Following DoorDash’s (NASDAQ:DASH) recent earnings release, the company continues to strengthen its position in the food delivery and broader local commerce markets. When I last wrote about DoorDash in October, the stock was trading at $142 per share. Since then, shares have soared 50%, reaching my previous price target. But this rally hasn’t been speculative it has been backed by strong financial performance and strategic execution.

DoorDash is expanding its ecosystem, diversifying into new verticals, and solidifying its role as a merchant technology partner. The latest earnings report reinforces these themes while unveiling new growth drivers and financial resilience.

In this article, I’ll take a closer look at DoorDash’s financial performance, future guidance, key strategic focus areas, and valuation.

Financial Performance: A Closer Look at Q4 ResultsDoorDash’s integrated platform benefits merchants, consumers, and Dashers, creating strong network effects. The company now boasts 42 million monthly active users (MAUs) and 22 million DashPass subscribers, further strengthening its market position.

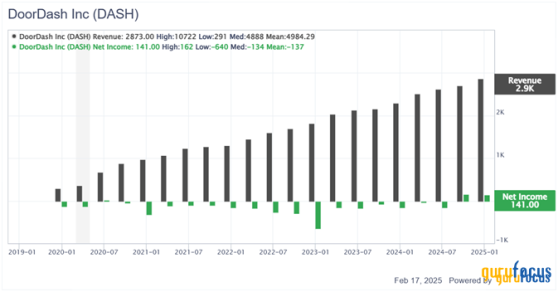

Source: Gurufocus

Fourth-quarter revenue grew 25% year-over-year (YoY) to $2.9 billion, driven by a 19% YoY increase in total orders and a 21% YoY rise in marketplace gross order volume (GOV). Revenue outpaced GOV growth primarily due to higher advertising revenue contributions, which has been a key driver of margin expansion over the past year. Merchants are competing for visibility, turning ads into a high-margin, recurring revenue stream and I would expect this trend to continue as merchants strive to remain at the top of the stack.

In fact, in January 2025, DoorDash announced a strategic partnership with The Trade Desk (NASDAQ:TTD), aiming to enhance advertising precision, transparency, and scalability for brands. This partnership allows brands to leverage DoorDash’s first-party data with The Trade Desk’s programmatic ad-buying technology, making ad targeting more effective and measurable. The better the targeting, the more advertisers will be willing to allocate ad spend to DoorDash’s platform.

I believe the real potential lies in how DoorDash can leverage artificial intelligence to enhance its strategy. With billions of deliveries completed and millions of customers in its system, the company has an enormous dataset that could be used to personalize customer experiences and optimize ad targeting. If DoorDash executes this correctly, it could unlock significant long-term value by improving both customer engagement and advertising efficiency.

Despite its strong market position, DoorDash still has substantial untapped potential within its ecosystem. Over 100 million customers place orders annually, yet only 22 million subscribe to DashPass. That leaves a huge opportunity to convert casual users into loyal subscribers. Management is actively working on enhancing DashPass’s appeal, aiming to increase adoption and improve customer retention. If successful, this could significantly boost customer lifetime value and recurring revenue.

Source: Author based on Business of Apps

Despite holding a 67% market share in the US, DoorDash continues to gain traction internationally, reaching record-high international MAUs. Order frequency continues to rise across key markets, showing growing consumer reliance on the platform. However, despite strong growth, I believe we’re still in a challenging macroeconomic environment. Many restaurants have reported slowing same-store sales, and while there have been some interest rate cuts, we are still in a high-interest-rate environment, which continues to pressure consumer spending. This has led some consumers to dine out less frequently, prioritizing budget-conscious decisions, presenting a near-term headwind.

Despite these headwinds, DoorDash has reached an inflection point. The company achieved a significant milestone in 2024 by reporting its first full year of GAAP profitability. This is the second consecutive quarter of GAAP profitability, with net income for the quarter at $141 million, bringing the full-year profit to $123 million. After years of focusing on growth, DoorDash has proven it can deliver profitability while continuing to scale.

Finally, from a balance sheet perspective, DoorDash remains in excellent shape, with $5.3 billion in cash and short-term investments and no debt. This strength provides the company with liquidity to fund future growth initiatives while continuing to increase free cash flow (FCF). The company grew its quarterly FCF by 6% YoY and 34% from 2023 to 2024. However, dilution remains a factor, with the share count growing 8% YoY. This trend will likely continue, but management is actively working to minimize its impact. In February 2025, the company authorized a $5 billion share repurchase program, signaling its commitment to offset dilution and enhance shareholder value over time.

Looking ahead, DoorDash expects marketplace GOV to grow between 17% and 20%, reaching a midpoint of $22.8 billion in the first quarter of 2025. If the company can maintain its take rate of around 14%, revenue could grow by 27% to approximately $3.2 billion. Additionally, management has projected adjusted EBITDA to range between $550 million and $600 million, demonstrating continued improvements in unit economics and operational efficiency. Free cash flow is also expected to expand further, providing more capital to reinvest in core businesses and new growth opportunities.

ValuationWhen I wrote about DoorDash in my previous article, the valuation was more attractive. The stock has appreciated significantly, and while the company continues to execute well, it’s important to reassess whether there’s still room to run.

Source: Author

DoorDash trades at a trailing 12-month P/S ratio of 8.4x and a forward P/S of 6.9x. The forward price-to-earnings ratio stands at 45x and the price-to-FCF stands at 44.2x. These multiples are notably higher than those of competitors like Uber (NYSE:UBER) and InstaCart (NASDAQ:CART), but investors are willing to pay a premium for DoorDash’s market dominance and higher revenue growth potential.

Using a discounted cash flow analysis that incorporates both a multiple-based approach and a perpetuity growth model, I estimate a fair value of $245 per share, suggesting a potential upside of around 15% from current levels. While this implies some remaining upside, the stock is no longer the bargain it was a few months ago.

Source: Author

ConclusionDoorDash’s latest earnings reaffirm its strong fundamentals and continued growth trajectory. But beyond the numbers, the real story lies in the company’s ability to evolve. Its expansion into new verticals like grocery and retail, its transition into a broader commerce and advertising platform, and the ongoing monetization of its ecosystem through DashPass and retail media all position it as a long-term winner.

For investors, the big question is whether the valuation still presents an opportunity. The stock has gained momentum, and at these levels, it’s fair to say it’s no longer undervalued. However, for those with a long-term perspective, I still see potential. If DoorDash continues to scale efficiently, drive subscription growth, and further integrate advertising, there is room for further appreciation.

As a long-term investor, I believe DoorDash is positioning itself as a dominant force in local commerce, and that makes it a compelling stock to own.

This content was originally published on Gurufocus.com