While most readers are focused on the precious metals, I’ve been waiting patiently for two other sectors to set up a long-term buy signal which I believe happened last week. I know you are well aware of my mantra that big consolidation patterns lead to big impulse moves. What’s pretty amazing is these 2 sectors have an almost identical long-term consolidation pattern and are breaking out at the same time. It stands to reason that if the Emerging Markets are going to be strong then the Basic Materials sector should benefit as well.

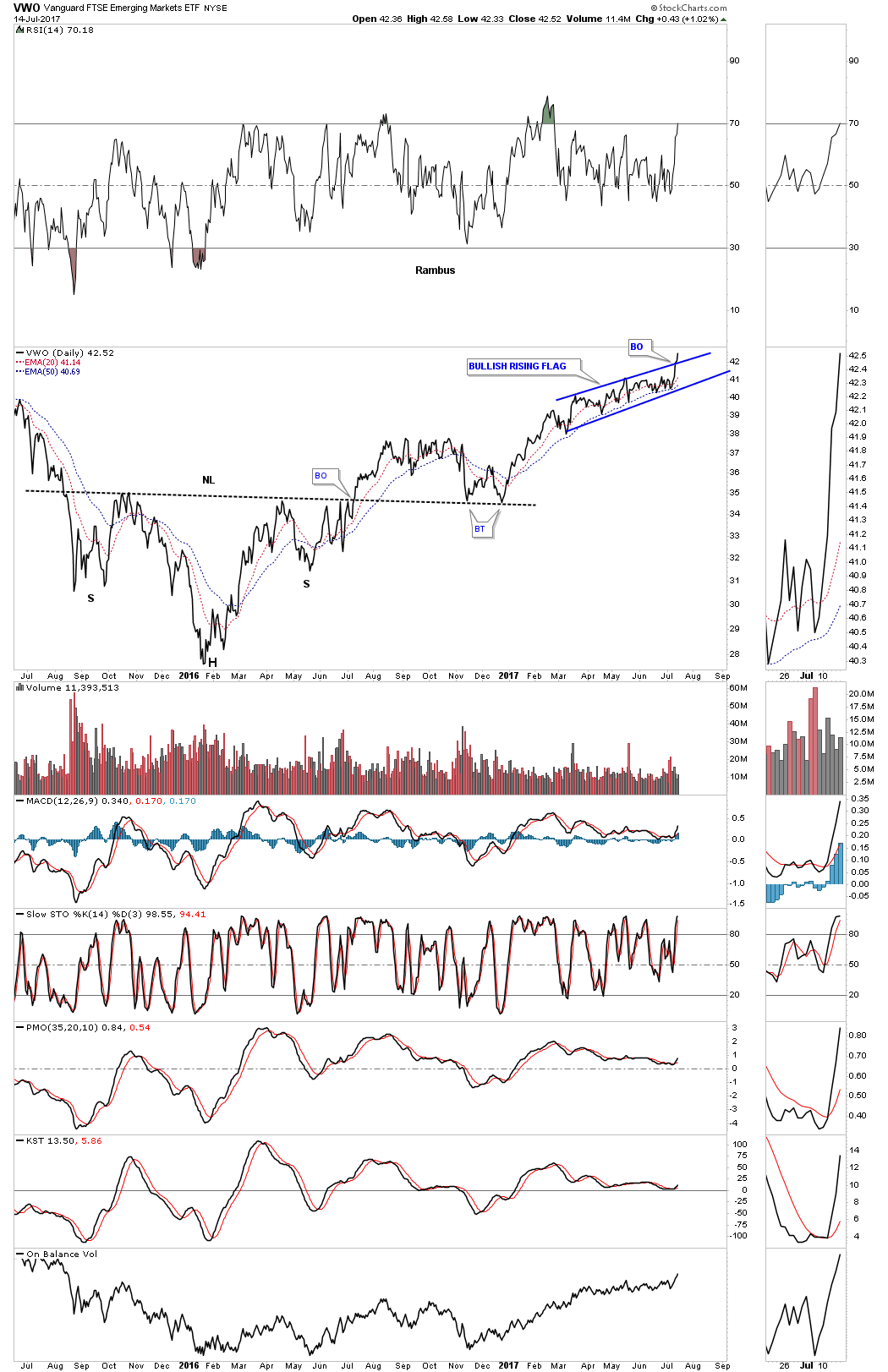

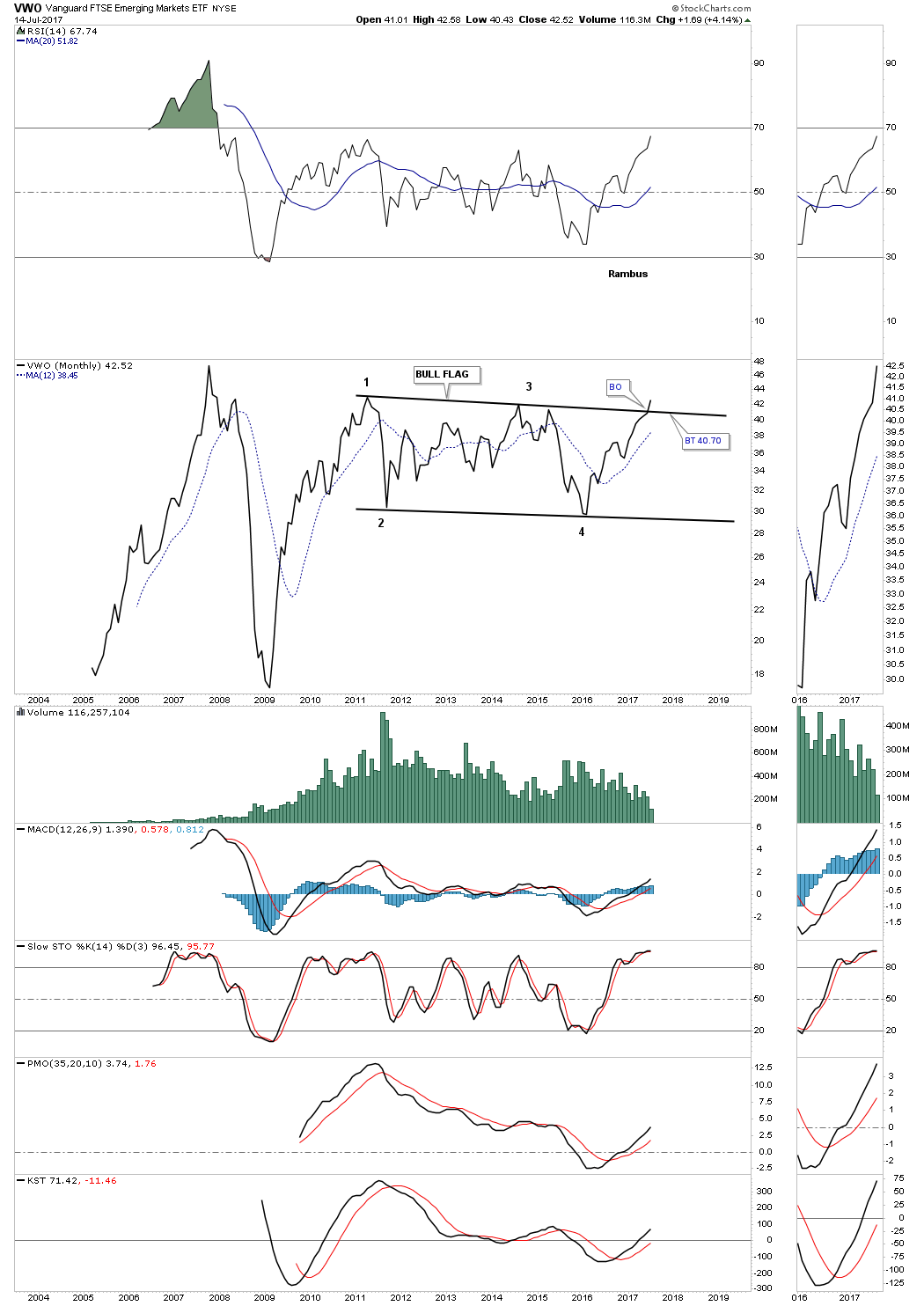

Most like to look at the iShares MSCI Emerging Markets ETF (NYSE:EEM), the emerging market index, but there is another emerging market index which trades with much more volume, Vanguard FTSE Emerging Markets (NYSE:VWO) which I will use in this post. Let's start with just a simple daily line chart for VWO which shows a H&S bottom in place and a breakout Friday of the blue bullish rising flag. Keep those two patterns in the back of your mind when we look at the longer term charts.

Below is a 5-year weekly bar chart which shows a double H&S bottom with the breakout of the blue bullish rising flag from Friday, which has formed just below the important overhead resistance zone. There are two things the blue bullish rising flag is suggesting: first these types of patterns form in strong moves and second it is forming just below important overhead resistance.

We’ve studied this set-up many times in the past which states, when you have a small consolidation pattern form just below important overhead resistance, it usually leads to a breakout. The small consolidation pattern builds up the energy needed for the final breakout move.

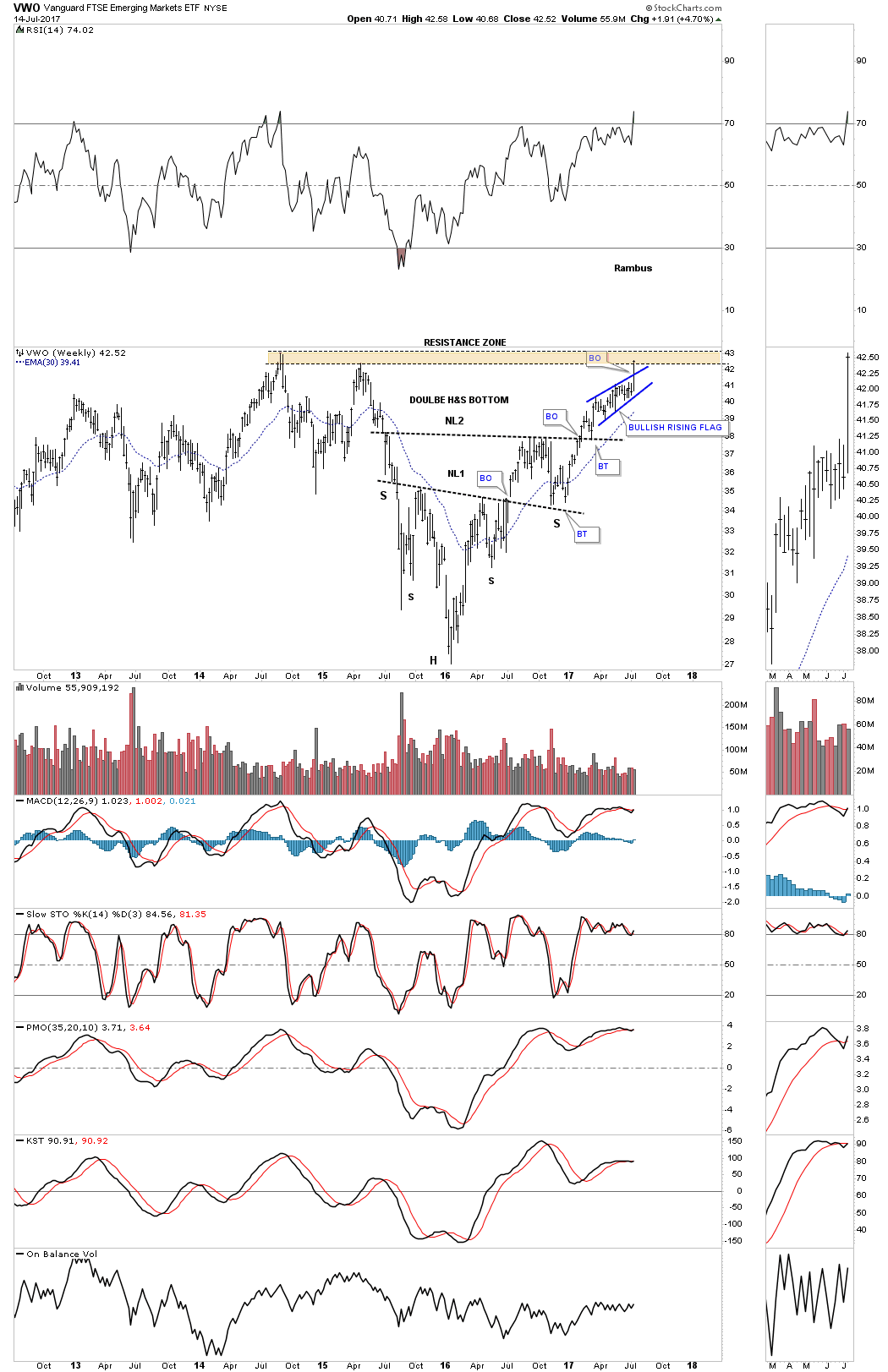

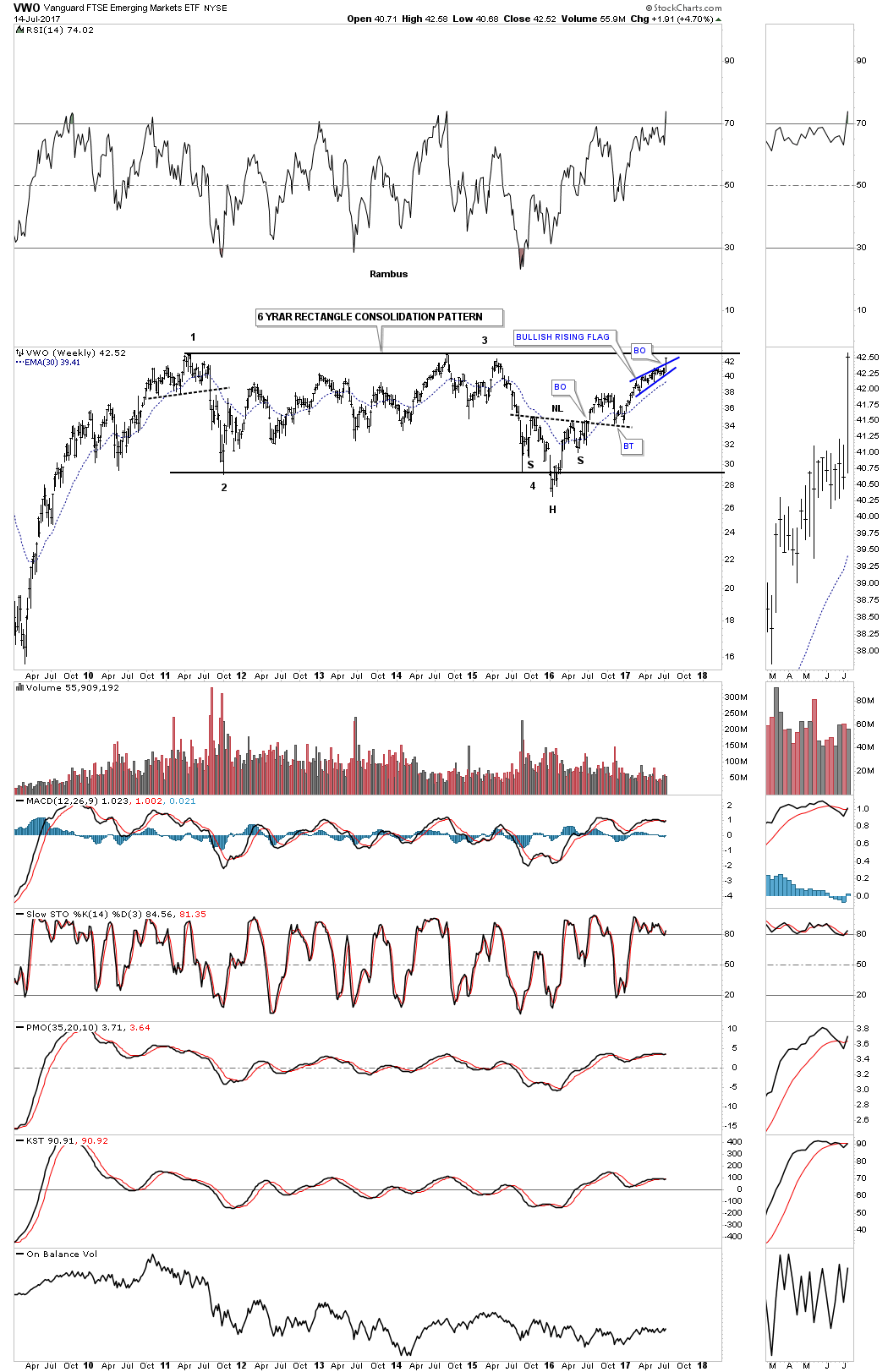

Now I would like to show you the long term weekly chart for the VWO so you can see the 6-year rectangle consolidation pattern that has been building out. Note how the blue bullish rising flag has formed just below that 6-year top rail of the rectangle consolidation pattern. If there was ever a place to see one of these types of bullish patterns build out, this is it.

As you can see on the weekly chart above, the breakout hasn’t actually happened yet. Most chartists don’t like to use line charts, but they can be a very useful tool to have in your toolbox. Another lesson I’ve shown in the past is how a line chart can often signal a breakout before you might see it on a bar chart.

Keep in mind a line chart just uses the closing price whether it be a daily, weekly or monthly chart. Below is a monthly line chart which shows the breakout taking place. A backtest would come in around the 40.70 area on a monthly closing basis. The bottom line is that we want to see the price action close the month of July above the top rail.

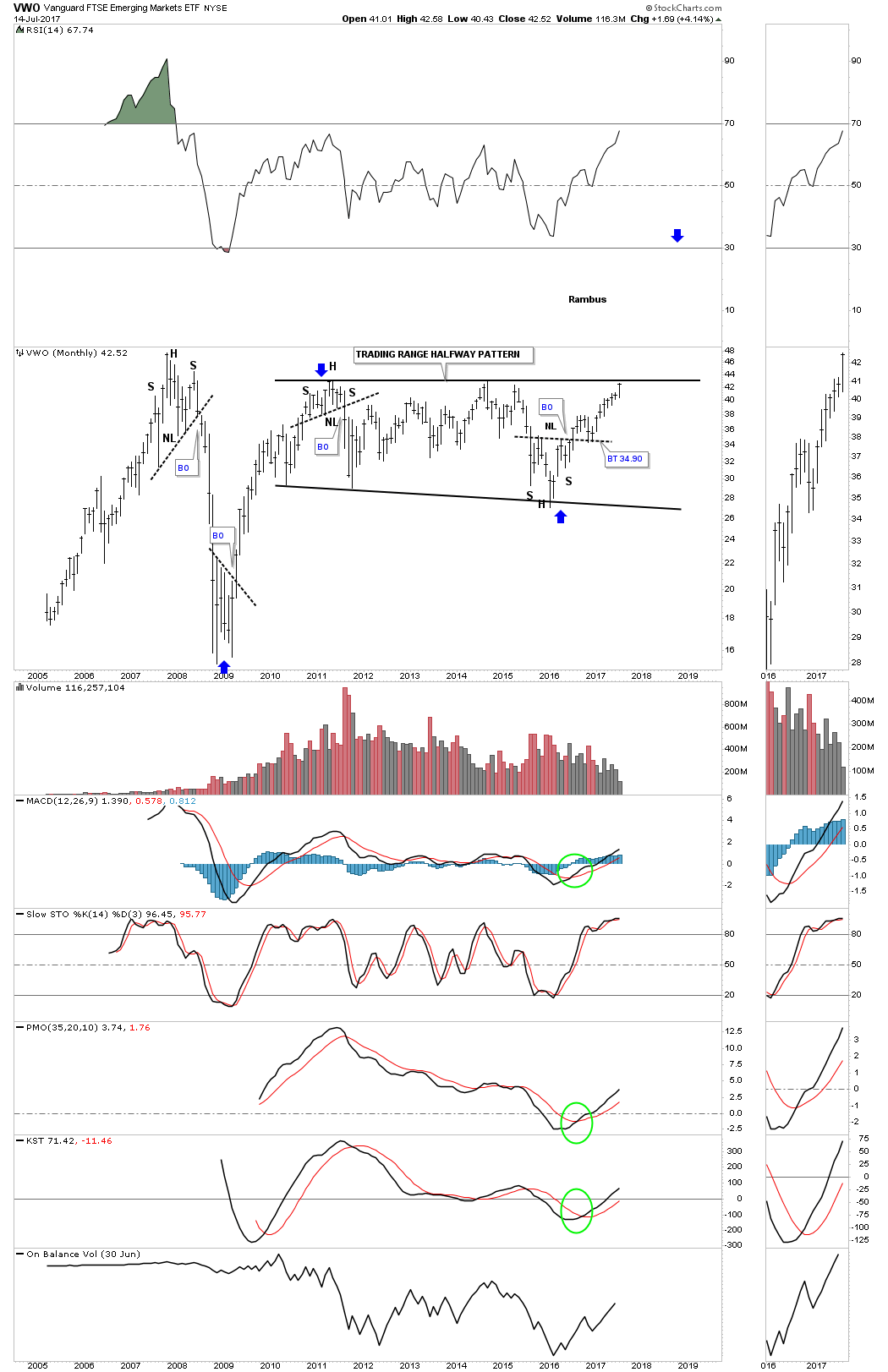

This last chart for VWO is a 20-year look which shows its entire history. With this week's move, the all important 4th reversal point was achieved when the top rail was hit, which completes the trading range. It now becomes very important to see a strong breakout move higher, leaving no doubt that the break out is for real. A failure at the top rail would then start another reversal point to the downside which is not what we want to see.

If the breakout move continues, then I would view the nearly 6-year trading range as a halfway pattern, as shown by the blue arrows. I would expect we would see a similar impulse move up that began at the 2009 crash low up to the 2011 high in time and price. Big consolidation patterns lead to big moves.

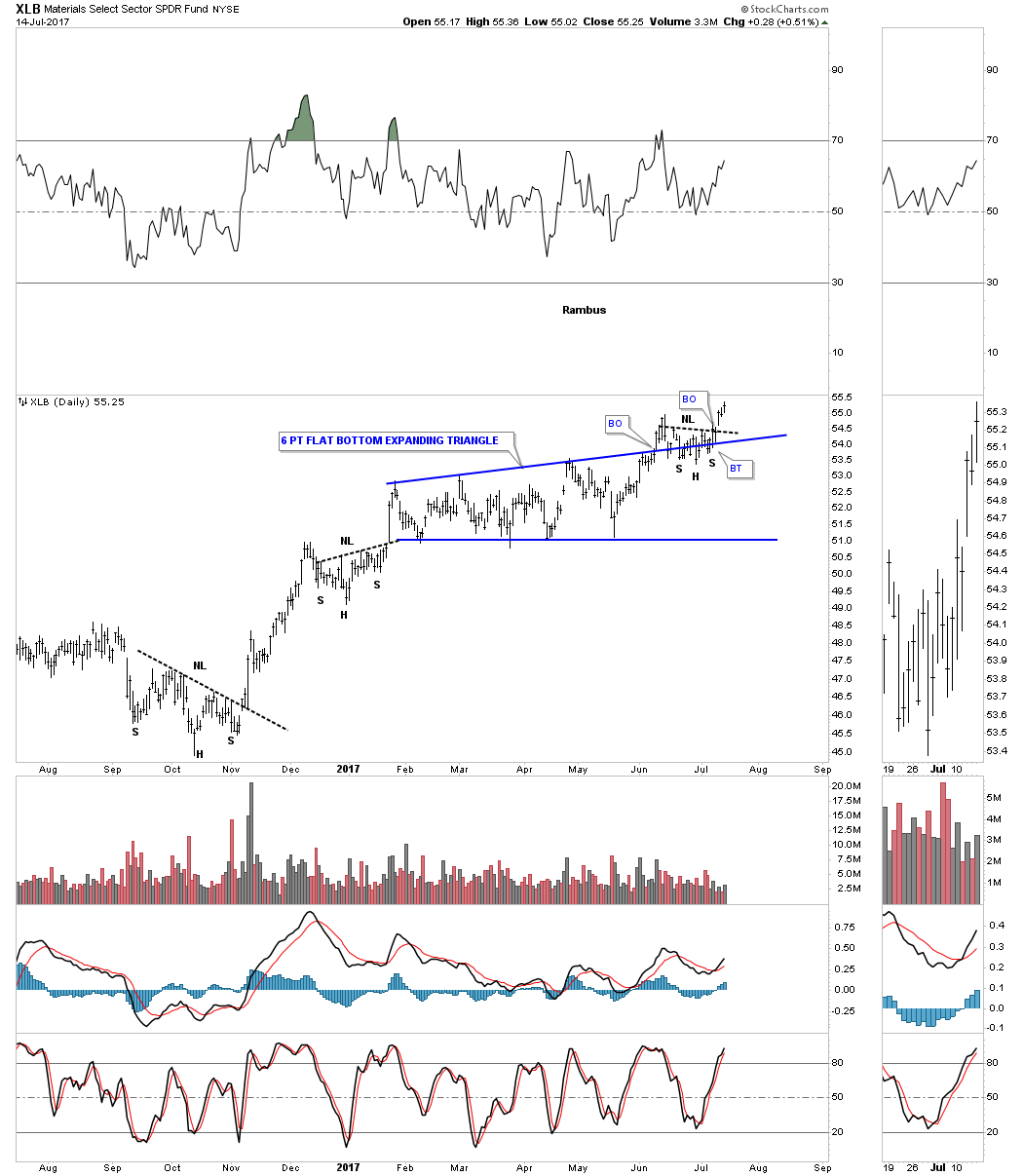

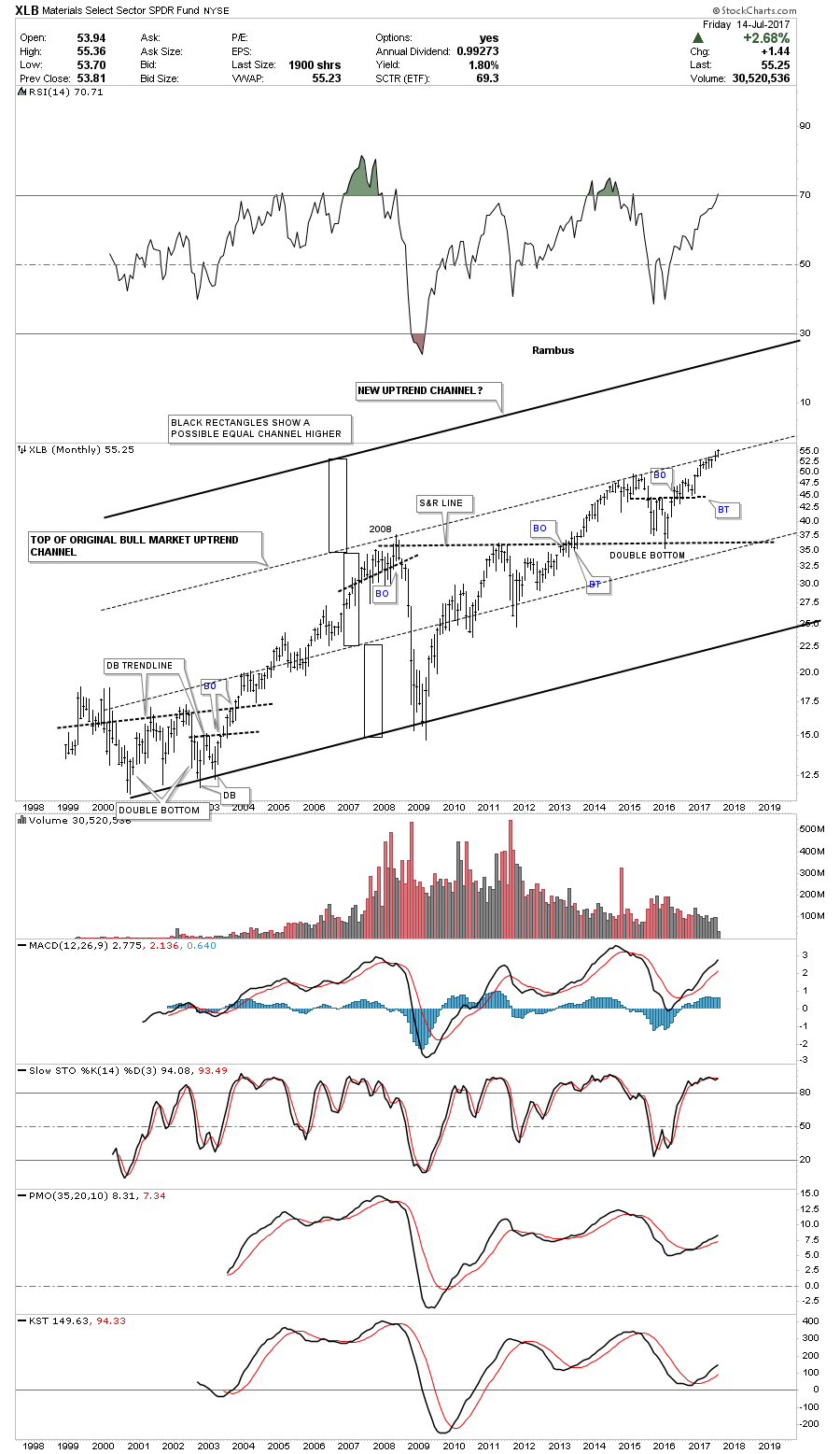

Now let's take a look at a daily chart for the Materials Select Sector SPDR ETF (NYSE:XLB), a basic materials index, which is showing it has just broken out of a 6-point, month-long blue expanding flat bottom triangle with a small H&S that formed as the backtest. Friday this basic materials index closed at a new all time high.

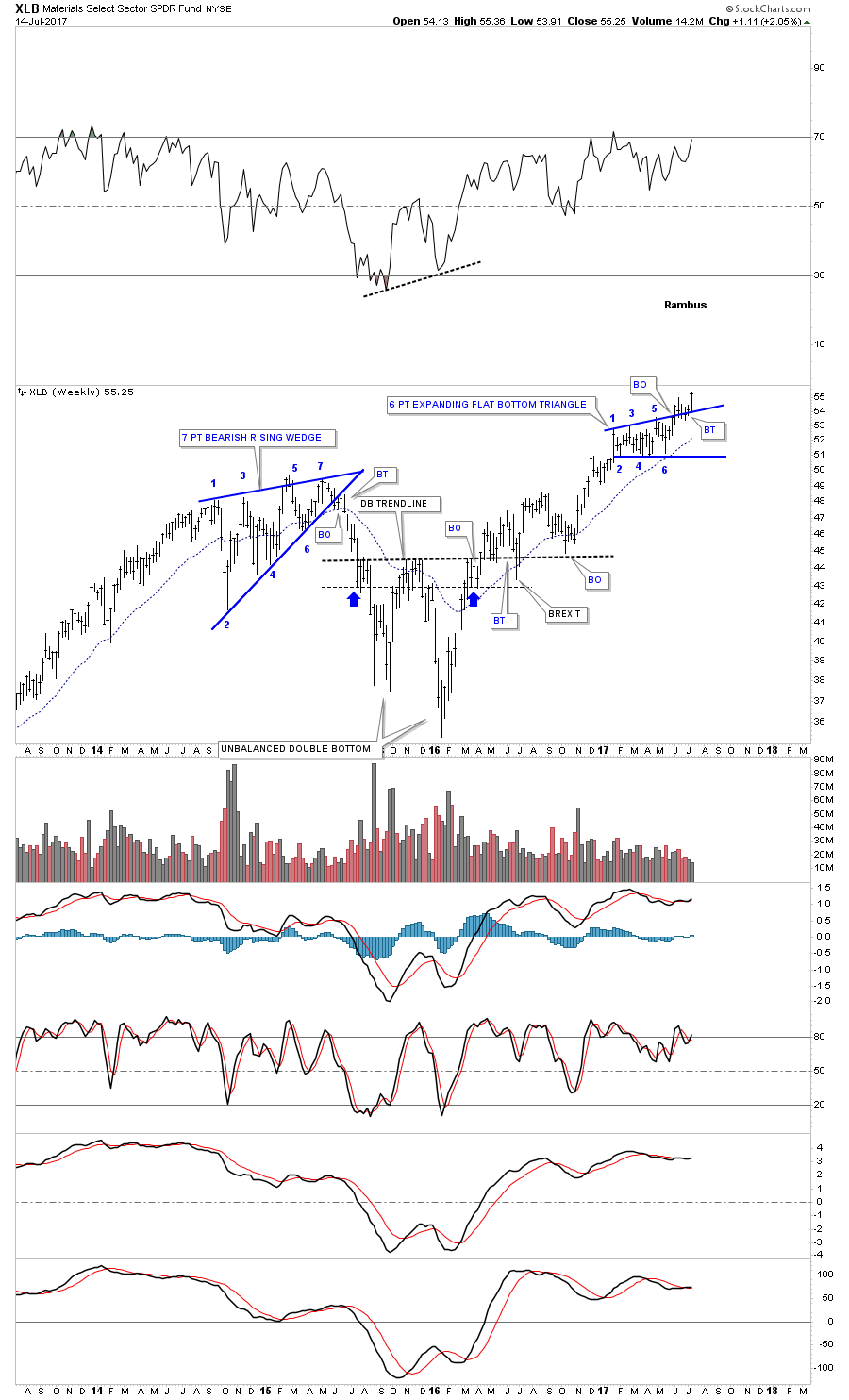

Below is a 4-year weekly bar chart that is showing the breakout from the 6-point flat bottom triangle consolidation pattern into new all-time highs this past week.

The long-term monthly chart for the XLB shows its entire history and its bull market uptrend channel. If the 6-point expanding flat bottom triangle is breaking out topside, then the original top rail of the major uptrend channel will be taken out.

Generally when that happens you can see another equal channel higher giving the uptrend 3 equal channels instead of two. The black rectangles show how this new uptrend may play out.

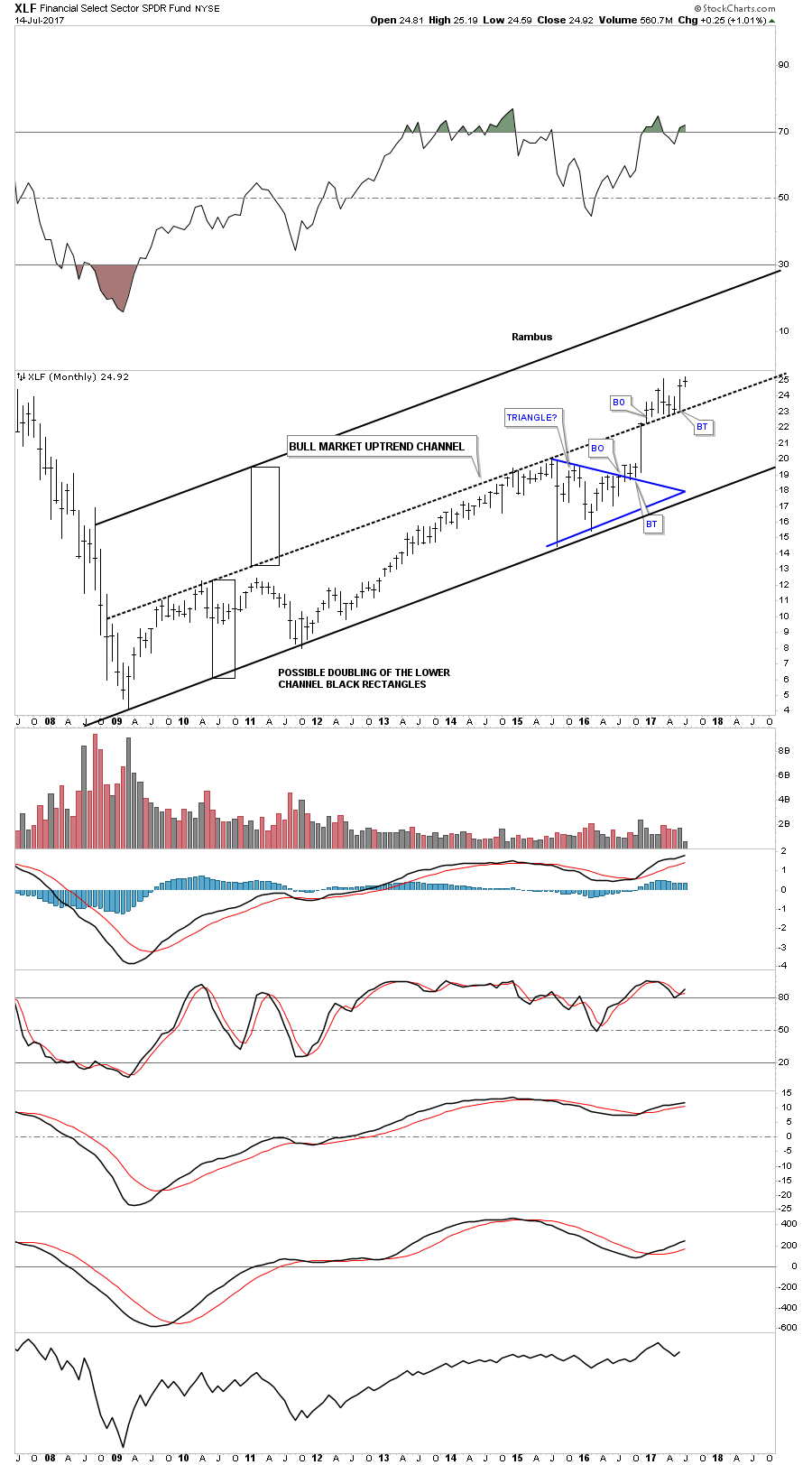

This next chart is a long term monthly chart for the Financial Select Sector SPDR (NYSE:XLF) which I’ve been showing as an example of how the lower channel may be morphing into a double uptrend channel with equal lower and upper channels. This is the same principle as the XLB chart above which is forming a possible third channel.

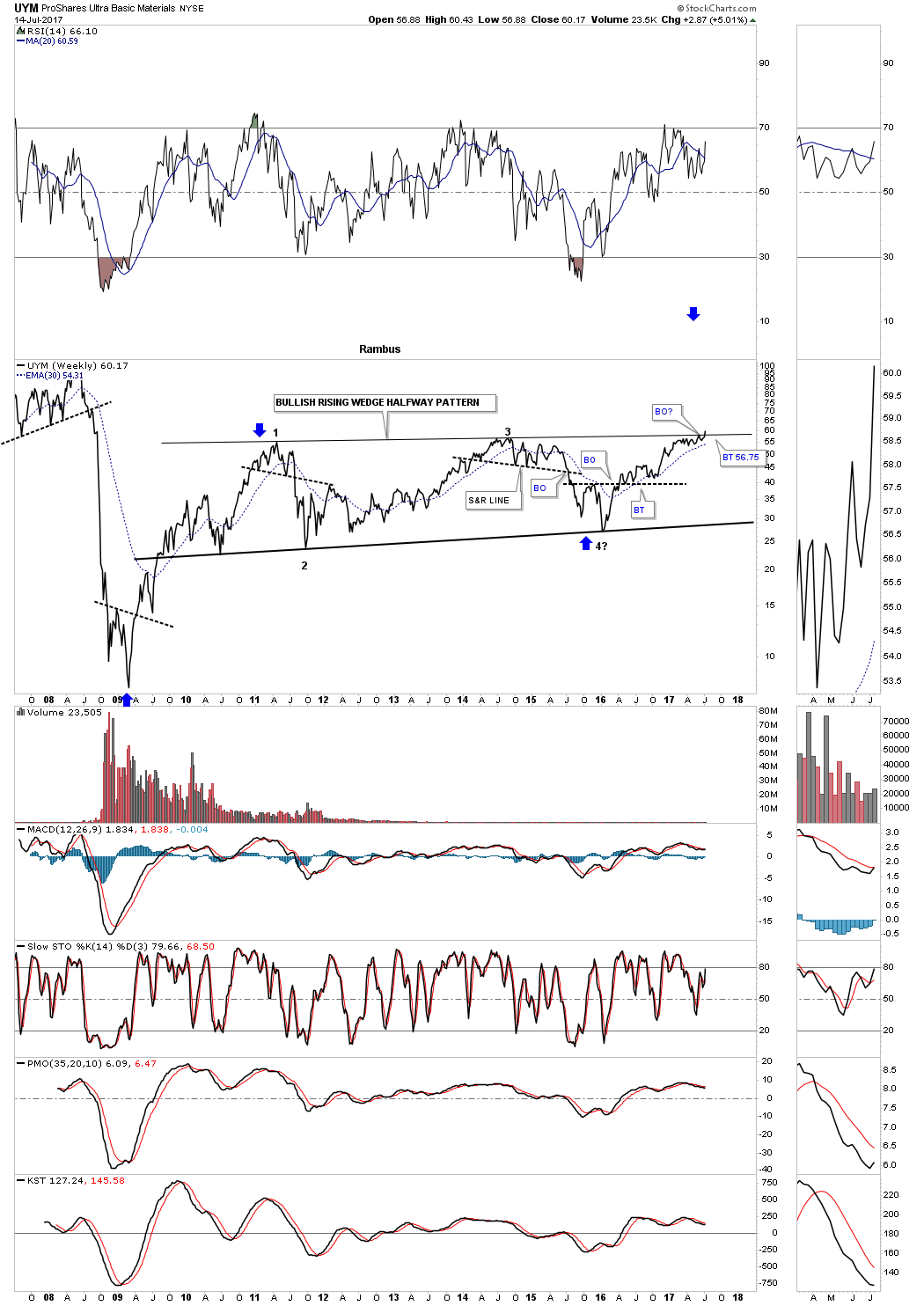

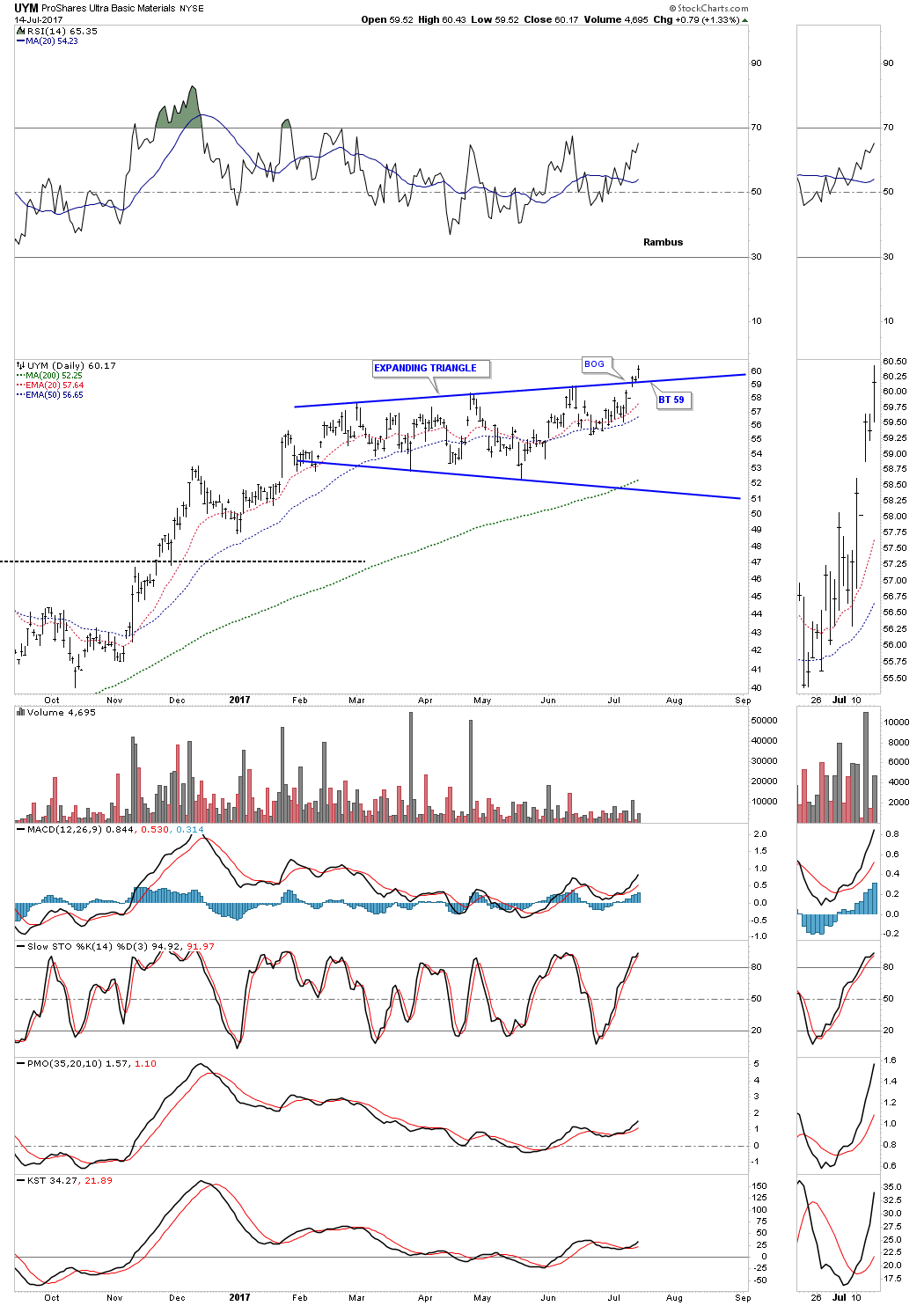

Below is a daily chart for the ProShares Ultra Basic Materials Fund (NYSE:UYM), 2 X long ETF of the basic materials sector, which last Friday just broke out from an almost 6-month expanding triangle consolidation pattern.

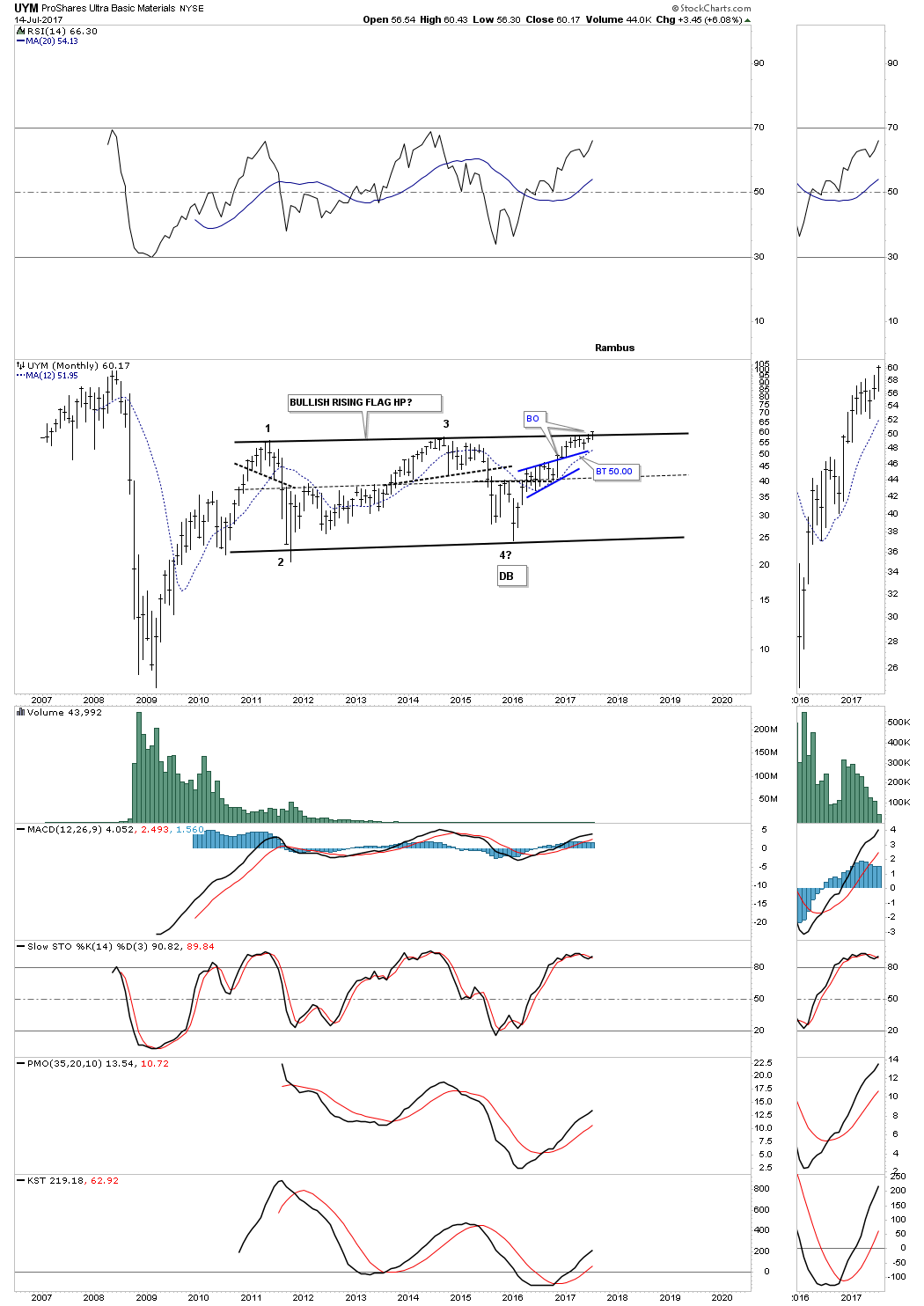

The long-term monthly chart for the XLB shows a very similar set-up to the long-term chart we looked at earlier on the VWO, emerging markets ETF. With the expanding triangle we just looked at on the daily chart above breaking out, the price action should also break out above the top rail of the 6-year bullish rising flag consolidation pattern.

This last chart is a weekly line chart which is showing the potential breakout underway. What the emerging markets and basic materials sectors are strongly suggesting is that there is a big move coming which has global implications for growth even if we can’t rationalize why at this point in time. We should see a very strong rally over the next 2-years or so, equal to the rally out of the 2009 low to the 2011 high.