The first exchange-traded fund (ETF) listed in the U.S. in 1993 was the SPDR® S&P 500 (NYSE:SPY). Since then, the ETF market has been growing rapidly. Metrics from the Investment Company Institute show that in the U.S., “the combined assets of … ETFs were $6.20 trillion in April.” A year ago, that number stood at $4.03 trillion.

So, today we introduce two new ETFs that have recently started trading. Interested investors might want to keep these small funds on their radar screen.

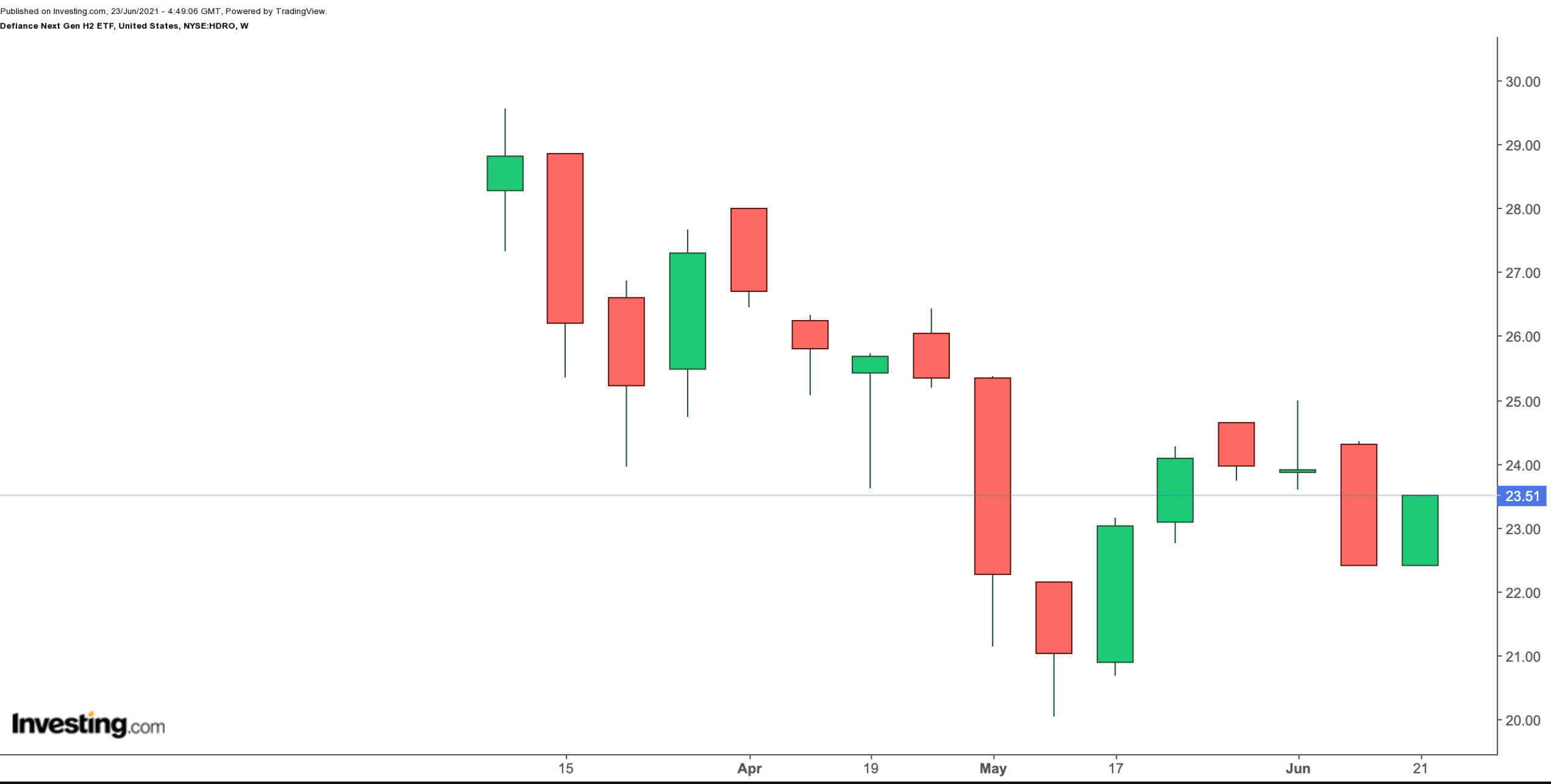

1. Defiance Next Gen H2 ETF

Current Price: $23.51

52-Week Range: $20.04 – $29.56

Expense Ratio: 0.30% per year

The U.S. Department of Energy highlights:

“Fuel cells are the most energy efficient devices for extracting power from fuels. [They are] capable of running on a variety of fuels, including hydrogen, natural gas and biogas… They can play a particularly important role in the future by enabling replacement of the petroleum we currently use in our cars and trucks with cleaner, lower-emission fuels like hydrogen or natural gas.”

This fund might appeal to readers who are interested in this clean energy source, as the Defiance Next Gen H2 ETF (NYSE:HDRO) provides exposure to the global hydrogen-based green energy sector. It invests in businesses that generate at least 50% of their revenue from hydrogen-based energy sources, fuel cell technologies and industrial gases.

HDRO, which tracks the BlueStar Global Hydrogen & Next Gen Fuel Cell Index, currently has 26 holdings. The index and the fund are reviewed quarterly. Since its inception in March 2021, net assets have grown to $33 million.

Any single holding in the fund cannot weigh more than 10% (4% for industrial gas securities). The sub-sector allocation includes hydrogen fuel cells (56.70%), hydrogen production (22.62%), and hydrogen tech and fuelling stations (20.68%).

The top 10 holdings comprise 57% of the fund. Among the leading names are the provider of hydrogen fuel cell systems Plug Power (NASDAQ:PLUG); Canadian-based proton exchange membrane fuel cell products designer Ballard Power Systems (NASDAQ:BLDP); Norwegian-based renewable energy equipment and services supplier Nel ASA (OTC:NLLSF); solid oxide fuel cell technology provider Bloom Energy (NYSE:BE); and South Korea’s Doosan Fuel Cell (KS:336260), which manufactures fuel cells for power generation.

In terms of geographic breakdown, we see the UK with the largest slice (18.45%). Next in line are the U.S. (17.54%), South Korea (11.33%), Canada (10.57%) and Norway (8.63%).

Since March, HDRO is down about 20%. Green energy, including hydrogen-based fuel, has become one of the most important secular growing trends in the global economy. Long-term investors could consider investing at current levels.

2. ProShares NASDAQ-100 Dorsey Wright Select ETF

Current Price: $41.81

52-Week Range: $40.64 - $42.66

Expense Ratio: 0.58% per year

The ProShares NASDAQ-100 Dorsey Wright Select ETF (NASDAQ:QQQA) invests in a select group of NASDAQ 100 shares that could potentially outperform other members of the index.

We recently covered the Invesco QQQ Trust (NASDAQ:QQQ), which tracks the returns of the NASDAQ 100 index, as well as the Invesco NASDAQ Next Gen 100 ETF (NASDAQ:QQQJ) that invests in the 101st to the 200th largest non-financial firms on the NASDAQ Composite. Thus, QQQA, which started trading in May 2021, extends our previous discussions.

QQQA tracks the NASDAQ 100 Dorsey Wright Momentum Index that selects the top-performing 21 NASDAQ 100 stocks based on a proprietary “relative strength” signal. These 21 stocks are assigned equally weighted and the index is reconstituted quarterly.

The sectors include information technology (50.29%), consumer discretionary (13.76%), health care (11.00%), communication services (10.26%), consumer staples (9.69%) and industrials (5.01%). The top 10 holdings comprise about 50% of net assets of $172.5 million.

Veterinary diagnostics group IDEXX Laboratories (NASDAQ:IDXX), which provides products for pets and livestock; Alphabet (NASDAQ:GOOGL); the Netherlands-based chip-group ASML (NASDAQ:ASML); dental device company Align Technology (NASDAQ:ALGN); and global food and beverage giant Kraft Heinz (NASDAQ:KHC) top the names in the roster.

In the past month, the ETF is up about 2%. QQQA’s trailing P/E and P/B ratios stand at 30.67 and 5.56, respectively. Buy-and-hold investors could also regard a drop toward $40 or below as an opportunity to buy into the fund.