For the month of June 2023, the Federal Reserve’s decision to pause interest rate hikes was welcomed news to the market, as the pace of inflation has begun to slow from May’s CPI reading. Though the Fed also intimated that rate hikes may continue into the future, the strong performance of US equity markets continued in the present. The Trackinsight ETF segments that had the greatest net fund flows were US Large Cap ($33.13 bn), US Small Cap ($5.29 bn), US Government Bonds ($4.86 bn), US Aggregate Bonds ($4.52 bn), and Developed Markets ex-US Blended ($4.43 bn).

A look at each Segment and ETF Flows

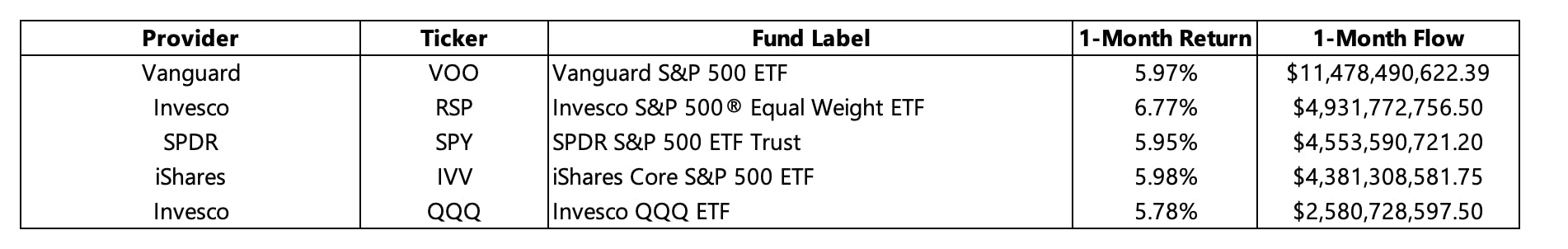

US Large Cap

US equity markets continue to climb higher, as the performance of US large cap equities was strong for the month of June 2023. All 11 US stock sectors were positive for the month, as the Dow Jones Industrial Average rose 4.7%, the S&P 500 advanced 6.6%, and the NASDAQ charged 6.8% higher. While the Vanguard S&P 500 ETF (VOO) garnered the most flows for the month, the Invesco S&P 500 ® Equal Weighted ETF (RSP) held the top performance among this grouping. The strong performance of the Consumer Discretionary (12.2%), Industrials (11.3%), and Materials (11.0%) sectors were contributing factors to the stellar performance of the overall market for the month.

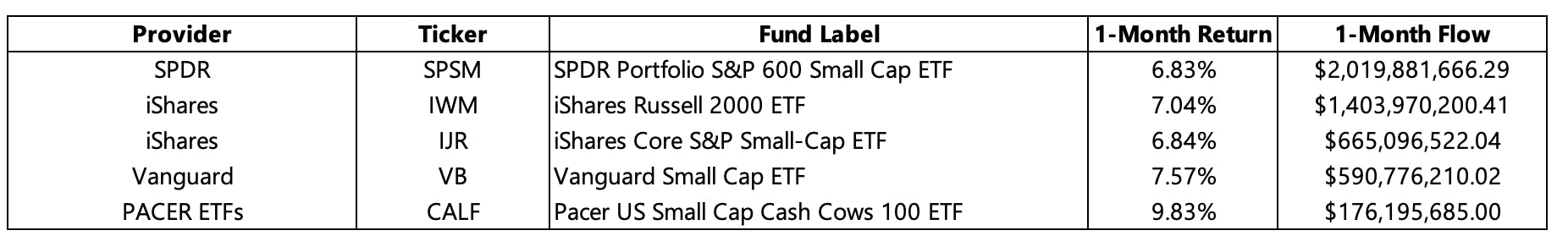

US Small Cap

The strong performance of US equities was not specific to only large cap stocks, but was also evident in US small cap equities. June 2023 was an especially good month for small-cap equities, as both the Russell Small-Cap Growth Index and Small-Cap Value Index outperformed their large cap counterparts, returning 8.2% and 7.9% respectively. Though the SPDR Portfolio S&P 600 Small Cap ETF (SPSM) garnered the largest flows for the month, the Pacer US Small Cap Cash Cows 100 ETF (CALF) had the strongest performance of the group. The Vanguard Small Cap ETF (VB) and iShares Russell 2000 ETF (IWM) also had strong returns for the period in question.

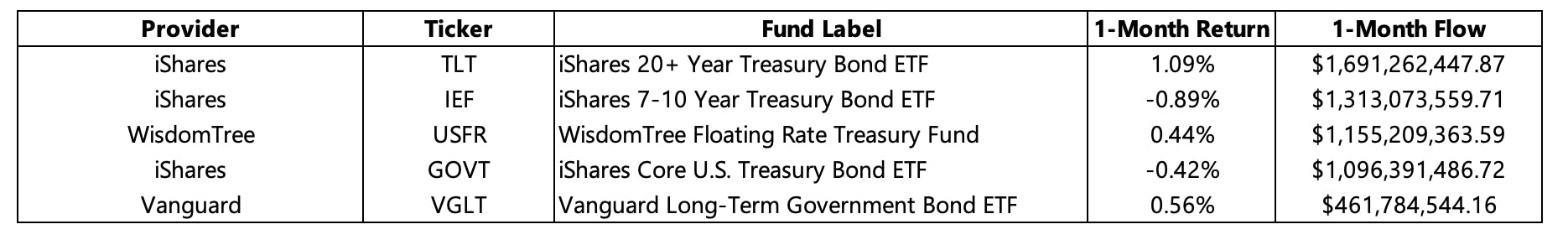

US Government Bonds

With interest rates remaining elevated, higher income from bonds has resulted in US Government Debt remaining top of mind for investors. The iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) had the largest inflow for the month and exhibited the best performance among its immediate group. Both the WisdomTree Floating Rate Treasury Fund (USFR) and Vanguard Long-Term Government Bond ETF (VGLT) had a positive return for the month. Though the Federal Reserve has momentarily paused their interest rate hikes, they have also intimated that additional rate hikes are expected in the future, as determined by incoming economic data.

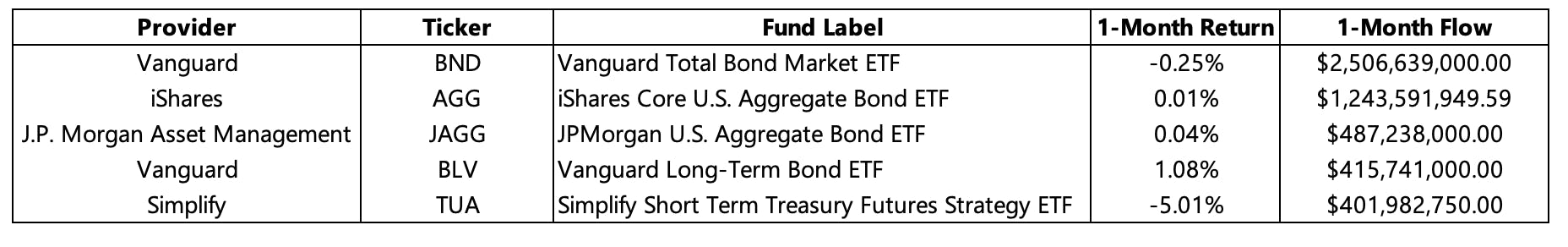

US Aggregate Bonds

Similar to US Government Bonds, US Aggregate Bonds have received strong inflows for the month, however performance was flat or negative. The Vanguard Total Return Bond (BND) garnered the most fund flows, followed by the iShares Core U.S. Aggregate Bond ETF (AGG), and JPMorgan (NYSE:JPM) U.S. Aggregate Bond ETF (JAGG). While performance among the top three funds was somewhat similar, the Vanguard Long-Term Bond ETF (BLV) had the best performance (1.08%), whereas the Simplify Short Term Treasury Futures Strategy ETF (TUA) had the worst performance (-5.01%).

Developed Markets ex-US Blended Cap

While much of this year’s equity resurgence has been centered on the performance of US equities, the performance of foreign capital markets has also been an exemplary year to date. For the month of June, flows into the Developed Markets ex-US Blended Cap category were strong, with the iShares Core MSCI EAFE ETF (IEFA) garnering the largest fund flows. In contrast, the Vanguard FTSE Developed Markets ETF (VEA) held the top performance among the immediate grouping but took in materially less from a fund flows standpoint, relative to IEFA. All other funds exhibited compelling returns for the month, with SPDR Portfolio Developed World ex-US ETF (SPDW) returning 3.02% and the Dimensional International Core Equity 2 ETF (DFIC) and Dimensional International Core Equity Market ETF (DFAI) returning 2.14% and 2.13%, respectively.

This content was originally published by our partners at ETF Central.