This is an exceptionally busy week in the foreign-exchange market with an economic calendar filled with market moving events outside of U.S. borders. However in the second day of trade the greenback is still dictating currency flows because now that U.S. traders are back from their summer vacations they are ready to position for the big events in the weeks ahead. There are no shortages of reasons why the dollar should be trading lower ranging from a potential North Korea nuclear crisis, the upcoming debt ceiling debacle, Friday’s surprisingly weak labor market report and the impact that it will have on the Federal Reserve’s plans for monetary policy for the rest of 2017. Even rating agency Standard & Poors’ chimed in today saying Hurricane Harvey will have near-term negative impact on data, and for this reason they don’t see the Fed raising interest rates again. Although Fed President Brainard also believes that Harvey will have a near-term negative impact on U.S. data, he feels the outlook for the labor market and growth are quite positive and therefore gradual balance-sheet normalization is needed. U.S. yields also fell sharply today, adding pressure on greenback and the latest U.S. economic reports failed to impress with factory orders falling -3.3% and durable goods confirmed to have declined by -6.8% in the month of July. It should only be a matter of time before USD/JPY tests its 4 month lows near 108.25.

Tuesday's biggest movers were the commodity currencies because of the Reserve Bank of Australia’s monetary policy announcement Monday night and the Bank of Canada’s rate decision on Wednesday. AUD/USD found its way above 80 cents after RBA Governor Lowe said lower rates would add to risk in household balance sheets. These comments actually came about 5 hours after the monetary-policy announcement, which was a nonevent for the currency. In the official RBA statement, the central bank said the higher A$ is weighing on the outlook for output and employment and while inflation is expected to pick up gradually, growth/prices may be slower than forecast if A$ rises further. Nonetheless, they believe that recent data is consistent with their forecast for a gradual pickup in growth. Monday night’s economic reports were mixed – service-sector activity slowed dramatically according to PMI but net exports of GDP rose more than expected, paving the way for a stronger Q2 GDP report. Growth in the second quarter is expected to have accelerated by 0.9%, which is significantly stronger than the 0.3% pace of growth experienced in Q1. The New Zealand dollar rose in lockstep with AUD, helped by 0.3% increase in dairy prices, the strongest increase in 3 months.

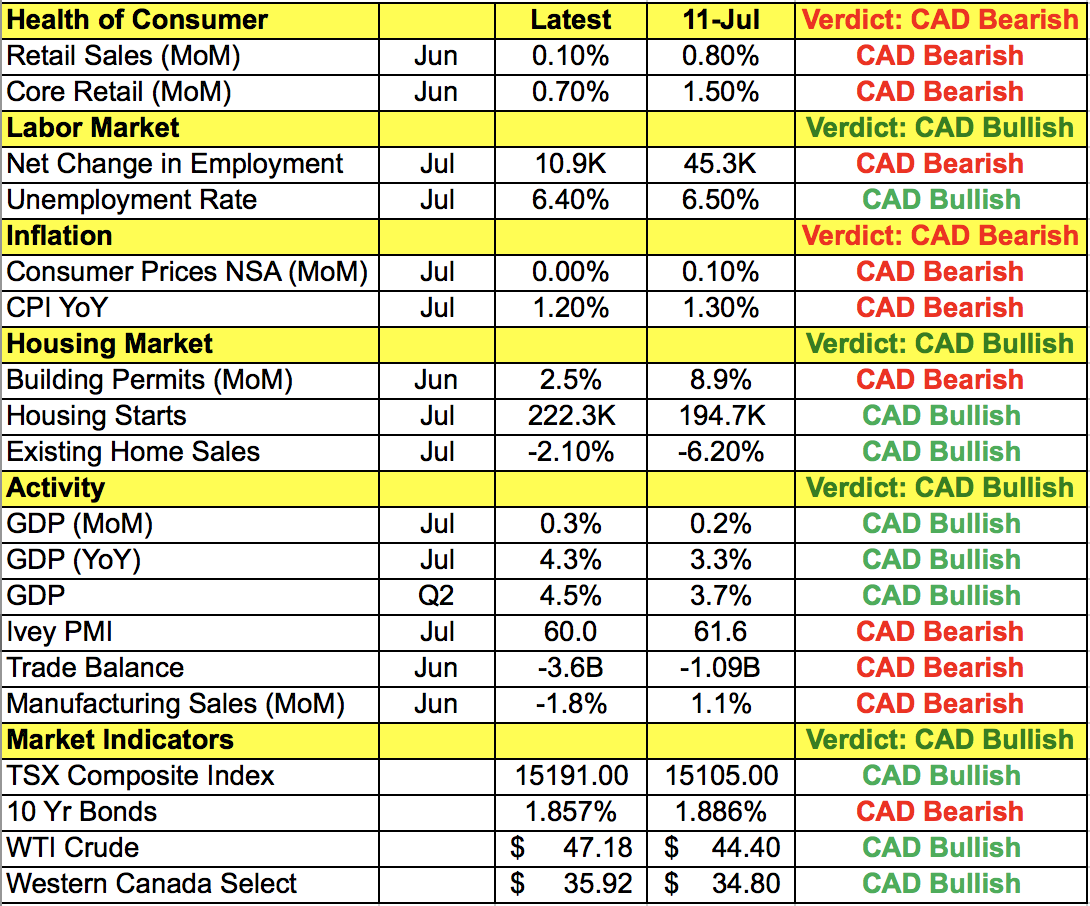

Looking ahead, the big focus will be on the Bank of Canada’s rate decision. The Canadian dollar hit fresh highs ahead of the monetary-policy announcement on the hope that the central bank will be hawkish and maybe even surprise with another 25bp rate hike. Canada is the best-performing G7 nation and according to the latest GDP report, the economy is on fire. Despite threats of the U.S. leaving NAFTA, last month’s rate hike and the recent dip in oil prices, Canada is running on all cylinders. In the month of June, Canada’s economy expanded by 0.3%, driving the quarterly GDP growth rate to 4.5% from 3.7%, yoy, the strongest pace since 2011. Even if the BoC passes on raising interest rates, the tone of the their monetary policy statement should be hawkish and that could be enough to not only drive USD/CAD to fresh 2-year lows but all the way down to 1.22 and possibly even 1.20. Until the BoC starts expressing concern about the currency, the Canadian dollar has the brightest prospects and should continue to outperform all other major currencies. Yet it is also important to realize that not every part of the Canadian economy saw improvements since the last monetary-policy meeting as shown in the table below. Retail sales growth and price pressures eased and the BoC is acutely aware of the negative impact of a rising currency. Since the July monetary-policy meeting, the Canadian dollar appreciated 4.5% versus the greenback, totaling gains of more than 10% over the past 4 months. For this reason, the BoC could err on the side of caution and if they express any concern that diminishes their hawkishness, short covering in USD/CAD could happen quickly and aggressively.

Softer-than-expected U.K. PMI numbers did not stop sterling from a making a run for 1.30. According to the latest reports, the service sector expanded at its slowest pace since September, which should be bad news for the currency but U.S. dollar weakness helped to sustain sterling’s gains. Euro on the other hand lagged behind its peers. Like the U.K., Eurozone data was weaker than expected with Eurozone PMIs revised lower in August and retail sales falling -0.3% in July. The European Central Bank meets on Thursday and it will be difficult for the currency to rally ahead of the event as investors worry that the strong currency will prevent the central bank from announcing any changes in policy. However the euro’s weakest performance will be against other currencies and not the U.S. dollar, which is struggling with its own troubles. We continue to see EUR/GBP headed for 90 cents and EUR/AUD headed for 1.4750.