It really requires nerves of steel to be an investor in Tesla (NASDAQ:TSLA). Thanks to Elon Musk, its unpredictable and casual CEO, the company is always in the grip of speculation and uncertainty.

The latest episode to hit the shares of the electric car-maker was Musk’s Twitter survey last weekend, asking his followers whether he should sell 10% of his stake in the company.

After getting a positive response from about 60% of his followers, Musk sold about $5 billion of his stake in Tesla by Thursday morning, according to regulatory filings. While that happened, Tesla investors had to face a steep bout of selling pressure in the shares, which lost about 13% of their value this week.

Without going into the real motives of Musk’s share sale, the current sell-off, in our view, offers an opportunity for investors to think whether this is a good time to take some money off the table after a remarkable run.

Even after accounting for this week’s losses, Tesla is up more than 50% this year. Shares closed yesterday at $1,063.51. The stock has a history of going through steep corrections every now and then before resuming its upward journey.

Just A Blip

Tesla’s most ardent supporters believe that the current sell-off is just a blip. According to Cathie Wood, who runs her high-performance ARK Innovation ETF (NYSE:ARKK), Tesla is on its way to reach $3,000 in five years.

In a Bloomberg interview at the Dynasty Financial Partners’ 2021 Investments Forum, Wood said:

“Of course the momentum players turned tail as soon as the stock reacted to that news and followed it down. For us, we have been taking profits on the way up and receiving a lot of criticism for it, and for us this is nothing but a blip.”

Jefferies analyst Philippe Houchois hiked his price target on Tesla to the Street high of $1,400 from $950, saying in a note to clients on Monday that the automaker’s recent strength suggested it would continue to be a major player even as the legacy automakers ramp up their electric car output.

His note said:

“With an acceleration of self-funded growth in Q3 and unheard-of returns at a brand price point moving towards volume segments, Tesla looks more scaled up today than most OEMs and in position to turn the Legacy zero-sum-game into a negative one.”

Amid these bullish calls, there are also concerns about extreme valuations in the whole EV sector. Rivian Automotive (NASDAQ:RIVN) raised $11.9 billion on Wednesday in the biggest initial public offering of the year. The stock opened 37% above its IPO price, even though the venture, backed by Amazon’s founder Jeff Bezos, lost almost $1 billion in the first half.

Tesla trades at about 14.8 times 2022 sales, much higher than the S&P 500’s 2.85 times, according to Bloomberg data.

In recent months, some EV stocks have gone through an extreme bout of selling pressure. Nikola (NASDAQ:NKLA) and Lordstown (NASDAQ:RIDE), for example, had shed about 80% from their 2020 peaks.

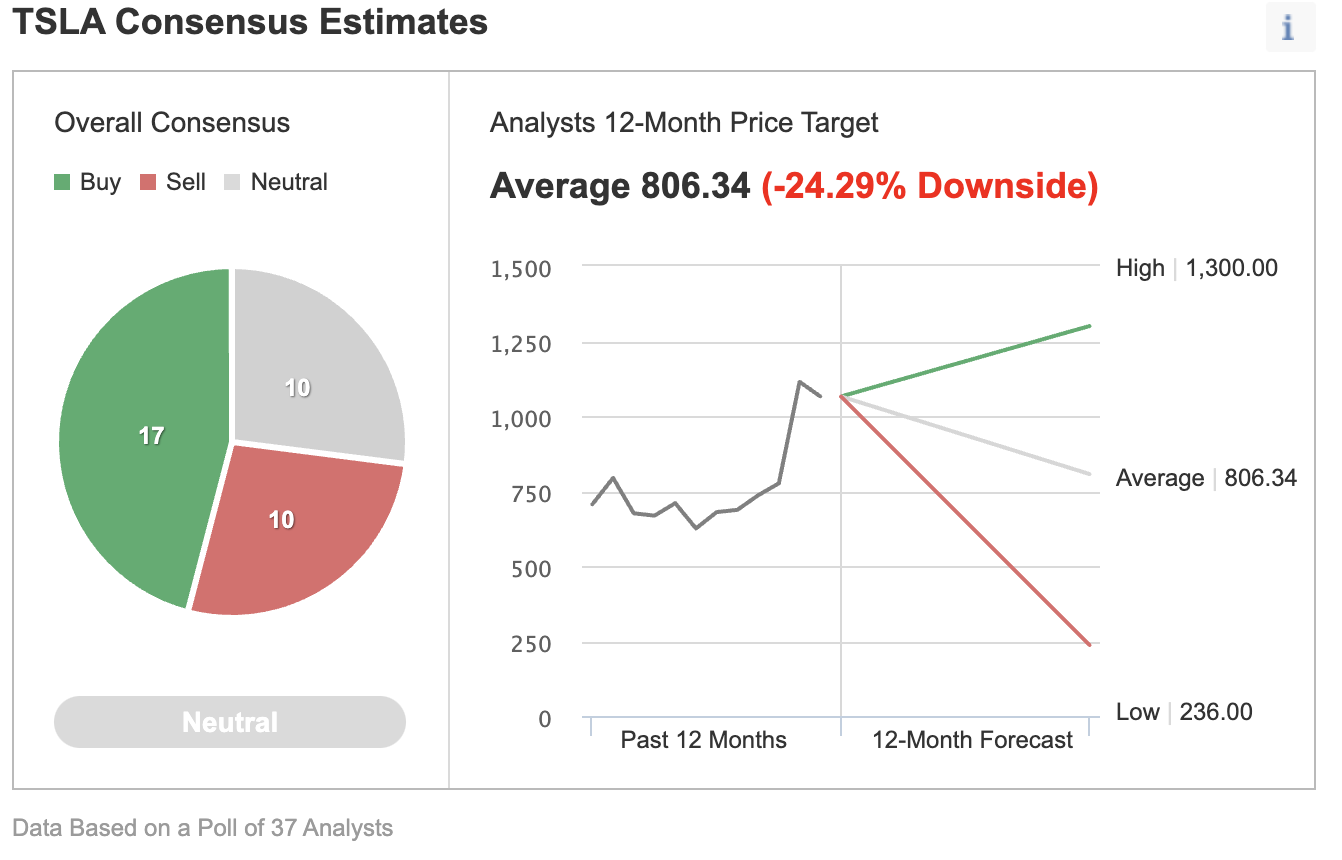

An Investing.com survey of 37 analysts show that 17 have a buy rating on Tesla, while 10 have a sell rating and other 10 are neutral, with a 25% downside potential in the stock during the next 12 months.

Bottom Line

Tesla, despite its massive lead in the EV market, continues to remain a highly speculative stock with no space to make a mistake due its rich valuations. After a highly impressive rally of 2021, it makes sense to take some money off the table before the stock goes through another bearish spell.