bp lower in February and Brexit was viewed as the UK’s problem.

However, the meltdown in equities shouldn’t change the course for currencies because a contraction in the US economy is bad for all countries. If the sell-off in stocks is rooted in the prospect of higher US interest rates, then rising yields in the US should keep the dollar attractive. The Fed should still be the most aggressive central bank next year and for now, the signs of weakness in the US economy have been minimal. Inflation and consumer confidence surprised to the downside last week but price pressures are strong according to the Fed. The real test for the dollar comes this week when retail sales and the FOMC minutes are scheduled for release. If consumer spending is strong, the dollar should resume its rise as investors are reminded of the outperformance in the US economy. The FOMC minutes should also be hawkish. If USD/JPY extends its slide, there’s support between 111.80 and 111.25.

Euro

Data Review

- GE Industrial Production -0.3% vs 0.3% Expected

- GE Trade Balance 17.2b vs 16.2b Expected

- GE Current Account Balance 15.3b vs 16.2b Expected

- GE CPI 0.4% vs 0.4% Expected

- EZ Industrial Production 1.0% vs 0.4% Expected

Data Preview

- EZ Trade Balance and GE ZEW Survey - Stronger GE trade offset by weaker FR trade. The outlook for investor confidence is unclear

- EZ CPI - Revisions are hard to predict but changes can be market moving

Key Levels

- Support 1.1400

- Resistance 1.1700

Like many other major currencies, the euro found a bottom last week but it is too soon to declare victory for the bulls. The rally was modest, it was not supported by data and the EUR/USD rejected the 20- and 100-day simple moving averages. While the trade surplus in Germany grew, exports and imports declined while industrial production contracted. We’re beginning to see some softness in German data and that could negatively affect this week’s investor sentiment (ZEW) report. The only thing that the euro has going for it are hawkish comments from ECB officials. A number of them including Mario Draghi have been talking about the upside risks to inflation. Despite last week’s decline, oil prices have been strong and more importantly, the weaker euro drives up price pressures. This message should not be ignored because the longer the euro remains weak, the louder these comments will be. There’s also a very good chance that these hawkish views on inflation will be reinforced at this month’s central bank meeting. For the euro’s trend to turn bullish, it needs to close above 1.1630.

British Pound

Data Review

- BRC Sales Like for Like (YoY) -0.2% vs 0.1% Expected

- Trade Balance -1.274b vs -1.2b Expected

- Visible Trade Balance -11.195b vs -10.850b Expected

- Trade Balance Non-EU -4.219b vs -3.1b Expected

- Industrial Production 0.2% vs 0.1% Expected

- Manufacturing Production -0.2% vs 0.1% Expected

- GDP 0.0% vs 0.1% Expected

- Monthly GDP 3M/3M Change 0.7% vs 0.6% Expected

Data Preview

- Employment Report - Potential for upside surprise given a strong rise in services and construction jobs. Manufacturing jobs also on the rise

- Consumer Price Index - Potential for upside surprise given sharp price increases seen in services, construction and manufacturing sectors

- Retail Sales - Will have to see how wage growth fares but BRC reported a decline in spending

Key Levels

- Support 1.2900

- Resistance 1.3100

The primary focus for sterling is Brexit and data is only a distraction. Last week’s softer GDP and trade balance report had very little impact on the currency and GBP even ignored the moves in equities. Instead, it rallied at the start of the week after the EU’s Chief Brexit negotiator Barnier said they could have a deal next week and fell at the end on reports that the Prime Minister won’t agree to being trapped in a customs union. The clock is ticking and a deal is drawing close but having been burned by false hopes, investors are ignoring the conflicting headlines and waiting for official confirmation. When a deal is announced, GBP will soar but until that happens investors are skeptical. Employment, inflation and retail sales data are scheduled for release this week and while all of these are big reports, Brexit progress or setbacks will still be the primary driver of GBP flows.

AUD, NZD, CAD

Data Review

Australia

- Westpac Consumer Confidence 1.0% vs -3.0% Prior

- AU Consumer Inflation Expectation 4.0% vs 4.0% Prior

New Zealand

- GDT Prices Drop 1.9%

Canada

- Housing Starts 188.7k vs 210k Expected

- Building Permits 0.4% vs 0.5% Expected

- New Housing Price Index 0.0% vs 0.1% Expected

Data Preview

Australia

- RBA Oct. Meeting Minutes - RBA will maintain a neutral outlook

- AU Employment Report - Potential for downside surprise given weaker construction and services employment. Stronger manufacturing jobs

- Chinese GDP, Retail Sales and Industrial Production - Chinese data is hard to predict but can be very market moving. Growth should be weaker as trade tensions intensify

New Zealand

- Services PMI - Potential for downside surprise given drop in manufacturing PMI

- CPI - Potential for downside surprise as food and commodity prices fell in Q3

Canada

- Retail Sales and CPI - Stronger wholesale sales point to stronger retail sales but lower prices according to IVEY suggests weaker CPI

Key Levels

- Support AUD .7000 NZD .6400 CAD 1.2800

- Resistance AUD .7200 NZD .6600 CAD 1.3100

Next to the Japanese yen, the Australian and New Zealand dollars were the best-performing currencies last week and their moves had little to do with data. While business and consumer confidence increased in Australia, housing-market activity continued to weaken. The Reserve Bank recognized the problem by saying that the downside risks have increased due to the rise in protectionism. In New Zealand, manufacturing activity slowed and yet AUD and NZD traded well. There are 2 main reasons for this – first, AUD and NZD were the worst-performing currencies this year so the anti-US dollar sentiment was particularly positive for these oversold currencies. Secondly, on Thursday, when AUD and NZD traded sharply higher, the Chinese yuan experienced its strongest one-day gain in 5 weeks. Coming on the heels of the US’ warning against currency devaluation and the Chinese government’s promise to not weaken its currency, some investors believe that this could mark a bottom for the yuan. Although we are skeptical of these hopes, if the yuan were to bottom, it would be exceptionally positive for AUD and NZD. Looking ahead, the Australian and New Zealand dollars will be on the move next week with Chinese GDP, RBA minutes, Australian employment and New Zealand CPI scheduled for release. The downtrends for both currencies remain intact until AUD/USD rises above .7230 and NZD/USD above 66 cents.

The Canadian dollar will also be in play with retail sales and the consumer price report due at the end of the week. The loonie was the only currency that failed to benefit from the decline in the US dollar. Despite a NAFTA deal and Canadian interest rate futures showing a 94% chance of a rate hike this month, USD/CAD refused to fall. Weaker housing starts and building permits contributed to the decline but lower oil prices are the primary reason for the currency’s weakness. We still feel that USD/CAD should fall, especially after the recent decline in the greenback but next week’s economic reports may not help because the data is scheduled for Friday. If US retail sales beat, it would lift USD/CAD. Technically, last week’s rally stalled at the 100-day SMA, which would be the prime place for a reversal.