Markets eased back from their weekly highs last week on declining volume, but has been a fairly orderly move lower. Support levels are there for indices to lean on.

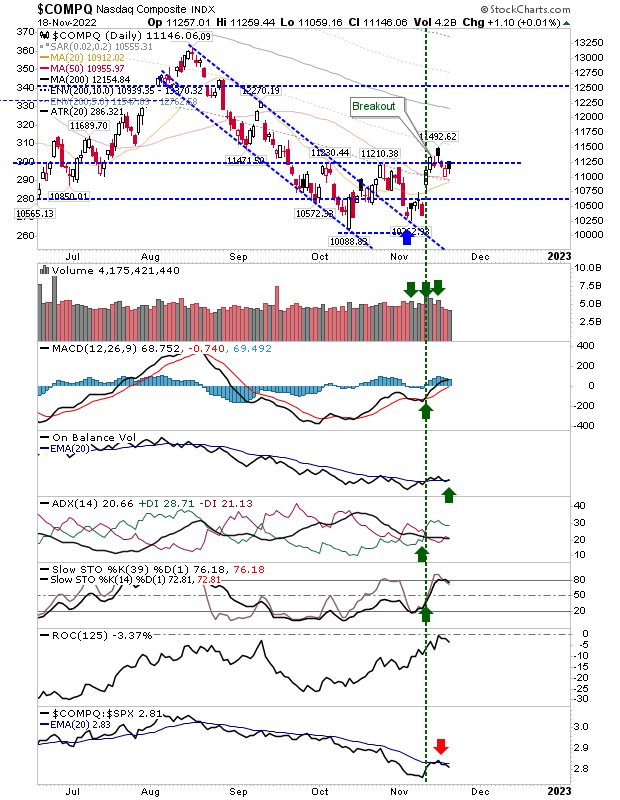

The Nasdaq has its 50-day MA alongside its 20-day MA to use as support. The 'black candlestick' is typically a bearish one-day candle, but as it's not positioned as a swing high it carries less weight. Technicals are net positive, although there is a return to underperformance against the S&P 500. An ideal candlestick would be a gravestone 'doji' or a bullish hammer as an end point to this decline.

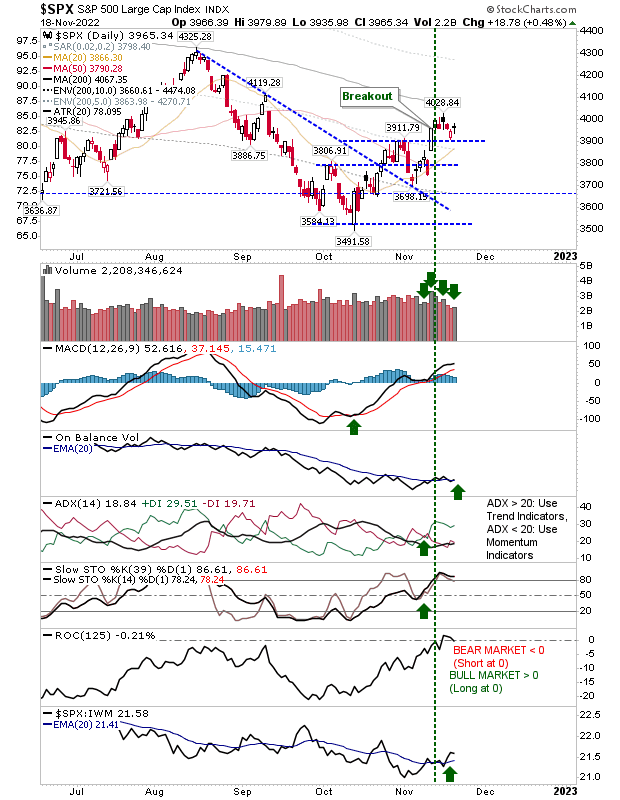

The S&P is lingering just below its 200-day MA and above the October swing high. Volume climbed to register as an accumulation day, and the sequence of recent buying days was enough to generate a 'buy' trigger in On-Balance-Volume.

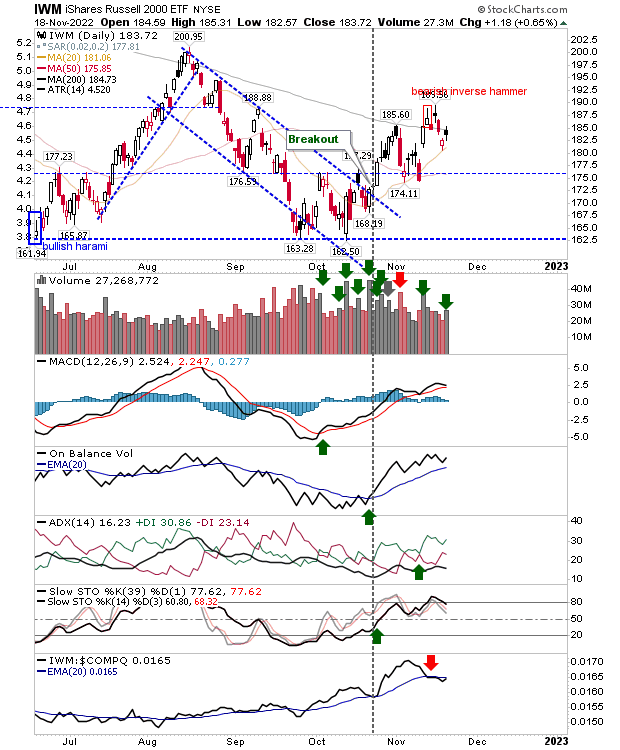

The Russell 2000 returned to its 200-day MA, and is running along 20-day MA support. After a strong period of outperformance relative to the Nasdaq the relationship has flat-lined, but other technicals are net bullish. The squeeze of the 200-day and 20-day MAs may be the catalyst for the next move.

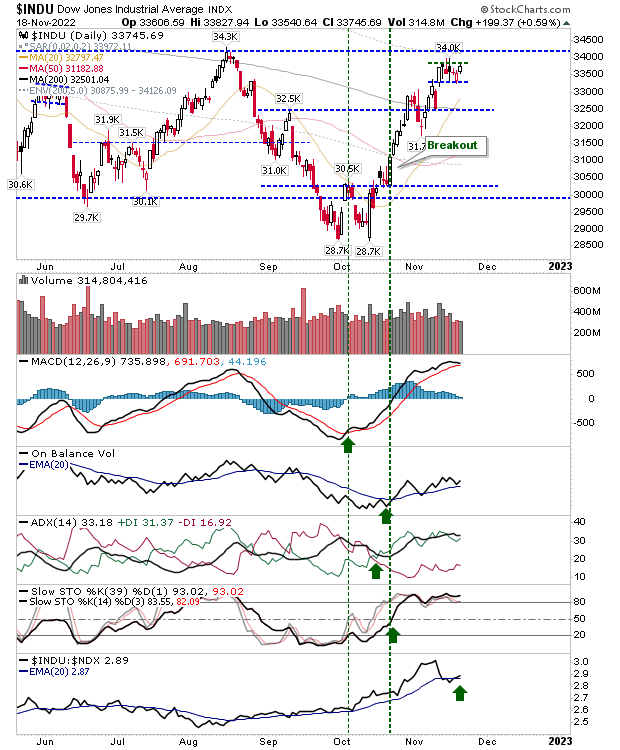

The index which is enjoying the best performance is the Dow Jones Industrial Average. It has shaped a nice handle just below the August swing high and is set up for a significant breakout. Technicals are net bullish with an improving trend in on-balance-volume accumulation.

In the grand scheme of things, Friday's action was generally positive. The Dow Jones Industrial Average looks like it will lead the indices out and I would be looking for the S&P to soon follow suit.