- The dollar has weakened on disinflation data, pushing EUR/USD towards resistance at $1.09.

- Today's PPI data could impact rate cut expectations; continued disinflation could increase the likelihood.

- ECB meeting on Wednesday, eurozone inflation data eyed; ECB may hold off on rate cuts.

- Unlock AI-powered Stock Picks for Under $8/Month: Summer Sale Starts Now!

Yesterday's US inflation data fueled a familiar market reaction. Disinflationary trends continued for another month, prompting a decline in the US dollar. This weakness rippled through the EUR/USD currency pair, pushing the Euro towards a key resistance zone near $1.09.

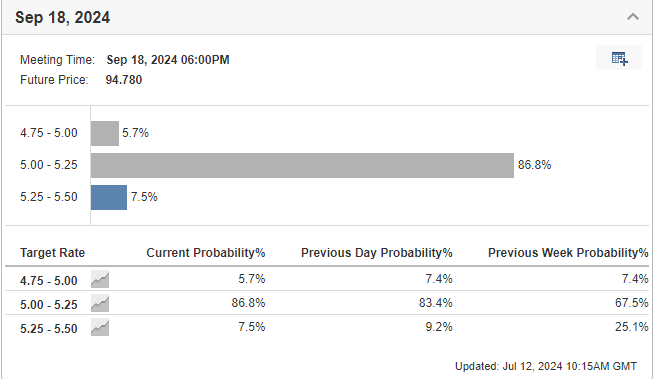

The dollar's decline stems from rising expectations of a rate cut as early as September. With the probability of a 25 basis point reduction in September now at 86.8%, investors are positioning themselves for a less hawkish monetary policy stance. This shift weakens the dollar's appeal as a safe haven asset.

Today's PPI inflation data could significantly influence the likelihood of an interest rate cut. If the figures come in below forecasts, the probability of a cut will increase further.

Is Disinflation Set to Continue?

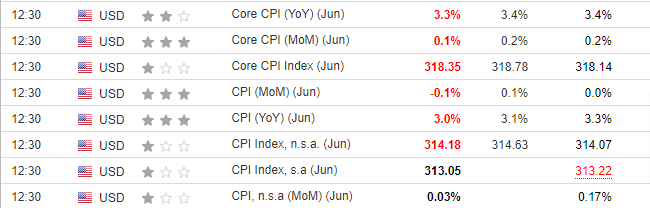

Recent data reveals a mixed inflation picture. While overall consumer and core inflation declined, certain sectors still face demand pressures. Housing and services, excluding energy, grew more expensive in June by 0.2% compared to May. Conversely, energy prices, especially gasoline, dropped, with prices falling 3.7% month-over-month.

Comparing current inflation dynamics to those recorded during the June 2022 Inflation Shift, transportation costs remain elevated. The forthcoming August readings will be crucial; if they indicate an inflation rate below 3%, an interest rate cut seems almost certain.

Will the ECB Follow Suit?

As the European Central Bank (ECB) prepares for its policy meeting, all eyes are on the upcoming inflation report for the eurozone. Set to be released on Wednesday, the report is expected to show a slight decline in consumer inflation to 2.5%, while core inflation is likely to remain steady. This data will heavily influence the ECB's decision on monetary policy, to be announced the following day.

Despite the anticipation, it seems likely that the ECB will hold off on further rate cuts until there's clearer evidence that inflation is moving towards its target. Should the Governing Council receive such evidence, we can expect two more 25 basis point interest rate cuts this year.

EUR/USD Technical View: Resistance at 1.09 Up Next

Following the release of recent economic data, the EUR/USD pair saw an upward push. However, this momentum has stalled around the 1.09 level, presenting a significant challenge for buyers moving forward.

The EUR/USD pair is poised for a continued upward trajectory after breaching the 1.09 mark, targeting the 1.0980 region, which aligns with the highs seen in March.

In the event of a pullback, investors should focus on the confluence of the 1.0850 support level and the upward trend line. This trend line serves as a crucial defense zone.

If it fails, the pair could see deeper declines toward levels below 1.08, though this scenario seems unlikely in the short term.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month!

Are you tired of watching the big players rake in profits while you're left on the sidelines?

InvestingPro's revolutionary AI tool, ProPicks, puts the power of Wall Street's secret weapon - AI-powered stock selection - at YOUR fingertips!

Don't miss this limited-time offer.

Subscribe to InvestingPro today and take your investing game to the next level!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.