5 big analyst AI moves: Nvidia top 2026 pick, ASML gets big price target hike

In a month that was mostly defined by bank failures and wavering investor confidence regarding the strength of the economy, the asset classes that had the greatest net flows were indicative of the prevailing sentiment of the market. For March 2023, the ETF segments that had the greatest net fund flows were US Government Bonds ($20.09 bn), Money Market Bonds ($7.37 bn), US Multi-Factor ($6.56 bn), US Large Cap Growth ($ 3.54 bn), and US Aggregate Bond ($2.90 bn).

A look at each Segment and ETF Flows

US GOVERNMENT BONDS

US investors engaged in a flight to safety for the month of March, as the US Government Bond asset class took in the greatest flows. As evidenced from the data, intermediate and long-term dated treasuries that offered higher interest rates were the preferred choice among investors. Among asset managers, BlackRock’s iShares offerings held three of the top five category leading funds, with iShares 7-10 Year Treasury Bond ETF (NYSE:IEF), iShares Core U.S. Treasury Bond ETF (GOVT), and iShares 20+ Year Treasury Bond ETF (NASDAQ:TLT) being the leading recipient of flows. Regarding performance, TLT was the standout performer of the group.

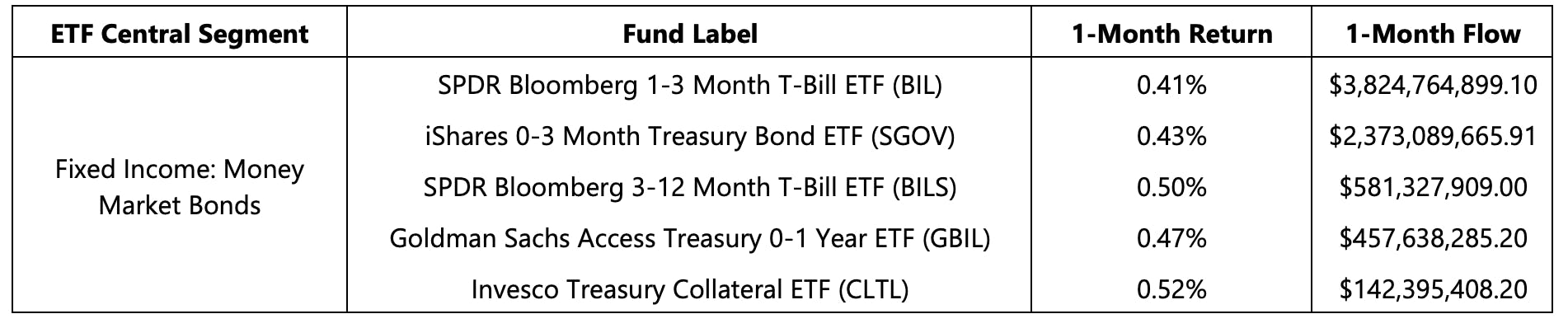

Money Market Bonds

As well as US government bonds, investors also allocated significant capital to money market instruments throughout March. With the failure of three regional banks occurring in rapid succession during the month, deposit flight became a real occurrence among many banking institutions. For individuals and investors that were seeking a safe haven for their monies, money market instruments became a viable landing spot, due to the opportunity cost and perceived loss many believed they were facing. Looking forward, the US Federal Reserve has intimated that future rate hikes may be slowing, but a decision will be predicated on incoming data; ultimately, we will wait to see what impact such policy decision-making will have on the net flows of this category. Regarding performance, the return of all top five funds was similar in nature.

US Multi-Factor

The US Multi-Factor segment saw the third most flows for the month, as safety for many investors meant investing in quality companies that have established business models and a proven track record of generating consistent earnings over time. Among the top five funds in this category for the month, the Quality investing factor was the overarching theme, with the iShares Edge MSCI USA Quality Factor ETF (QUAL), Invesco S&P 500® Quality ETF (SPHQ), and WisdomTree U.S. Quality Dividend Growth Fund (DGRW) being present. Both SPHQ and QUAL had strong performances for the month, returning 5.18% and 4.79% respectively. As uncertainty about the US economy remains, it’s possible that flows into this category will continue to grow, as investors will feel safest investing in companies that have proven their ability to navigate through different stages of the economic cycle and remain fundamentally intact.

US Large Cap Growth

The growth investing factor performed exceedingly well for the month of March, outperforming its value investing counterpart in a truly material manner. Though the top performing funds in this category are managed by two prominent asset managers, Vanguard and BlackRock (NYSE:BLK), the difference in performance amongst the funds is where the intrigue lies. In the case of Vanguard Mega Cap Growth ETF (MGK) and Vanguard Growth ETF (VUG), while they broadly share a similar investment objective, the former’s focus on ‘mega cap’ growth results in a portfolio that has more concentrated holdings. MGK’s incrementally higher exposure to the technology sector helped it outperform VUG for the month. The same conclusion can be drawn for iShares Russell Top 200 Growth ETF (IWY) versus iShares Russell 1000 Growth ETF (IWF). Though developments in the broader economy have made investors wary of growth-oriented companies, the strong performance of and flows into the category for March are notable and could be a sign of investor outlook and risk appetite going forward.

US Aggregate Bonds

Within the US Aggregate Bond Segment, the iShares Core Total Bond Market ETF (IUSB) garnered the most flows for the month. Given the uncertainty stemming from regional bank failures, investors engaged in a flight to safety, pivoting towards US Treasuries, US Government Bonds, or Multi-Sector fixed income solutions, such as IUSB. Though IUSB has the most net flows, the Vanguard Total Bond Market ETF (BND) had a better return performance for the month. As mentioned previously, with the US Federal Reserve indicating its intention to slow future rate hikes, based on incoming data, we will wait to see what impact it will have on the flows into this category going forward.

Important: While fund flows represent a snapshot of where investor dollars are currently moving en masse, understanding how a particular solution fits within one’s overall portfolio is paramount. In examining ETF fund flows, investors can gain a general understanding of what asset classes and strategies are of interest within the broader landscape and assess their suitability for one’s own wealth generation journey.

This content was originally published by our partners at ETF Central.