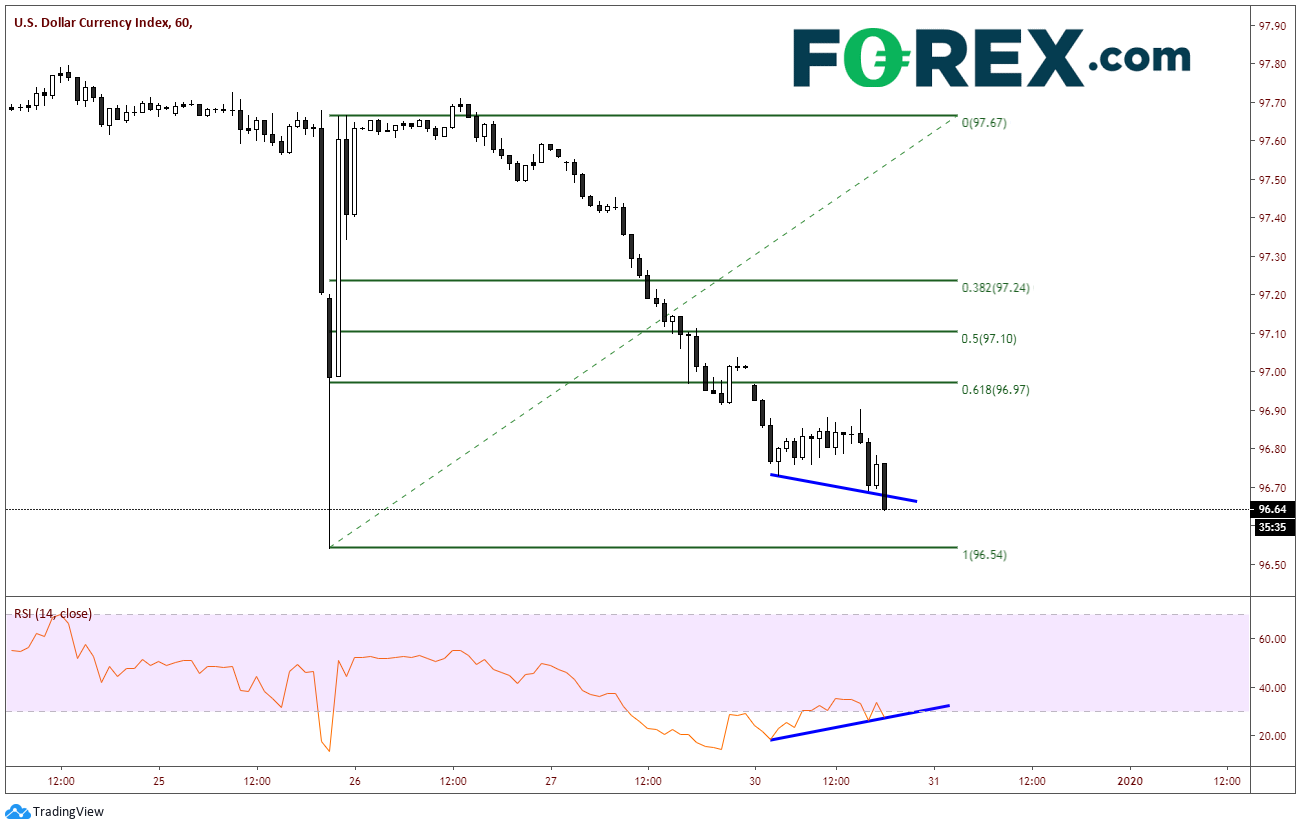

On Friday, the DXY was down over 0.6%, and today the selloff continues. The price today is down nearly another 0.4% in U.S. trading as the DXY looks to test the spike lows from the Christmas night. Price is diverging on a short-term time frame; however, yearend flows will dominate and the technical won’t be as relevant if people need to get things done for end of year.

Even though technicals may not be as important when funds need to get things done, it is still important to look for areas where price may pause or reverse. DXY is well underneath the upward channel it has been in since mid-2018. If DXY breaks through recent spike lows, the next level is the 50% retracement level from the June 2018 lows to the highs on Sept. 30 of this year at 96.43. Below that is a zone for support between the 61.8% retracement of the same time period and horizontal support, between 95.66 and 95.84. Resistance is back at the upward sloping channel line near 97.50.

As a result, many of the U.S. dollar counter currencies are continuing to trade higher.

EUR/USD has broken decisively above 1.1200 and the 61.8% retracement level from the June highs to the Sept. 30 lows at 1.1207. If this move continues, price can easily run up to 1.1350.

USD/CHF twice failed to take out the 61.8% retracement level from the April 25 highs to the Aug. 12 lows and put in a double top. Price is moving towards the target of the double top near .9640 and well as the Aug. 12 lows near .9663.

Commodity currencies have been hit as well versus the U.S. dollar, with USD/NOK being one of the hardest hit over the last few weeks. The bid is the Norwegian Krone has been hit by a double whammy of a weak U.S. dollar and strong oil. Price has fallen from a high of 9.1846 on Dec. 12 to current levels near 8.7894. Along the way, the pair has broken the 200-day moving average, horizontal support and the 61.8% retracement of the move from the low on July 19 to the highs on Dec.12. The RSI is in oversold territory.

Note: The Australian dollar, the New Zealand dollar and the Canadian dollar are also testing toward new recent highs versus the U.S. dollar as well.

It is important to remember that until the market reopens Jan. 2, these appear to be year-end flows. Many of the U.S. dollar moves continue to be exaggerated. The technicals mentioned here will become more useful once we enter the new year.