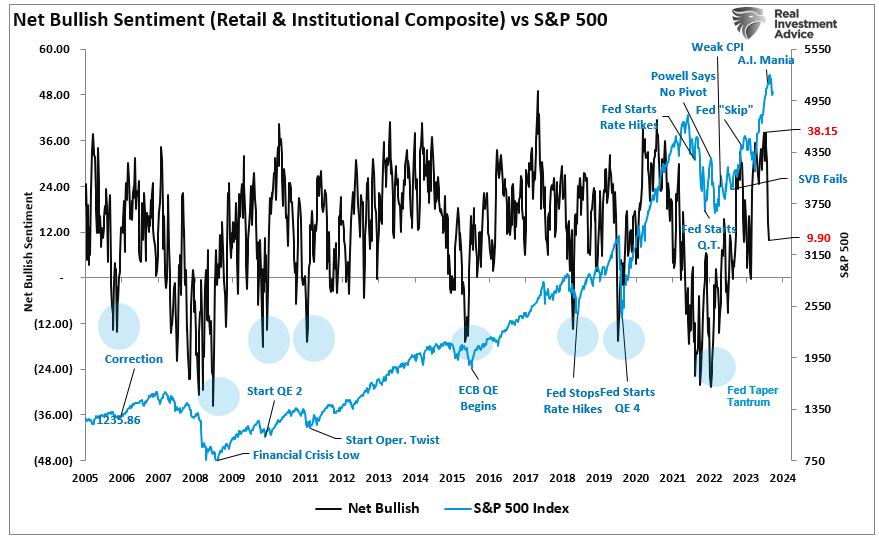

Over the last two weeks, the bullish sentiment index has reversed from extreme greed to fear. The composite net bullish sentiment index, comprised of professional and retail investors, fell from 38.15 to 9.9 in two weeks. The previous drop between July and October last year was similar and marked the bottom of the S&P 500 correction.

While the bullish sentiment index can indeed fall further, what is notable is the sharp reversal of market “exuberance” in such a short span. However, as discussed in “Just A Correction,” there was a significant gap between buyers and sellers.

“However, at some point, for whatever reason, this dynamic will change. Buyers will become more scarce as they refuse to pay a higher price. When sellers realize the change, they will rush to sell to a diminishing pool of buyers. Eventually, sellers will begin to “panic sell” as buyers evaporate and prices plunge.”

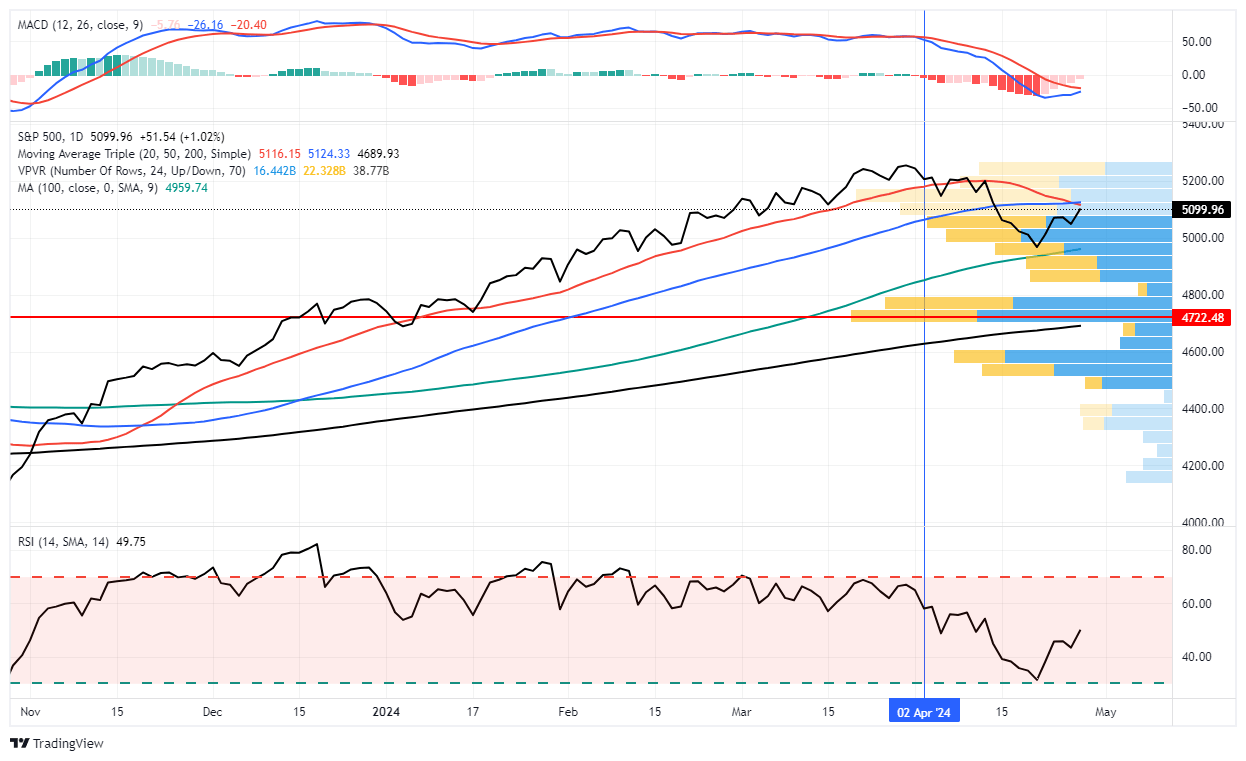

Like clockwork, that correction came quickly, with the market finding initial support at the 100-DMA. With solid earnings from Alphabet (NASDAQ:GOOG) and Microsoft (NASDAQ:MSFT), the market rallied to initial resistance at the convergence of the 20- and 50-DMA. It would be unsurprising if the market failed this initial resistance test and ultimately retested the 100-DMA soon. Such a pullback would solidify that support and complete the reversal of the bullish sentiment index.

In early April, we wrote:

“Whatever trigger causes a reversal in the bullish signals, we will act accordingly to reduce risk and rebalance exposures. But one thing is sure: investor sentiment is extremely bullish, which has almost always been a good “bearish signal” to be more cautious.

While we have warned of a potential correction over the past few weeks, it reminds us much of June and July last year, where similar warnings for a 10% correction went unheeded. We are now seeing many individuals ‘jumping into the pool’ in some of the most speculative areas of the market. Such is usually a sign we are closer to a market peak than not. As such, we want to make adjustments before the correction comes.”

Very quickly, as supported by the bullish sentiment index, those bulls are turning bearish and are now calling for a more profound decline. While such is possible, I suspect most of this correction is complete for two reasons.

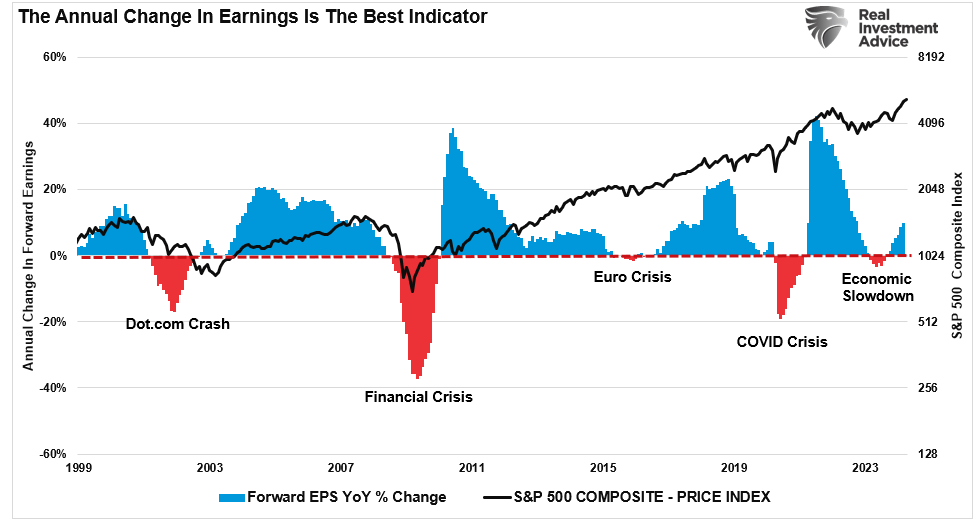

Earnings Continue to Remain Strong

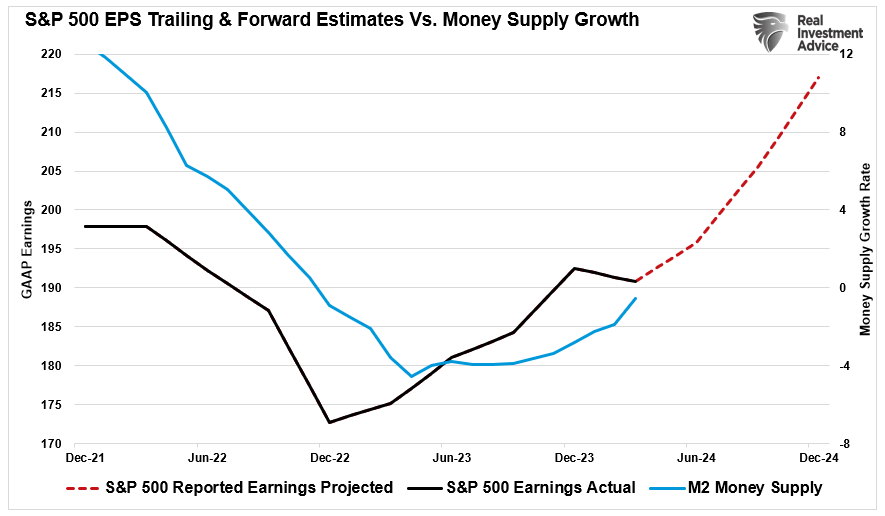

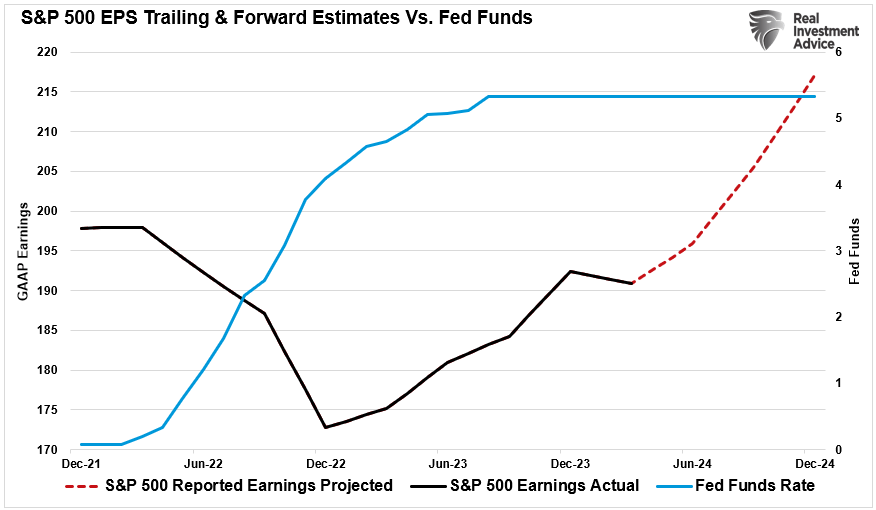

The first reason is that despite higher interest rates, earnings growth continues to remain robust, at least among the “Magnificent 7,” where Google (GOOG) and Microsoft (MSFT), in particular, exceeded estimates by a wide margin. However, overall, and most importantly, earnings growth has continued since the October lows of 2022. Notably, the support for improving earnings comes from the increased fiscal policies such as the Inflation Reduction Act and CHIPS Act.

While those policies will eventually fade, making forward estimates subject to downward revisions, the current earnings environment remains relatively robust. Furthermore, forward estimates remain optimistic that the Federal Reserve will cut rates later this year, lowering borrowing costs and supporting economic activity.

Notably, the increase in earnings, at least for now, remains a strong indicator of rising asset prices. The risk of a deeper market correction (greater than 10%) is significantly reduced during previous periods of improving earnings. While such does not mean a deeper correction can not happen, historically, corrections between 5% and 10% in an earnings growth environment tend to be buying opportunities and limit deeper reversal in the bullish sentiment index.

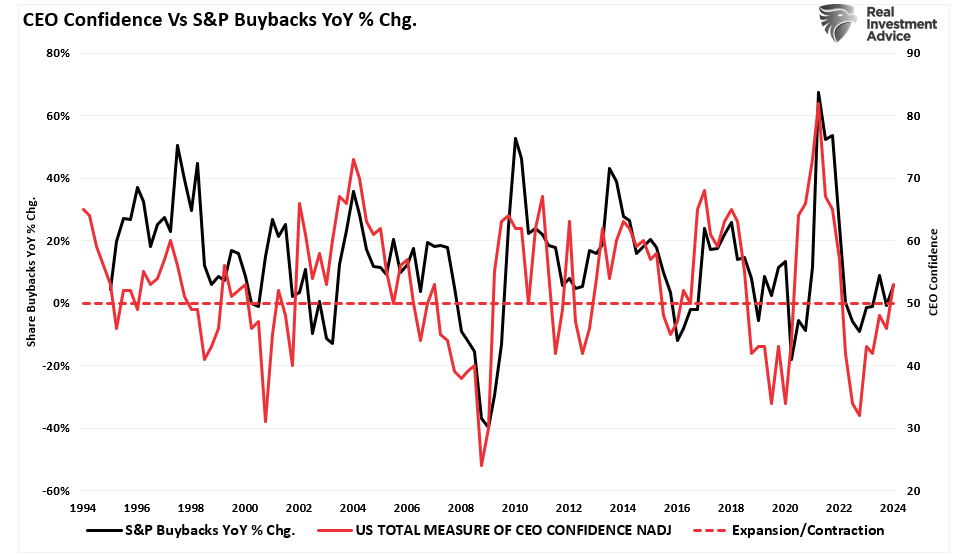

Improving earnings also precedes improving CEO confidence, which has provided pivotal support to financial markets since 2000.

Buybacks Returning

We discussed the most critical reason we expected a market correction in mid-March. To wit:

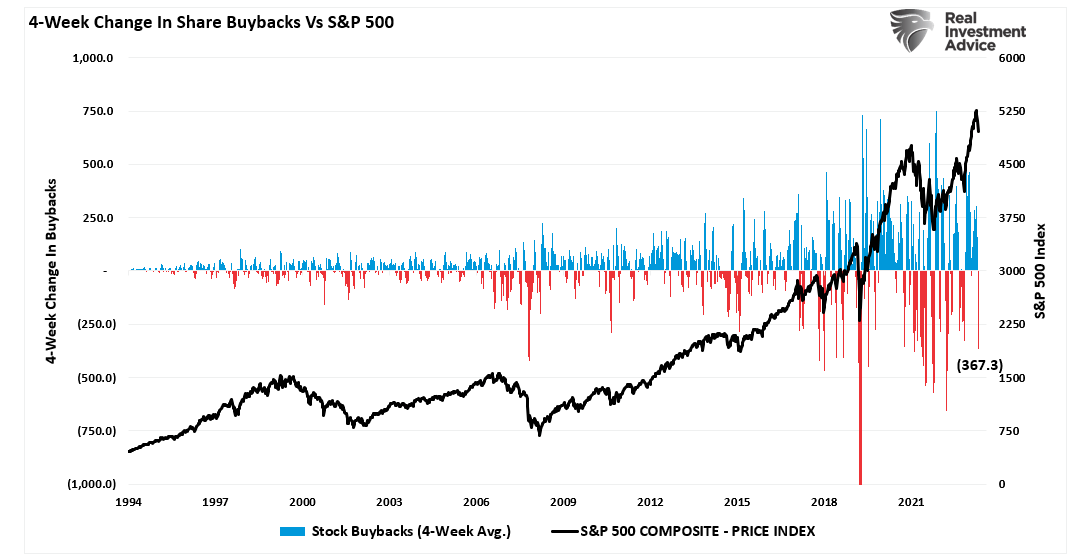

“Notably, since 2009, and accelerating starting in 2012, the percentage change in buybacks has far outstripped the increase in asset prices. As we will discuss, it is more than just a casual correlation, and the upcoming blackout window may be more critical to the rally than many think.” – March 19, 2024

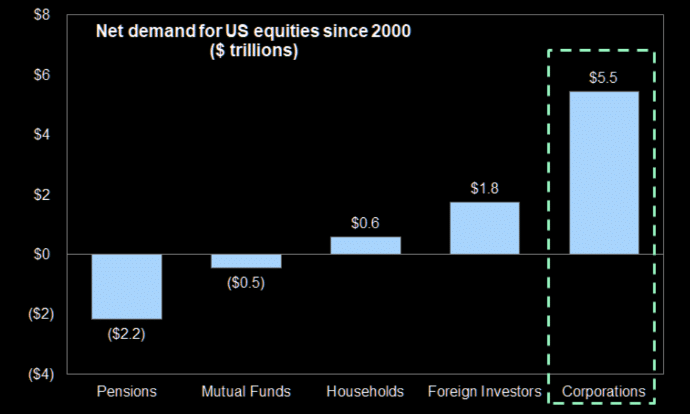

Furthermore, the “blackout” of corporate buybacks coincided with more extreme readings in the bullish sentiment index. Buybacks are crucial to the market because corporations have accounted for roughly 100% of net equity purchases over the last two decades.

Here is the math of net flows if you don’t believe the chart:

- Pensions and Mutual Funds = (-$2.7 Trillion)

- Households and Foreign Investors = +$2.4 Trillion

- Sub Total = (-$0.3 T)

- Corporations (Buybacks) = $5.5T

- Net Total = $5.2 Trillion = Or 100% of all equities purchased

Unsurprisingly, that blackout window coincided with a sharp contraction of more than $367 billion in buybacks over the last 4-weeks. Consequently, when you remove a critical “buyer” from the market, the ensuing correction is unsurprising.

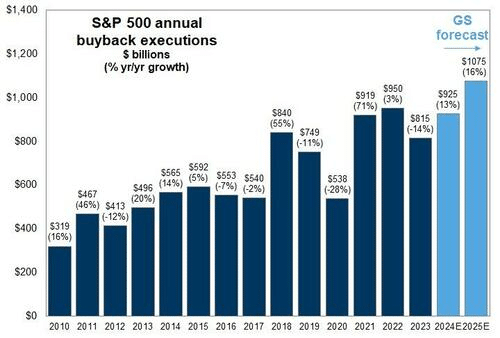

However, corporate share buybacks will resume in the next couple of weeks, and with more than $1 trillion slated for 2024, many buybacks remain to complete. Such is particularly the case with Google (NASDAQ:GOOGL) adding another $70 billion to that total.

As noted above, improving earnings and a decent outlook for the rest of this year also boost CEO confidence. (If you don’t understand why buybacks benefit insiders and not shareholders, read this.) With robust economic activity supporting earnings growth, that improvement boosts CEO confidence. As CEOs are more confident about their business, they accelerate share buybacks to increase executive compensation.

The liquidity boost from buybacks and stronger earnings will likely provide a floor below the market. This doesn’t mean the current correction doesn’t have more work to do. However, it is unlikely that it will resolve into something more significant.

At least for now.